Domo (DOMO)

Domo is up against the odds. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think Domo Will Underperform

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

- Products, pricing, or go-to-market strategy need some adjustments as its billings have averaged 2.4% declines over the last year

- Demand is forecasted to shrink as its estimated sales for the next 12 months are flat

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Domo’s quality isn’t great. Better stocks can be found in the market.

Why There Are Better Opportunities Than Domo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Domo

At $12.63 per share, Domo trades at 1.6x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Domo (DOMO) Research Report: Q1 CY2025 Update

Data visualization and business intelligence company Domo (NASDAQ:DOMO) announced better-than-expected revenue in Q1 CY2025, but sales were flat year on year at $80.11 million. Guidance for next quarter’s revenue was better than expected at $78 million at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP loss of $0.09 per share was 53.6% above analysts’ consensus estimates.

Domo (DOMO) Q1 CY2025 Highlights:

- Revenue: $80.11 million vs analyst estimates of $77.68 million (flat year on year, 3.1% beat)

- Adjusted EPS: -$0.09 vs analyst estimates of -$0.19 (53.6% beat)

- Adjusted Operating Income: $1.03 million vs analyst estimates of -$2.68 million (1.3% margin, significant beat)

- The company slightly lifted its revenue guidance for the full year to $316 million at the midpoint from $314 million

- Management lowered its full-year Adjusted EPS guidance to $0.22 at the midpoint, a 35.3% decrease

- Operating Margin: -17.9%, up from -26.8% in the same quarter last year

- Free Cash Flow Margin: 1.3%, down from 7.6% in the previous quarter

- Billings: $63.9 million at quarter end, down 2.4% year on year

- Market Capitalization: $343.7 million

Company Overview

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Serial entrepreneur Josh James founded the company, after selling his prior company, Omniture, to Adobe (NASDAQ:ADBE). He had noticed that it was very difficult for the management to understand the vital signs of their company since data around various metrics such as staff numbers, retention rates, and customer acquisition costs were often held in disparate systems.

Today, Domo allows decision makers to monitor all these things and more from their phone and can draw data from thousands of sources, such as disparate points of sales across a large franchisee network.

For example, pharmaceutical companies rely on Domo's software to track the temperature of perishable products as they travel through the supply chain via real time updates. This helps them to test different refrigeration systems to know which one performs best, ensuring they save costs and deliver their products faster to users.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

In the business intelligence space, Domo is competing with Tableau (owned by Salesforce), Microsoft (NASDAQ:MSFT), and SAP (NYSE:SAP).

5. Sales Growth

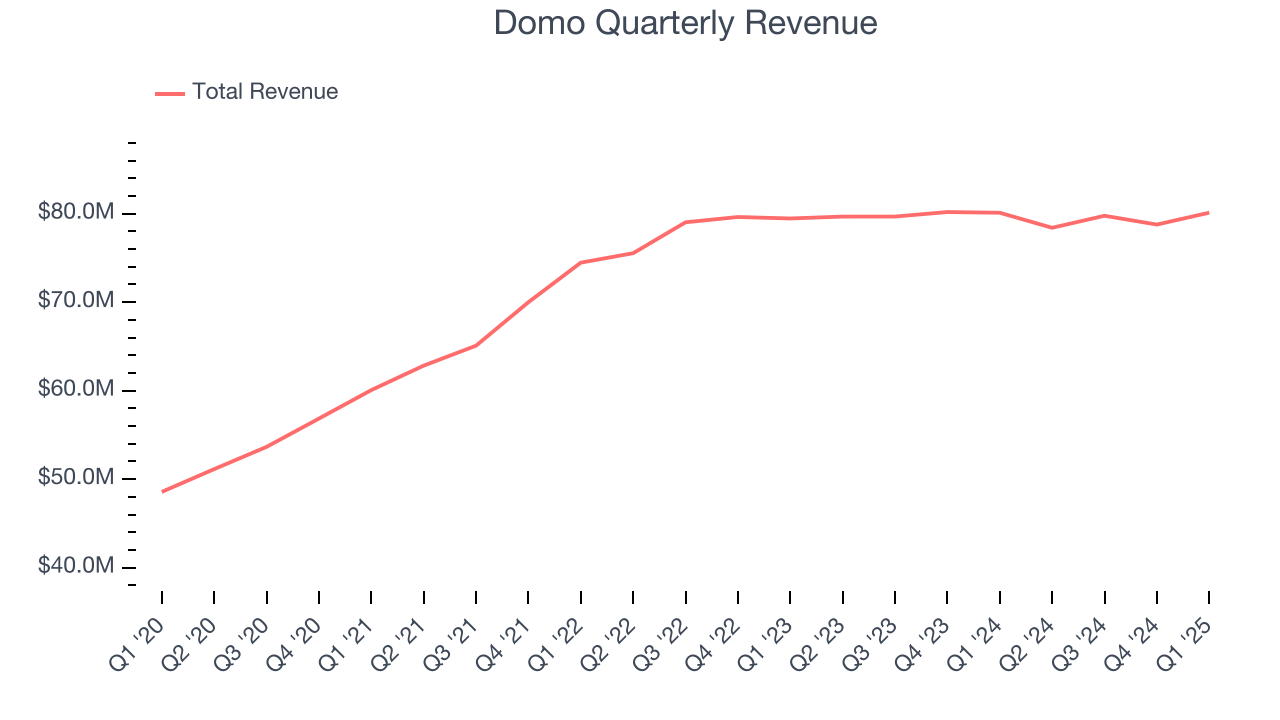

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Domo grew its sales at a weak 5.2% compounded annual growth rate. This was below our standard for the software sector and is a poor baseline for our analysis.

This quarter, Domo’s $80.11 million of revenue was flat year on year but beat Wall Street’s estimates by 3.1%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Domo’s billings came in at $63.9 million in Q1, and it averaged 2.4% year-on-year declines over the last four quarters. This performance mirrored its total sales and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Domo’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Domo’s products and its peers.

8. Gross Margin & Pricing Power

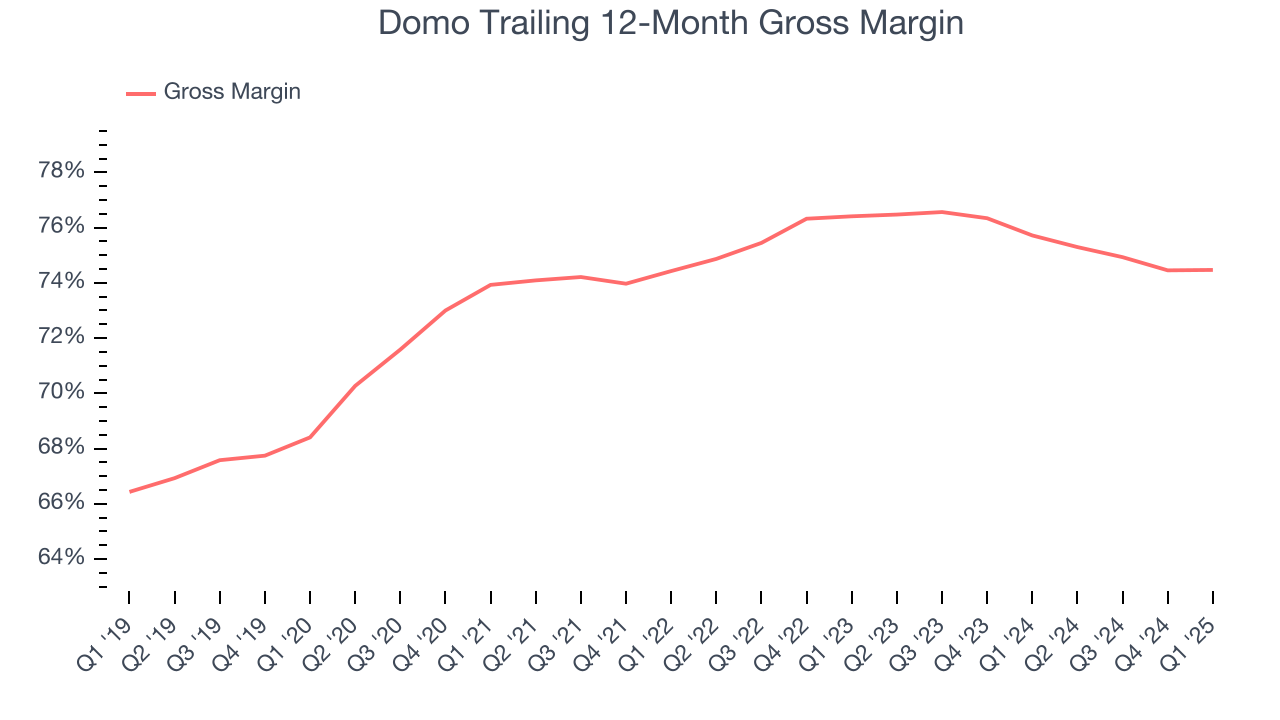

For software companies like Domo, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Domo’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 74.5% gross margin over the last year. That means for every $100 in revenue, roughly $74.47 was left to spend on selling, marketing, and R&D.

Domo produced a 74.2% gross profit margin in Q1, in line with the same quarter last year. On a wider time horizon, Domo’s full-year margin has been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Domo’s expensive cost structure has contributed to an average operating margin of negative 16.5% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Domo reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last year, Domo’s expanding sales gave it operating leverage as its margin rose by 1.3 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Domo generated a negative 17.9% operating margin. The company's consistent lack of profits raise a flag.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Domo posted positive free cash flow this quarter, the broader story hasn’t been so clean. Domo’s demanding reinvestments have consumed many resources over the last year, contributing to an average free cash flow margin of negative 4.8%. This means it lit $4.77 of cash on fire for every $100 in revenue.

Domo’s free cash flow clocked in at $1.03 million in Q1, equivalent to a 1.3% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Looking forward, analysts predict Domo will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 4.8% for the last 12 months will increase to positive 1.2%, giving it more money to invest.

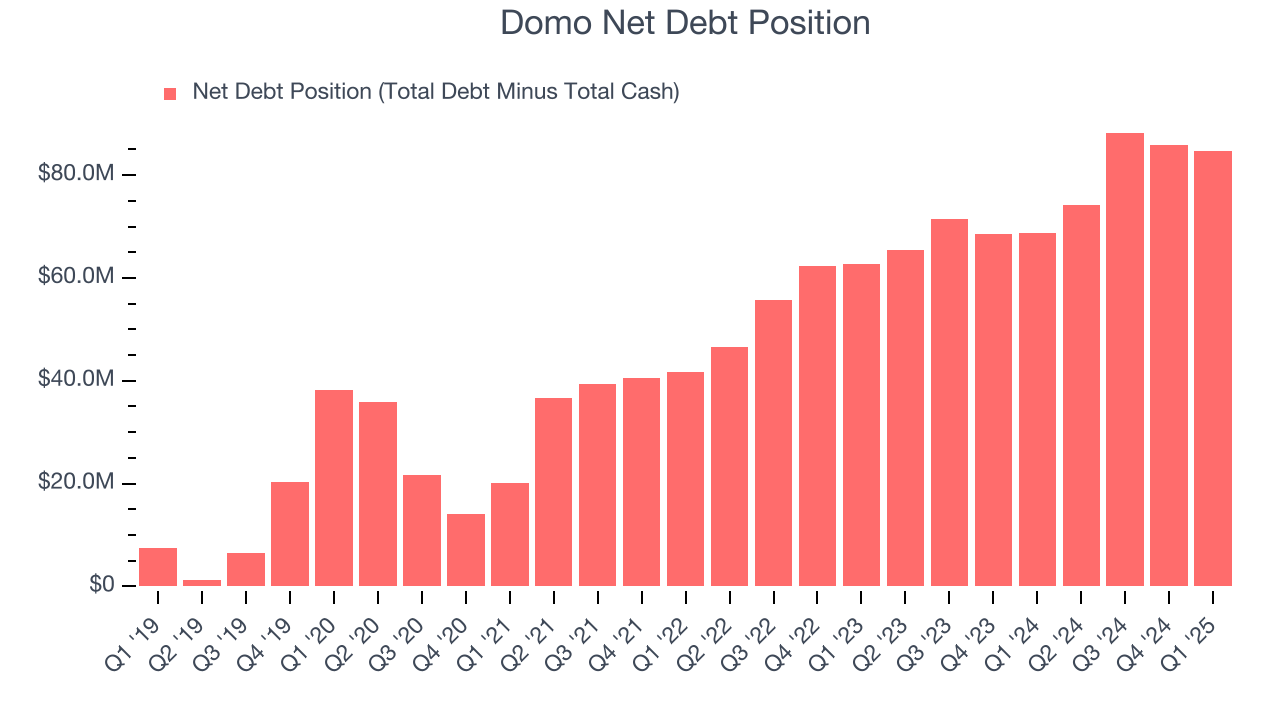

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Domo burned through $14.86 million of cash over the last year, and its $131.9 million of debt exceeds the $47.18 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Domo’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Domo until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Domo’s Q1 Results

Revenue and adjusted EPS in the quarter beat, which is always a good start. We were also impressed by Domo’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 7% to $9.15 immediately following the results.

13. Is Now The Time To Buy Domo?

Updated: June 18, 2025 at 10:09 PM EDT

Before investing in or passing on Domo, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Domo doesn’t pass our quality test. First off, its revenue growth was weak over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its growth is coming at the cost of significant cash burn.

Domo’s price-to-sales ratio based on the next 12 months is 1.6x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $12.80 on the company (compared to the current share price of $12.63).