ON24 (ONTF)

We wouldn’t buy ON24. Its shrinking sales suggest demand is waning and its lousy free cash flow generation doesn’t do it any favors.― StockStory Analyst Team

1. News

2. Summary

Why We Think ON24 Will Underperform

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

- Sales tumbled by 10.4% annually over the last three years, showing industry trends like AI are working against its favor

- ARR has averaged 6.7% declines over the last year, suggesting that competition is pulling attention away from its software

- Sales are projected to tank by 6% over the next 12 months as its demand continues evaporating

ON24 is in the doghouse. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than ON24

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ON24

At $5.53 per share, ON24 trades at 1.7x forward price-to-sales. ON24’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. ON24 (ONTF) Research Report: Q1 CY2025 Update

Virtual events software company (NYSE:ONTF) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 7.9% year on year to $34.73 million. On the other hand, next quarter’s revenue guidance of $34.8 million was less impressive, coming in 0.7% below analysts’ estimates. Its non-GAAP loss of $0.01 per share was $0.01 above analysts’ consensus estimates.

ON24 (ONTF) Q1 CY2025 Highlights:

- Revenue: $34.73 million vs analyst estimates of $34.23 million (7.9% year-on-year decline, 1.5% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.02 ($0.01 beat)

- Adjusted Operating Income: -$2.12 million vs analyst estimates of -$2.88 million (-6.1% margin, relatively in line)

- The company dropped its revenue guidance for the full year to $137.5 million at the midpoint from $140.1 million, a 1.9% decrease

- Management reiterated its full-year Adjusted EPS guidance of $0.04 at the midpoint

- Operating Margin: -30.1%, up from -33.1% in the same quarter last year

- Free Cash Flow Margin: 5.6%, up from 1.2% in the previous quarter

- Market Capitalization: $200.5 million

Company Overview

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

The Covid-19 pandemic has accelerated the shift to a digital-first world. Given the growing difficulty of organizing physical meetings, more companies are adopting digital channels to engage with customers and are realizing it is harder than just video streaming a presentation. One directional online webinars are missing the interactivity of real world conferences and potential customers either give up during the stream or leave without being able to engage anybody from the company to ask questions.

ON24’s software as a service helps companies organize interactive online events like webinars or conferences and create a library of engaging pre-recorded content. The software provides users with tools that handle everything from registrations, streaming the video itself, to analytics on how customers reacted during the talk. Most importantly it allows companies to enhance their webinars with interactive features that allow the viewers to ask questions, immediately start a free trial of the product or request a meeting with the company’s representative. ON24 also connects with marketing and sales automation data to provide better insights to sales teams, making it easier to convert prospects into paying users.

4. Virtual Events Software

Online marketing and sales are expanding at a rapid pace. Compared to the offline advertising market, which has been affected by the Covid pandemic and is challenging to measure and improve, more organizations are expected to adopt data-driven digital engagement platforms to better engage their customers online.

ON24 faces competition from marketing and web engagement tools provided by companies including Zoom (NASDAQ:ZM), LogMeIn (NASDAQ:LOGM), Intrado, Cisco (NASDAQ:CSCO), and Cvent.

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. ON24 struggled to consistently generate demand over the last three years as its sales dropped at a 10.4% annual rate. This wasn’t a great result and is a sign of poor business quality.

This quarter, ON24’s revenue fell by 7.9% year on year to $34.73 million but beat Wall Street’s estimates by 1.5%. Company management is currently guiding for a 6.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 4% over the next 12 months. Although this projection is better than its three-year trend, it's hard to get excited about a company that is struggling with demand.

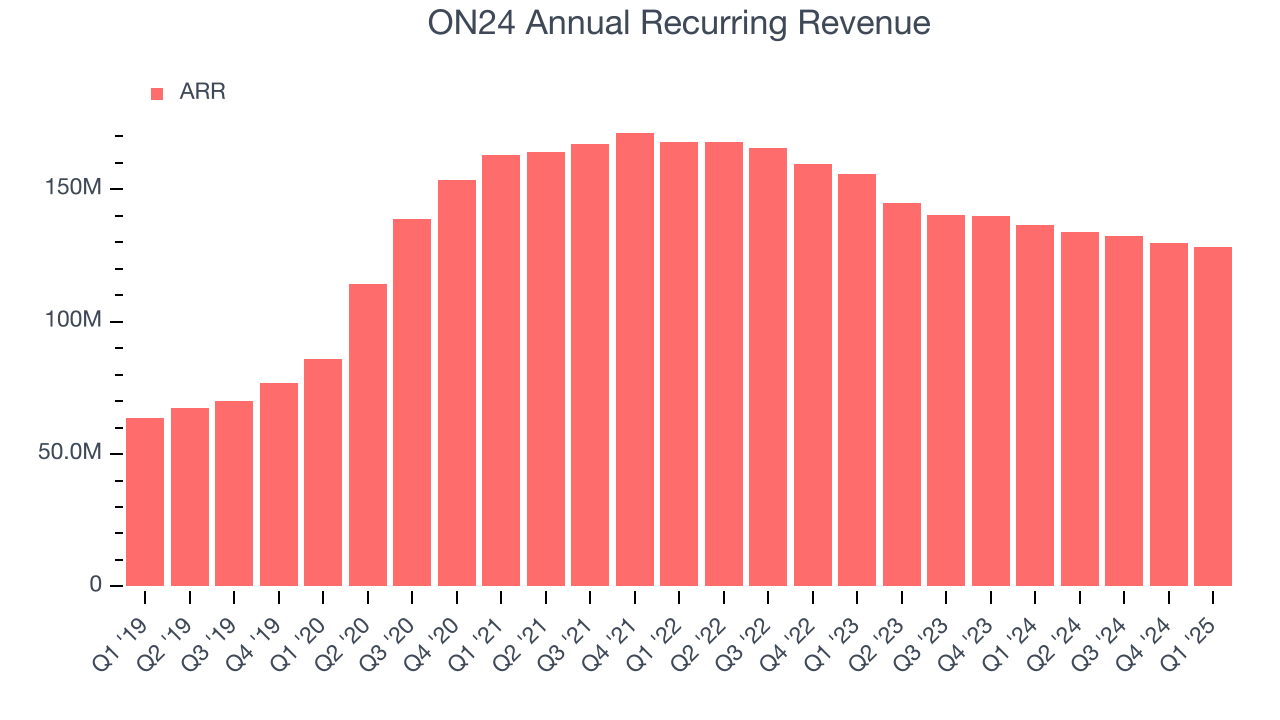

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

ON24’s ARR came in at $128.2 million in Q1, and it averaged 6.7% year-on-year declines over the last four quarters. This performance mirrored its total sales, showing the company lost long-term deals and renewals. It also suggests there may be increasing competition or market saturation.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

ON24’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between ON24’s products and its peers.

8. Gross Margin & Pricing Power

For software companies like ON24, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

ON24’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 74.4% gross margin over the last year. That means for every $100 in revenue, roughly $74.40 was left to spend on selling, marketing, and R&D.

In Q1, ON24 produced a 73.8% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

ON24’s expensive cost structure has contributed to an average operating margin of negative 33.5% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if ON24 reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Analyzing the trend in its profitability, ON24’s operating margin might fluctuated slightly but has generally stayed the same over the last year, meaning it will take a fundamental shift in the business model to change.

In Q1, ON24 generated a negative 30.1% operating margin. The company's consistent lack of profits raise a flag.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ON24 has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a software business.

ON24’s free cash flow clocked in at $1.94 million in Q1, equivalent to a 5.6% margin. This result was good as its margin was 2.7 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict ON24’s cash conversion will fall to break even. Their consensus estimates imply its free cash flow margin of 2.3% for the last 12 months will decrease by 1.8 percentage points.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

ON24 is a well-capitalized company with $181 million of cash and no debt. This position is 90.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from ON24’s Q1 Results

We were impressed by how significantly ON24 blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $4.72 immediately after reporting.

13. Is Now The Time To Buy ON24?

Updated: June 7, 2025 at 10:09 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ON24.

ON24 doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. And while its gross margin suggests it can generate sustainable profits, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. On top of that, its customer acquisition is less efficient than many comparable companies.

ON24’s price-to-sales ratio based on the next 12 months is 1.7x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $5.33 on the company (compared to the current share price of $5.53).