EverQuote (EVER)

EverQuote does well for itself, but it doesn’t meet our bar for a high-quality company. We believe there are better opportunities in the market.― StockStory Analyst Team

1. News

2. Summary

Why EverQuote Is Not Exciting

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

- Highly competitive market means it’s on the never-ending treadmill of sales and marketing spend

- A consolation is that its platform is difficult to replicate at scale and results in a best-in-class gross margin of 94.9%

EverQuote doesn’t check our boxes. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than EverQuote

High Quality

Investable

Underperform

Why There Are Better Opportunities Than EverQuote

At $23.18 per share, EverQuote trades at 10.7x forward EV/EBITDA. We acknowledge that the current valuation is justified, but we’re passing on this stock for the time being.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. EverQuote (EVER) Research Report: Q1 CY2025 Update

Online insurance comparison site EverQuote (NASDAQ:EVER) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 83% year on year to $166.6 million. On top of that, next quarter’s revenue guidance ($157.5 million at the midpoint) was surprisingly good and 5.4% above what analysts were expecting. Its GAAP profit of $0.21 per share was 36.4% below analysts’ consensus estimates.

EverQuote (EVER) Q1 CY2025 Highlights:

- Revenue: $166.6 million vs analyst estimates of $158.3 million (83% year-on-year growth, 5.2% beat)

- EPS (GAAP): $0.21 vs analyst expectations of $0.33 (36.4% miss)

- Adjusted EBITDA: $22.51 million vs analyst estimates of $19.97 million (13.5% margin, 12.7% beat)

- Revenue Guidance for Q2 CY2025 is $157.5 million at the midpoint, above analyst estimates of $149.5 million

- EBITDA guidance for Q2 CY2025 is $21 million at the midpoint, above analyst estimates of $18.61 million

- Operating Margin: 4.8%, up from 1.9% in the same quarter last year

- Free Cash Flow Margin: 13.3%, similar to the previous quarter

- Market Capitalization: $965.7 million

Company Overview

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote is an online insurance marketplace founded in 2011 by Seth Birnbaum and Tomas Revesz, with the aim of revolutionizing the way people shop for and compare insurance policies. EverQuote's primary product is an online platform that allows users to compare and purchase auto, home, renters, and life insurance policies from different insurance companies. The platform uses proprietary analytics and algorithms to match users with insurance providers that offer the best coverage and prices based on their specific needs and budget.

The service provided by EverQuote is essential for customers because shopping for insurance can be a daunting and confusing process, especially for those who are not familiar with the intricacies of insurance policies. With EverQuote, customers can easily and quickly compare policies from different providers and choose the one that suits them best.

EverQuote makes money by charging insurance companies a fee for every lead generated through its platform. This fee is based on the type of insurance policy, the lead's quality, and the competition in the market.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering an insurance marketplace include Progressive (NYSE:PGR) as well as private companies Farmer’s Insurance and Liberty Mutual.

5. Sales Growth

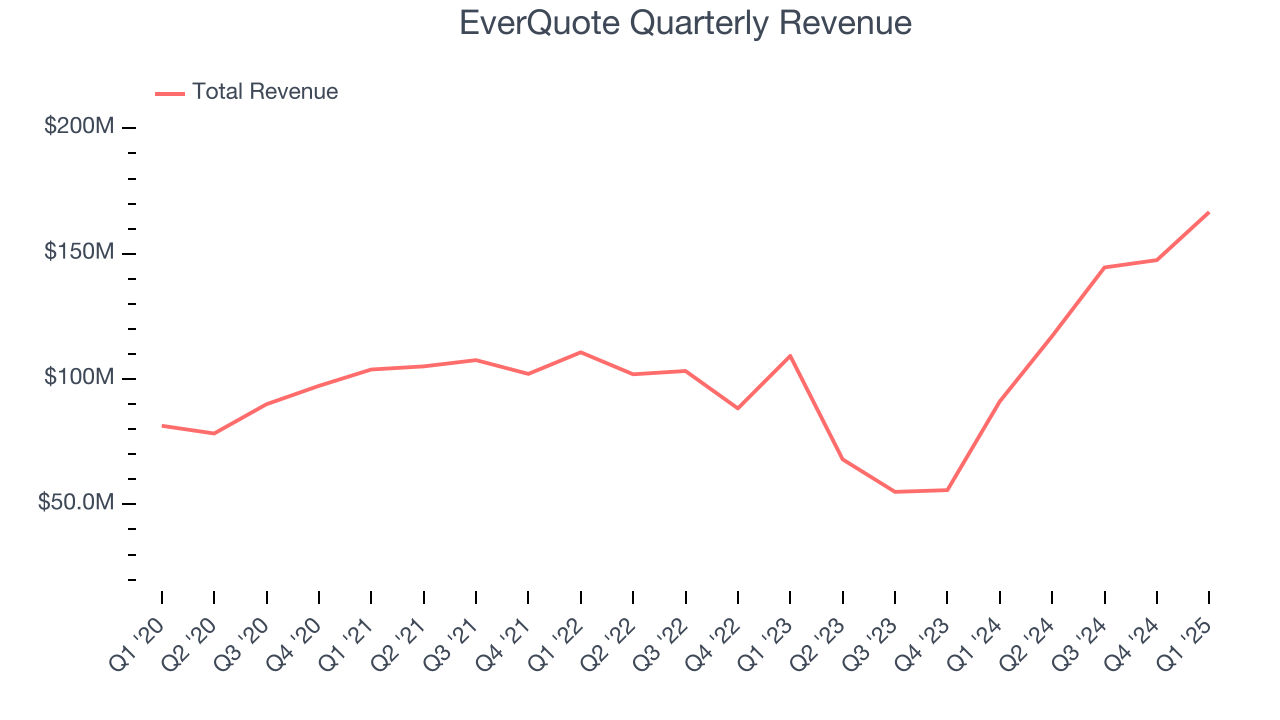

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, EverQuote’s 10.6% annualized revenue growth over the last three years was decent. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, EverQuote reported magnificent year-on-year revenue growth of 83%, and its $166.6 million of revenue beat Wall Street’s estimates by 5.2%. Company management is currently guiding for a 34.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, similar to its three-year rate. This projection is above the sector average and suggests its newer products and services will help maintain its historical top-line performance.

6. Gross Margin & Pricing Power

For online marketplaces like EverQuote, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

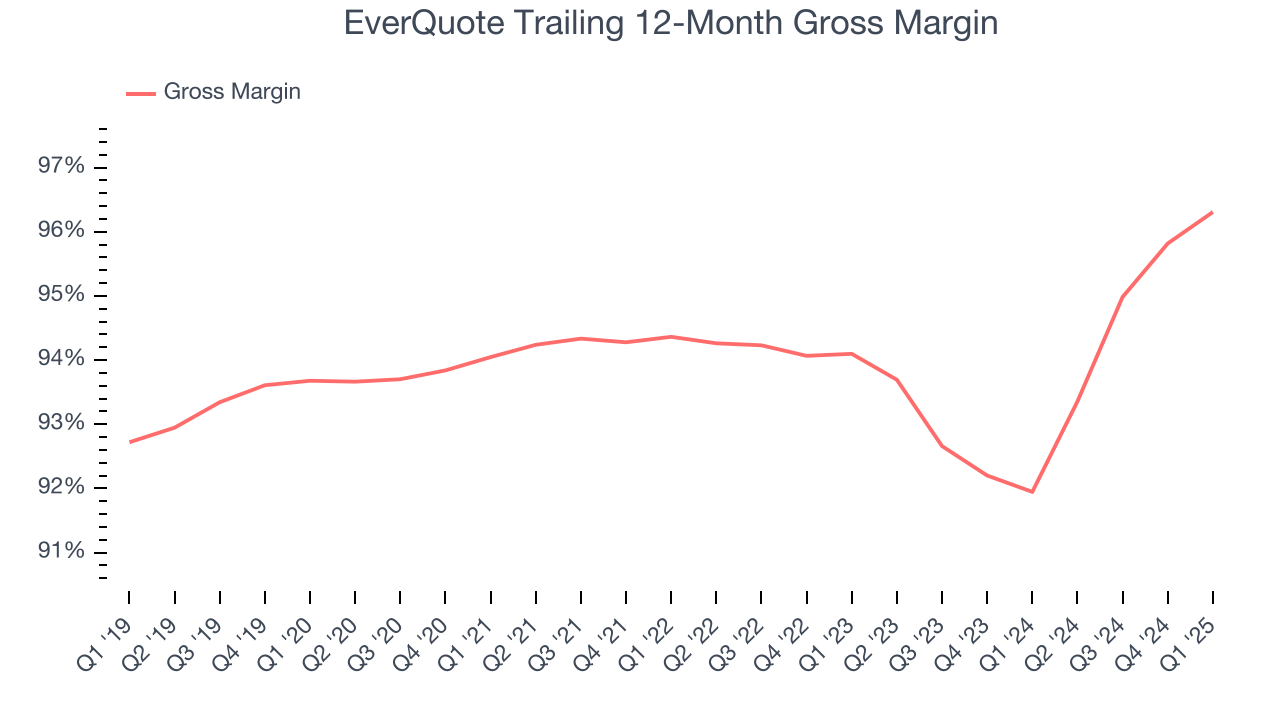

EverQuote’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 94.9% gross margin over the last two years. That means EverQuote only paid its providers $5.08 for every $100 in revenue.

EverQuote’s gross profit margin came in at 96.8% this quarter, marking a 2.3 percentage point increase from 94.5% in the same quarter last year. EverQuote’s full-year margin has also been trending up over the past 12 months, increasing by 4.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

7. User Acquisition Efficiency

Consumer internet businesses like EverQuote grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s very expensive for EverQuote to acquire new users as the company has spent 80.5% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between EverQuote and its peers.

8. EBITDA

EverQuote has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, EverQuote’s EBITDA margin rose by 9.8 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, EverQuote generated an EBITDA profit margin of 13.5%, up 5.2 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

EverQuote’s full-year EPS flipped from negative to positive over the last three years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, EverQuote reported EPS at $0.21, up from $0.05 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects EverQuote’s full-year EPS of $1.02 to grow 20.1%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

EverQuote has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.5% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that EverQuote’s margin expanded by 13.7 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

EverQuote’s free cash flow clocked in at $22.17 million in Q1, equivalent to a 13.3% margin. This result was good as its margin was 2.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

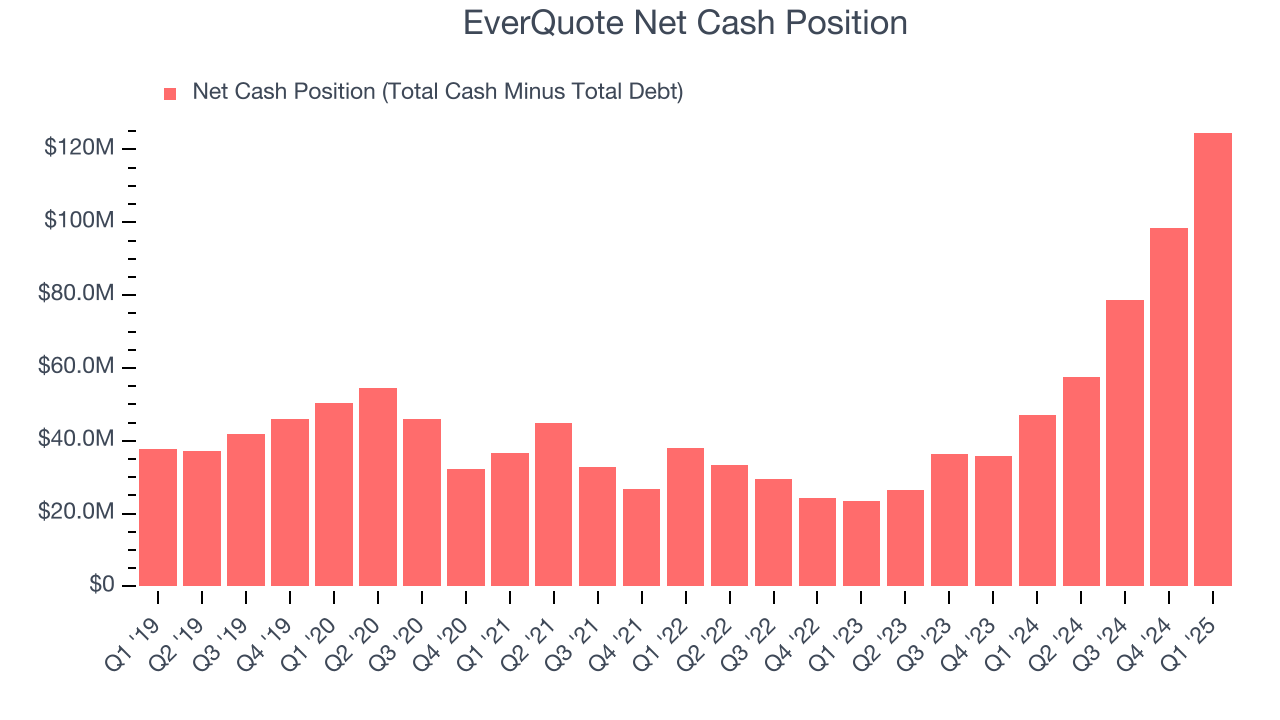

EverQuote is a profitable, well-capitalized company with $125 million of cash and $335,000 of debt on its balance sheet. This $124.6 million net cash position is 12.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from EverQuote’s Q1 Results

We were impressed by EverQuote’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. However, expectations may have been elevated as shares traded down 1.3% to $26 immediately following the results.

13. Is Now The Time To Buy EverQuote?

Updated: May 22, 2025 at 10:29 PM EDT

Are you wondering whether to buy EverQuote or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

EverQuote has some positive attributes, but it isn’t one of our picks. First off, its revenue growth was decent over the last three years and is expected to accelerate over the next 12 months. And while EverQuote’s sales and marketing spend is very high compared to other consumer internet businesses, its admirable gross margins are a wonderful starting point for the overall profitability of the business.

EverQuote’s EV/EBITDA ratio based on the next 12 months is 10.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $34.17 on the company (compared to the current share price of $23.18).

Want to invest in a High Quality big tech company? We’d point you in the direction of Microsoft and Google, which have durable competitive moats and strong fundamentals, factors that are large determinants of long-term market outperformance.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist. We typically have quarterly earnings results analyzed within seconds of the data being released, giving investors the chance to react before the market has fully absorbed the information. This is especially true for companies reporting pre-market.