ePlus (PLUS)

ePlus faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think ePlus Will Underperform

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ:PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

- Earnings per share have contracted by 3.7% annually over the last two years, a headwind for returns as stock prices often echo long-term EPS performance

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last two years

- Poor expense management has led to an operating margin that is below the industry average

ePlus doesn’t check our boxes. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than ePlus

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ePlus

At $71.25 per share, ePlus trades at 15.5x forward P/E. This multiple is lower than most business services companies, but for good reason.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. ePlus (PLUS) Research Report: Q1 CY2025 Update

IT solutions provider ePlus (NASDAQ:PLUS) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 10.2% year on year to $498.1 million. Its non-GAAP profit of $1.11 per share was 28.3% above analysts’ consensus estimates.

ePlus (PLUS) Q1 CY2025 Highlights:

- Revenue: $498.1 million vs analyst estimates of $523.9 million (10.2% year-on-year decline, 4.9% miss)

- Adjusted EPS: $1.11 vs analyst estimates of $0.87 (28.3% beat)

- Initiating fiscal 2026 guidance (the company's fiscal year ends in March): "net sales growth of low single digits, and gross profit and adjusted EBITDA in the mid single digits" (below expectations)

- Operating Margin: 7%, up from 5.3% in the same quarter last year

- Market Capitalization: $1.72 billion

Company Overview

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ:PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

ePlus operates through two main business segments: technology and financing. The technology segment, which generates about 98% of revenue, offers hardware, software, and a suite of professional and managed services. The company partners with major technology manufacturers like Cisco, Amazon Web Services, Microsoft, Dell EMC, and NetApp to deliver solutions across cloud computing, cybersecurity, data center infrastructure, networking, and collaboration technologies.

The company's professional services team helps clients design and implement complex IT systems, while their managed services division provides ongoing support through offerings like cloud management, security monitoring, and IT help desk services. For example, a healthcare organization might engage ePlus to design a secure cloud infrastructure, implement the solution, and then provide 24/7 monitoring and management.

ePlus serves mid-market to large enterprises across diverse sectors, with telecommunications, technology, government/education, healthcare, and financial services being their primary markets. Verizon Communications represents a significant customer, accounting for approximately 19% of net sales.

The financing segment, though smaller at just 2% of revenue, contributes about 16% of operating income. This division helps customers acquire technology through various financing arrangements including leases, loans, and consumption-based models. Beyond simple financing, ePlus offers asset management services throughout the technology lifecycle, from procurement to end-of-life disposal.

With operations primarily in the United States and select international markets including the United Kingdom, European Union, India, and Singapore, ePlus employs hundreds of sales and technical professionals who hold certifications from leading technology manufacturers. This expertise allows the company to design and deliver integrated solutions that address complex business challenges rather than simply selling individual products.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

ePlus competes with large IT solution providers and value-added resellers such as CDW (NASDAQ:CDW), Insight Enterprises (NASDAQ:NSIT), and Connection (NASDAQ:CNXN), as well as with the professional services divisions of major technology manufacturers and consulting firms.

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.07 billion in revenue over the past 12 months, ePlus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, ePlus grew its sales at a mediocre 4.9% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ePlus’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, ePlus missed Wall Street’s estimates and reported a rather uninspiring 10.2% year-on-year revenue decline, generating $498.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

6. Operating Margin

ePlus was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.5% was weak for a business services business.

Looking at the trend in its profitability, ePlus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, ePlus generated an operating profit margin of 7%, up 1.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

ePlus’s EPS grew at a decent 8.7% compounded annual growth rate over the last five years, higher than its 4.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

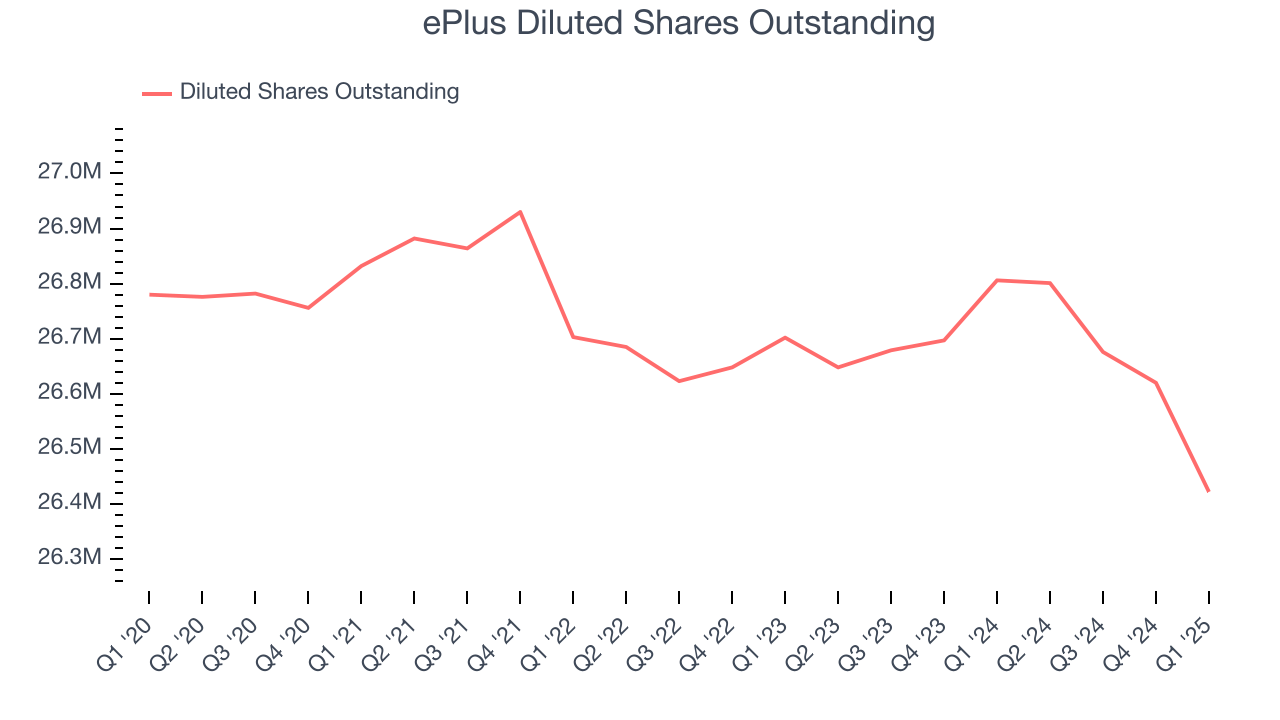

We can take a deeper look into ePlus’s earnings to better understand the drivers of its performance. A five-year view shows that ePlus has repurchased its stock, shrinking its share count by 1.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, ePlus reported EPS at $1.11, up from $0.93 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ePlus’s full-year EPS of $4.66 to shrink by 1.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

ePlus has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.6%, subpar for a business services business.

Taking a step back, an encouraging sign is that ePlus’s margin expanded by 8.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

ePlus historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, ePlus’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

ePlus is a well-capitalized company with $389.4 million of cash and $38.77 million of debt on its balance sheet. This $350.6 million net cash position is 20.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from ePlus’s Q1 Results

Revenue missed, but EPS managed to beat. Looking ahead, the company initiated full-year fiscal 2026 guidance (since fiscal year 2025 ended in March), guiding to "net sales growth of low single digits, and gross profit and adjusted EBITDA in the mid single digits". This is below expectations of mid single digit revenue growth and double digit EBITDA growth. Shares traded down 3.2% to $63.76 immediately following the results.

12. Is Now The Time To Buy ePlus?

Updated: June 19, 2025 at 12:10 AM EDT

Are you wondering whether to buy ePlus or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We see the value of companies helping their customers, but in the case of ePlus, we’re out. First off, its revenue growth was mediocre over the last five years, and analysts don’t see anything changing over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its projected EPS for the next year is lacking. On top of that, its operating margins are low compared to other business services companies.

ePlus’s P/E ratio based on the next 12 months is 15.5x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $92 on the company (compared to the current share price of $71.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.