Addus HomeCare (ADUS)

Addus HomeCare doesn’t excite us. It not only barely generates profits but also has been less efficient lately, as seen by its falling margins.― StockStory Analyst Team

1. News

2. Summary

Why Addus HomeCare Is Not Exciting

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ:ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

- Modest revenue base of $1.21 billion gives it less fixed cost leverage and fewer distribution channels than larger companies

- Subpar adjusted operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- A positive is that its earnings per share grew by 14.3% annually over the last five years, outpacing its peers

Addus HomeCare’s quality is inadequate. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Addus HomeCare

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Addus HomeCare

Addus HomeCare is trading at $116.56 per share, or 18.8x forward P/E. We acknowledge that the current valuation is justified, but we’re passing on this stock for the time being.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Addus HomeCare (ADUS) Research Report: Q1 CY2025 Update

Home healthcare provider Addus HomeCare (NASDAQ:ADUS) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 20.3% year on year to $337.7 million. Its non-GAAP profit of $1.42 per share was 6.5% above analysts’ consensus estimates.

Addus HomeCare (ADUS) Q1 CY2025 Highlights:

- Revenue: $337.7 million vs analyst estimates of $339.9 million (20.3% year-on-year growth, 0.6% miss)

- Adjusted EPS: $1.42 vs analyst estimates of $1.33 (6.5% beat)

- Adjusted EBITDA: $40.57 million vs analyst estimates of $39.97 million (12% margin, 1.5% beat)

- Operating Margin: 9%, in line with the same quarter last year

- Sales Volumes rose 33.8% year on year (-1.7% in the same quarter last year)

- Market Capitalization: $1.91 billion

Company Overview

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ:ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

Addus HomeCare operates through three distinct service segments that form a comprehensive continuum of care. The Personal Care segment, which represents the company's largest service offering, provides non-medical assistance with daily living activities such as bathing, grooming, meal preparation, medication reminders, and transportation. These services help vulnerable individuals maintain independence while avoiding costly institutionalization.

The Hospice segment delivers end-of-life care for terminally ill patients, typically those with a life expectancy of six months or less. This includes palliative nursing care, spiritual counseling, social work, and bereavement support for families. Meanwhile, the Home Health segment provides medically-oriented services like skilled nursing and physical, occupational, and speech therapy, generally on a short-term basis for patients recovering from illness or injury.

Addus primarily generates revenue through contracts with government agencies, including state Medicaid programs, the Veterans Health Administration, and managed care organizations. The company receives client referrals through these agencies as well as from hospitals, physicians, nursing homes, and other healthcare providers. For example, a hospital discharge planner might refer an elderly patient recovering from surgery to Addus for in-home physical therapy and personal care assistance during recovery.

The company pursues growth through both organic expansion in existing markets and strategic acquisitions. In 2022, Addus acquired JourneyCare and Apple Home Healthcare, further expanding its service capabilities and geographic reach. The company strategically focuses on markets where it can offer its full continuum of care, providing clients with seamless transitions between service types as their needs change.

Addus operates in a highly regulated industry, with services subject to extensive federal and state oversight, including Medicare and Medicaid requirements, fraud and abuse laws, and patient privacy regulations.

4. Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Addus HomeCare's competitors include other home healthcare providers such as Amedisys (NASDAQ:AMED), LHC Group (acquired by UnitedHealth Group's Optum), Encompass Health (NYSE:EHC), and Brookdale Senior Living (NYSE:BKD), as well as numerous regional and local home care agencies.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.21 billion in revenue over the past 12 months, Addus HomeCare is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Addus HomeCare grew its sales at a decent 11.6% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Addus HomeCare’s annualized revenue growth of 11.4% over the last two years aligns with its five-year trend, suggesting its demand was stable.

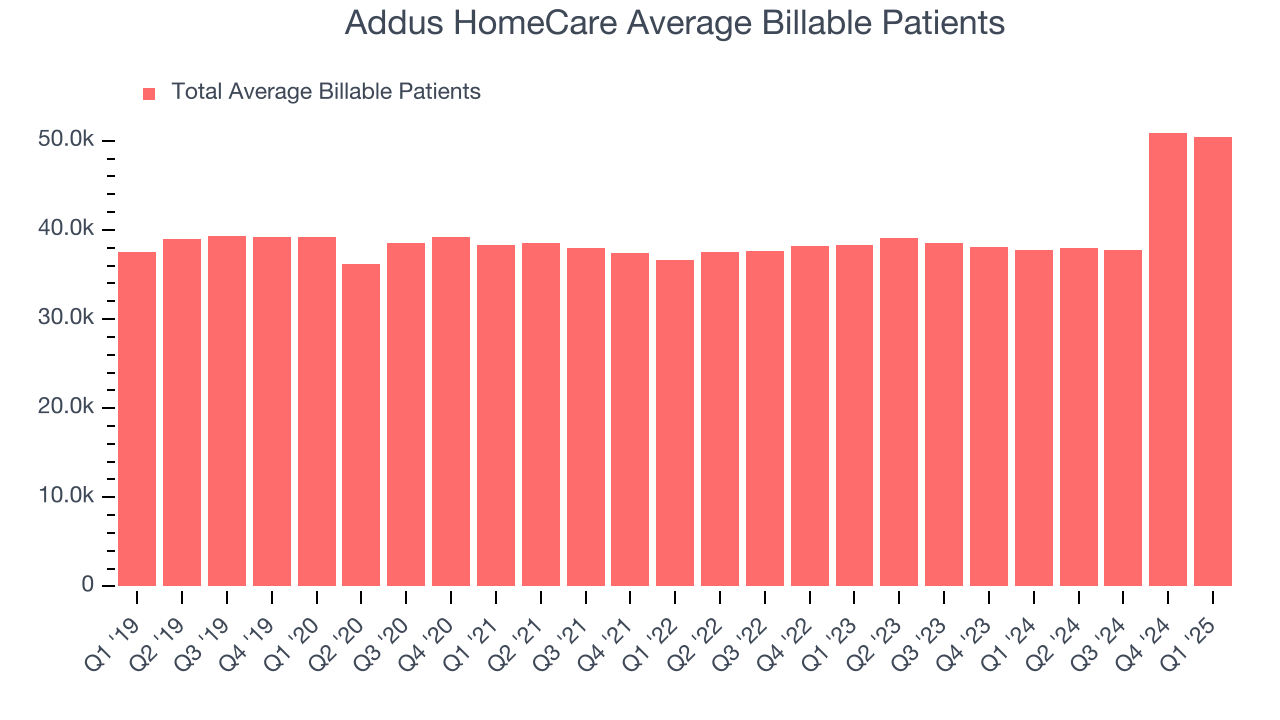

Addus HomeCare also reports its number of average billable patients, which reached 50,478 in the latest quarter. Over the last two years, Addus HomeCare’s average billable patients averaged 8.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Addus HomeCare generated an excellent 20.3% year-on-year revenue growth rate, but its $337.7 million of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 17.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel better top-line performance.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Addus HomeCare was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.9% was weak for a healthcare business.

On the plus side, Addus HomeCare’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.5 percentage points on a two-year basis.

This quarter, Addus HomeCare generated an operating profit margin of 9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Addus HomeCare’s EPS grew at a spectacular 14.3% compounded annual growth rate over the last five years, higher than its 11.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Addus HomeCare’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Addus HomeCare’s operating margin was flat this quarter but expanded by 3.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Addus HomeCare reported EPS at $1.42, up from $1.21 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Addus HomeCare’s full-year EPS of $5.45 to grow 13.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Addus HomeCare has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.3% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Addus HomeCare’s margin dropped by 6.4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Addus HomeCare’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 7.8%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Addus HomeCare’s ROIC averaged 1.9 percentage point increases over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

Addus HomeCare reported $96.95 million of cash and $398.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $147.9 million of EBITDA over the last 12 months, we view Addus HomeCare’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $2.51 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Addus HomeCare’s Q1 Results

It was good to see Addus HomeCare narrowly top analysts’ sales volume expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 2.3% to $106.80 immediately following the results.

13. Is Now The Time To Buy Addus HomeCare?

Updated: June 10, 2025 at 11:49 PM EDT

When considering an investment in Addus HomeCare, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Addus HomeCare isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was good over the last five years and is expected to accelerate over the next 12 months, its subscale operations give it fewer distribution channels than its larger rivals.

Addus HomeCare’s P/E ratio based on the next 12 months is 19.1x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $136.45 on the company (compared to the current share price of $118).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.