Bandwidth (BAND)

Bandwidth keeps us up at night. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bandwidth Will Underperform

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

- Bad unit economics and steep infrastructure costs are reflected in its gross margin of 38%, one of the worst among software companies

- Estimated sales growth of 2.8% for the next 12 months implies demand will slow from its three-year trend

- 13.9% annual revenue growth over the last three years was slower than its software peers

Bandwidth doesn’t satisfy our quality benchmarks. There are better opportunities in the market.

Why There Are Better Opportunities Than Bandwidth

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bandwidth

At $13.57 per share, Bandwidth trades at 0.5x forward price-to-sales. Bandwidth’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Bandwidth (BAND) Research Report: Q1 CY2025 Update

Communications platform-as-a-service company Bandwidth (NASDAQ: BAND) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 1.9% year on year to $174.2 million. Guidance for next quarter’s revenue was better than expected at $179 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.36 per share was 33.3% above analysts’ consensus estimates.

Bandwidth (BAND) Q1 CY2025 Highlights:

- Revenue: $174.2 million vs analyst estimates of $168.9 million (1.9% year-on-year growth, 3.1% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.27 (33.3% beat)

- Adjusted Operating Income: -$3.74 million vs analyst estimates of $11.96 million (-2.1% margin, significant miss)

- The company slightly lifted its revenue guidance for the full year to $752.5 million at the midpoint from $750 million

- EBITDA guidance for the full year is $87.5 million at the midpoint, above analyst estimates of $86.38 million

- Operating Margin: -2.7%, up from -6.1% in the same quarter last year

- Free Cash Flow was -$13.3 million, down from $30.35 million in the previous quarter

- Market Capitalization: $364.9 million

Company Overview

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Founder David Morken started Bandwidth while on 90 days of paid leave from the Marine Corps. He moved into his parent’s house with his three children and wife to bootstrap the company.

Bandwidth might not be well known to consumers, but most of us would have used their services unknowingly either using online conferencing software or contacting customer service representatives through a company’s website. Bandwidth’s core advantage is that it provides a software platform over its own telecommunications network, and is therefore able to better control the quality of the connection, all while providing cheaper prices than a legacy voice connection.

4. Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Even though Bandwidth competes with other well known CPaaS companies like Twilio (NYSE:TWLO), it mostly competes with legacy telecommunications companies such as Verizon (NYSE:VZ) and AT&T (NYSE:T), which lack the equivalent software layer over their own networks.

5. Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Bandwidth grew its sales at a 13.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Bandwidth reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 3.1%. Company management is currently guiding for a 3.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Bandwidth is very efficient at acquiring new customers, and its CAC payback period checked in at 27.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

For software companies like Bandwidth, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Bandwidth’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 38% gross margin over the last year. That means Bandwidth paid its providers a lot of money ($61.95 for every $100 in revenue) to run its business.

In Q1, Bandwidth produced a 41% gross profit margin, marking a 2.8 percentage point increase from 38.3% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Bandwidth’s expensive cost structure has contributed to an average operating margin of negative 1.9% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Bandwidth reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last year, Bandwidth’s expanding sales gave it operating leverage as its margin rose by 3.5 percentage points. Still, it will take much more for the company to reach long-term profitability.

Bandwidth’s operating margin was negative 2.7% this quarter. The company's consistent lack of profits raise a flag.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Bandwidth has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.6%, subpar for a software business.

Bandwidth burned through $13.3 million of cash in Q1, equivalent to a negative 7.6% margin. The company’s cash burn was similar to its $4.41 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business.

Over the next year, analysts predict Bandwidth’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 6.6% for the last 12 months will increase to 8.4%, giving it more flexibility for investments, share buybacks, and dividends.

10. Balance Sheet Assessment

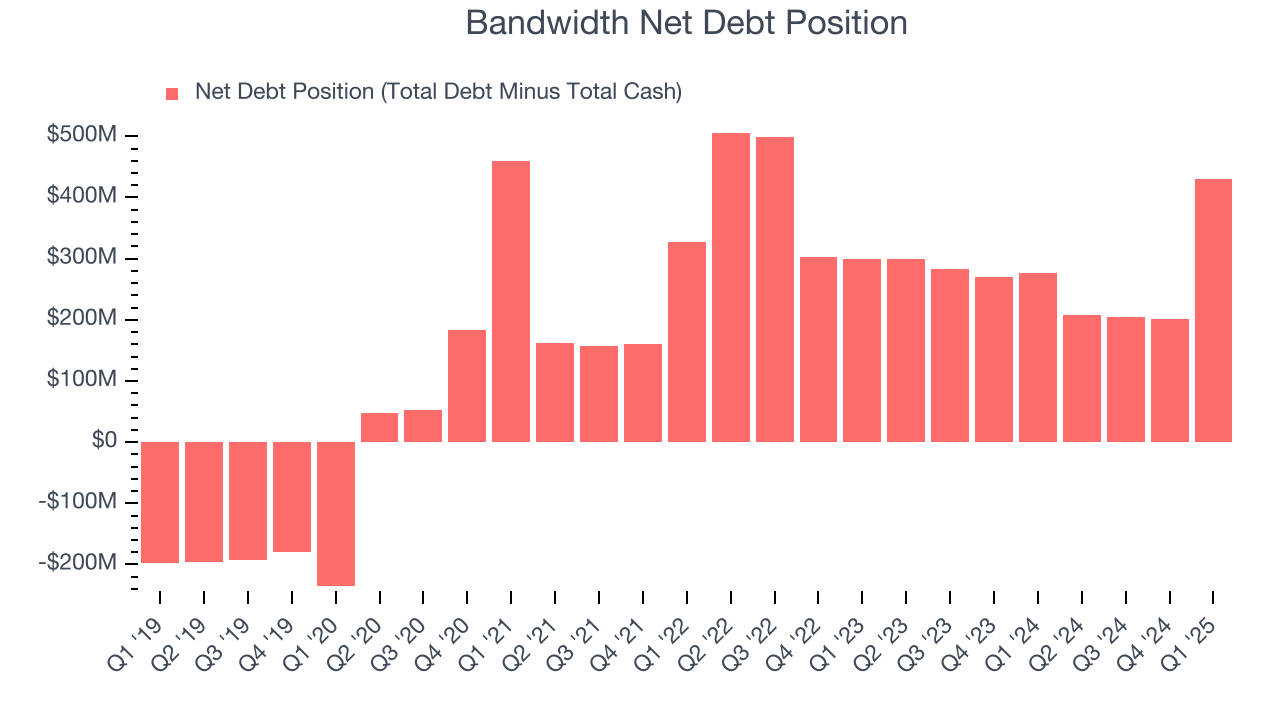

Bandwidth reported $41.69 million of cash and $471.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $88.35 million of EBITDA over the last 12 months, we view Bandwidth’s 4.9× net-debt-to-EBITDA ratio as safe. We also see its $1.87 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Bandwidth’s Q1 Results

We were impressed by how Bandwidth blew past analysts’ revenue and EBITDA expectations this quarter. We were also glad it lifted its full-year revenue guidance. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock traded up 7.7% to $13.24 immediately following the results.

12. Is Now The Time To Buy Bandwidth?

Updated: June 14, 2025 at 10:16 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Bandwidth.

Bandwidth falls short of our quality standards. First off, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its gross margins show its business model is much less lucrative than other companies. On top of that, its low free cash flow margins give it little breathing room.

Bandwidth’s price-to-sales ratio based on the next 12 months is 0.5x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $20.75 on the company (compared to the current share price of $13.57).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.