Sanmina (SANM)

Sanmina is in for a bumpy ride. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sanmina Will Underperform

Founded in 1980, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 6.2% annually over the last two years

- Earnings per share have dipped by 4.2% annually over the past two years, which is concerning because stock prices follow EPS over the long term

- High input costs result in an inferior gross margin of 8.2% that must be offset through higher volumes

Sanmina falls short of our expectations. There are more appealing investments to be made.

Why There Are Better Opportunities Than Sanmina

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sanmina

At $96.99 per share, Sanmina trades at 14.4x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Sanmina (SANM) Research Report: Q1 CY2025 Update

Electronics manufacturing services company Sanmina (NASDAQ:SANM) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 8.1% year on year to $1.98 billion. On the other hand, next quarter’s revenue guidance of $1.98 billion was less impressive, coming in 4.4% below analysts’ estimates. Its non-GAAP profit of $1.41 per share was 2.5% above analysts’ consensus estimates.

Sanmina (SANM) Q1 CY2025 Highlights:

- Revenue: $1.98 billion vs analyst estimates of $1.97 billion (8.1% year-on-year growth, 1% beat)

- Adjusted EPS: $1.41 vs analyst estimates of $1.38 (2.5% beat)

- Adjusted Operating Income: $110.6 million vs analyst estimates of $106.8 million (5.6% margin, 3.6% beat)

- Revenue Guidance for Q2 CY2025 is $1.98 billion at the midpoint, below analyst estimates of $2.07 billion

- Adjusted EPS guidance for Q2 CY2025 is $1.40 at the midpoint, below analyst estimates of $1.54

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 7.9%, up from 2.3% in the same quarter last year

- Market Capitalization: $4.47 billion

Company Overview

Founded in 1980, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

Initially focusing on printed circuit boards, Sanmina expanded through strategic acquisitions and diversification, enabling it to provide end-to-end manufacturing solutions across various high-tech sectors. One significant merger was with SCI Systems in 2001, significantly expanding its capabilities and global footprint.

Sanmina offers a diverse suite of services designed to enhance the productivity and efficiency of businesses across several sectors including industrial manufacturing, medical, defense and aerospace, and communications networks. Its product offerings range from electronic components like printed circuit boards and backplanes to complex systems such as medical devices and communications hardware. Additionally, Sanmina provides services including product design, engineering, direct order fulfillment, and after-market services. For example, its advanced manufacturing products cater to the aerospace industry where precision and reliability are critical.

Sanmina's revenue primarily stems from its long-term supply agreements with major OEM customers. These agreements typically last three to five years, though they often don't require the customer to commit to minimum purchase volumes. This can lead to some variability in revenue, but it's mitigated by clauses that make the customer responsible for the cost of materials ordered based on their forecasts, even if those materials are not ultimately used.

This structure supports recurring revenue streams by ensuring that, while individual orders might fluctuate, the overall relationship and contractual obligations continue over a multi-year period. This setup helps stabilize Sanmina's revenue generation, making it less susceptible to short-term market fluctuations and more reliant on long-term strategic partnerships.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Sanmina in the electronics manufacturing services (EMS) industry include Flex (NASDAQ:FLEX), Javil (NYSE:JBL), and Celestica (NYSE:CLS).

5. Sales Growth

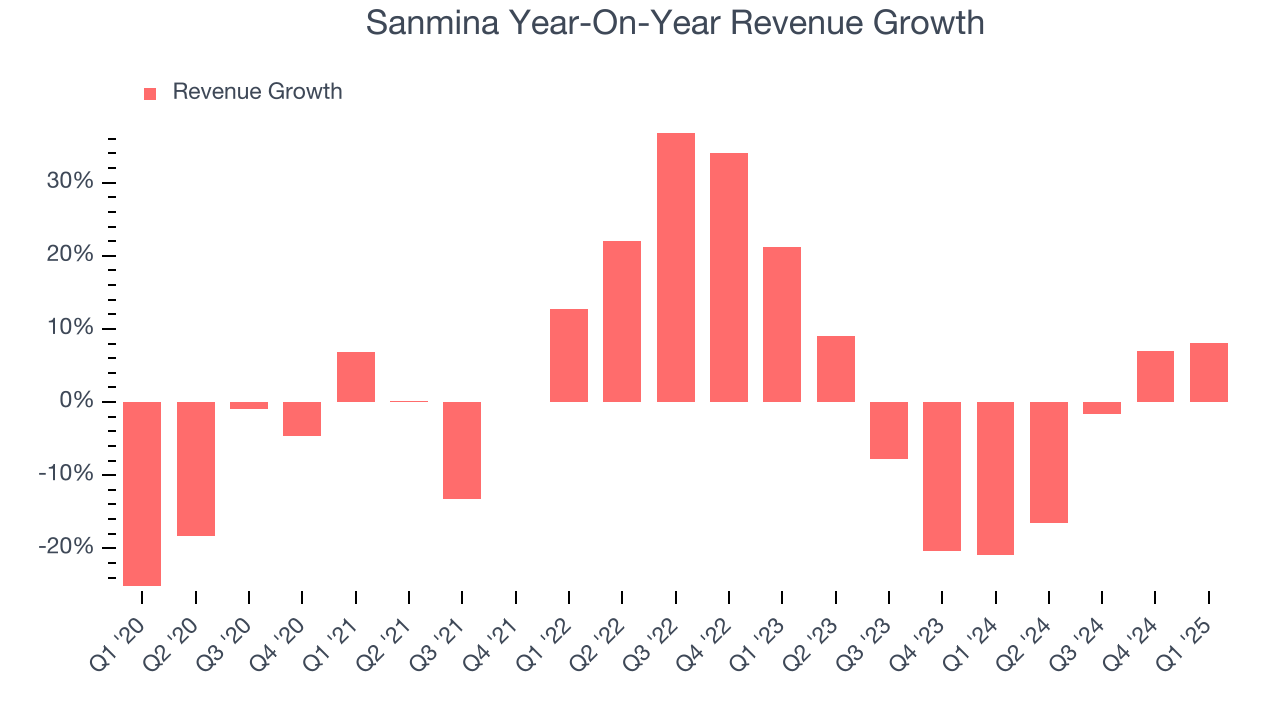

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Sanmina’s 1.3% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Sanmina’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.2% annually. Sanmina isn’t alone in its struggles as the Electrical Systems industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Sanmina reported year-on-year revenue growth of 8.1%, and its $1.98 billion of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 7.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

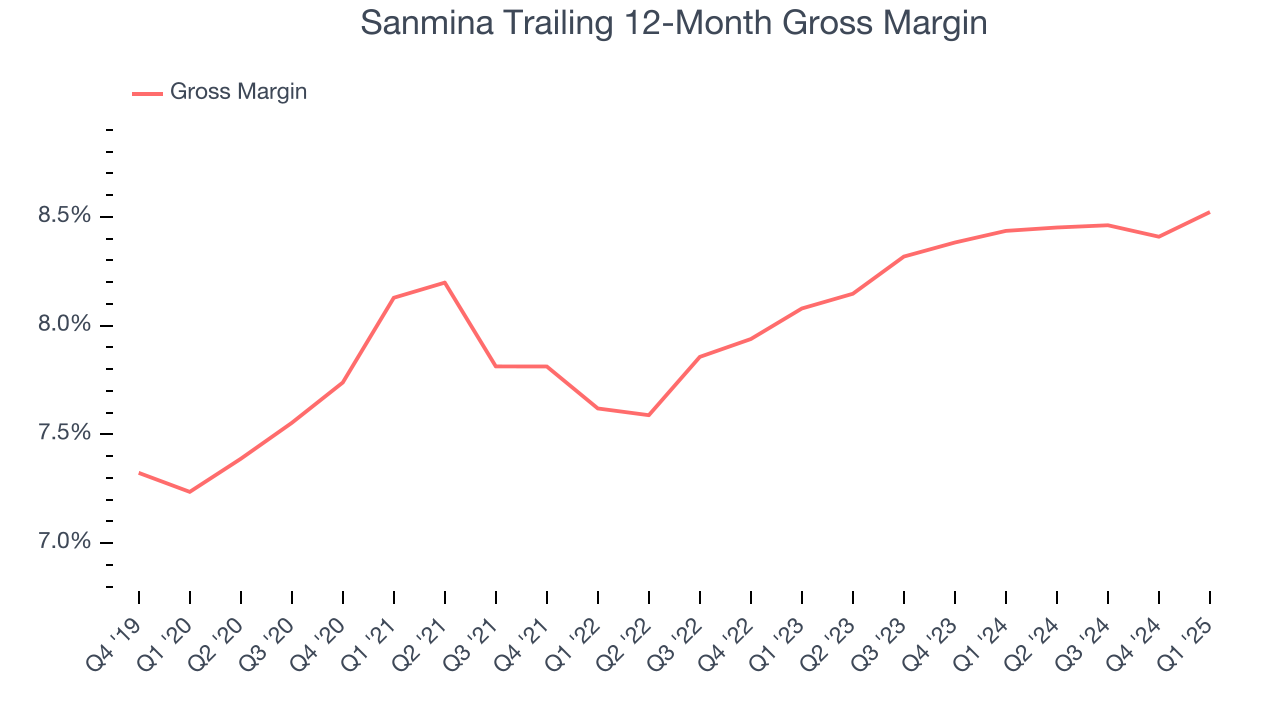

6. Gross Margin & Pricing Power

Sanmina has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 8.2% gross margin over the last five years. Said differently, Sanmina had to pay a chunky $91.83 to its suppliers for every $100 in revenue.

Sanmina’s gross profit margin came in at 8.9% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

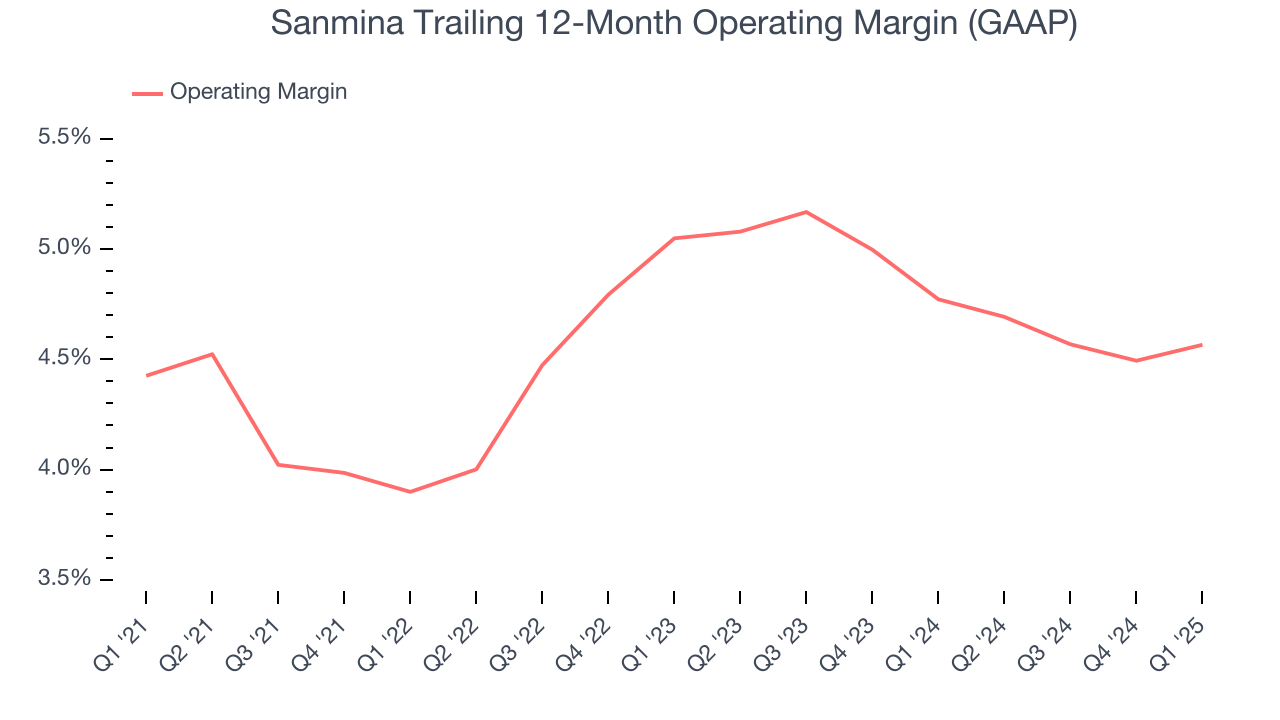

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Sanmina was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Sanmina’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Sanmina generated an operating profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sanmina’s EPS grew at a spectacular 14.8% compounded annual growth rate over the last five years, higher than its 1.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into Sanmina’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Sanmina has repurchased its stock, shrinking its share count by 23.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Sanmina, its two-year annual EPS declines of 4.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Sanmina can return to earnings growth in the future.

In Q1, Sanmina reported EPS at $1.41, up from $1.30 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects Sanmina’s full-year EPS of $5.53 to grow 20.5%.

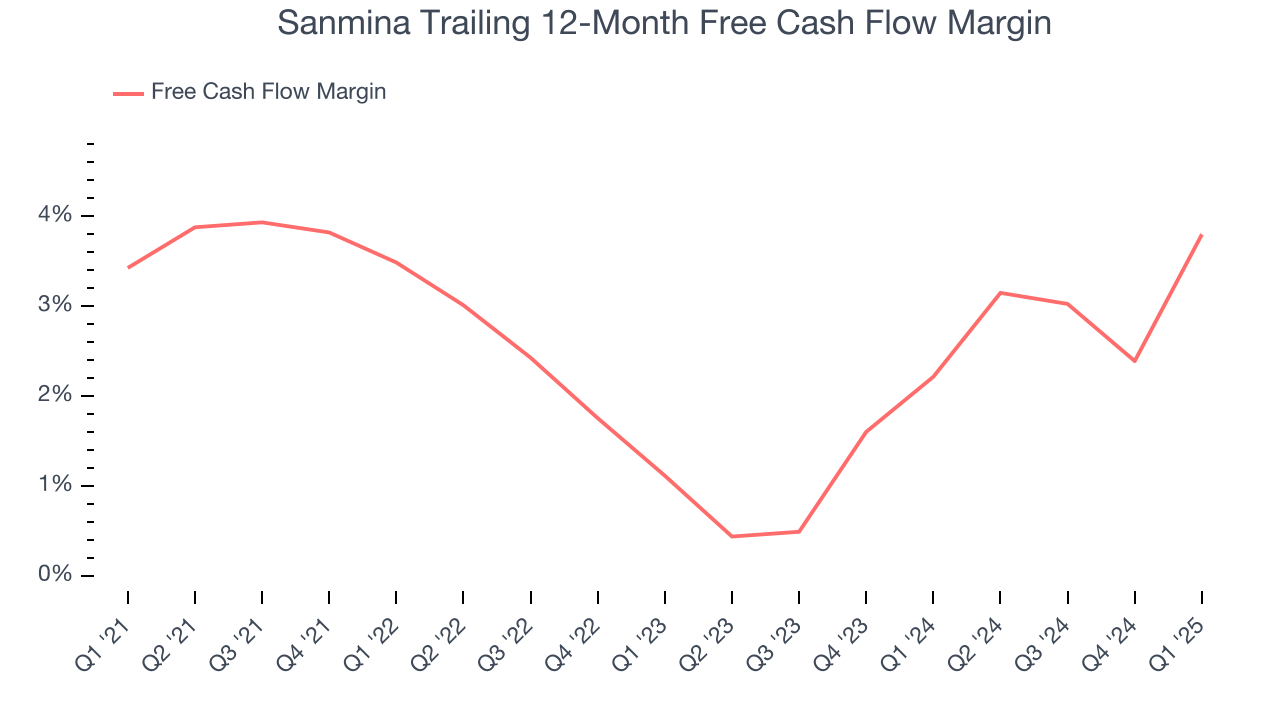

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Sanmina has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.7%, lousy for an industrials business.

Taking a step back, we can see that Sanmina failed to improve its margin during that time. Its unexciting margin and trend likely have shareholders hoping for a change.

Sanmina’s free cash flow clocked in at $156.9 million in Q1, equivalent to a 7.9% margin. This result was good as its margin was 5.6 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

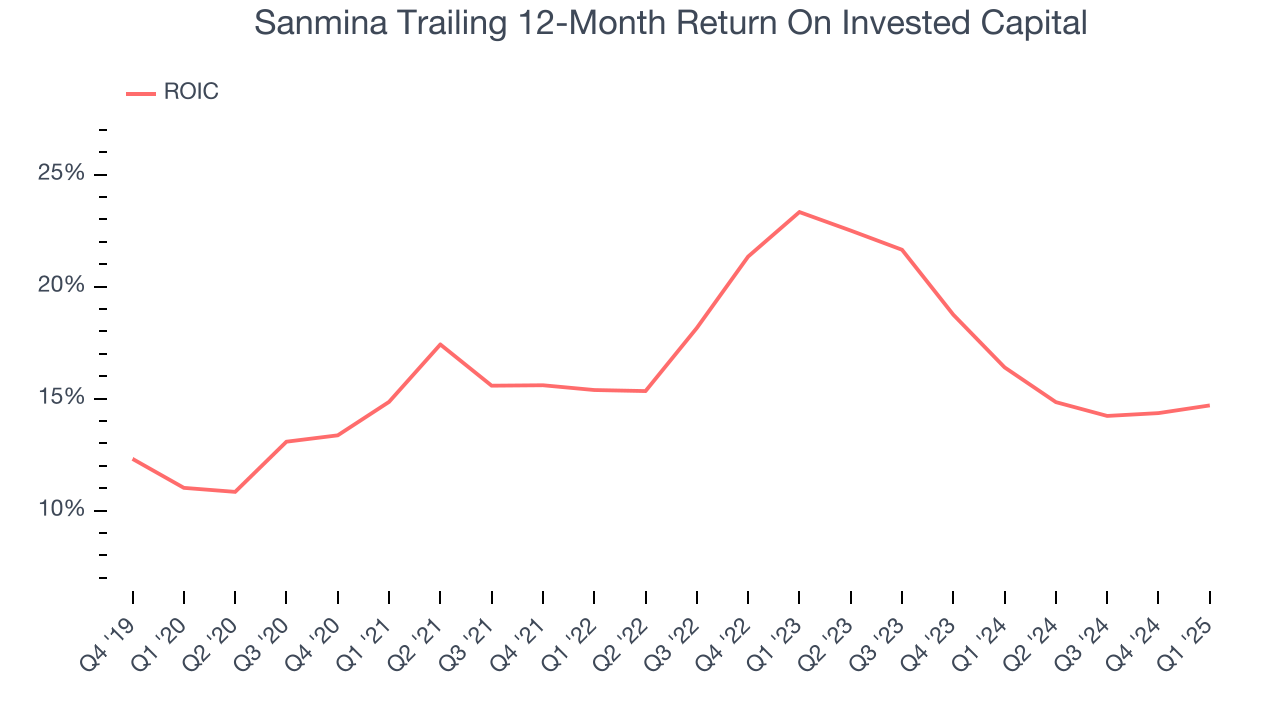

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Sanmina hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16.9%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Sanmina’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Sanmina is a profitable, well-capitalized company with $647.1 million of cash and $330.5 million of debt on its balance sheet. This $316.6 million net cash position is 7.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Sanmina’s Q1 Results

It was encouraging to see Sanmina beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $80.73 immediately following the results.

13. Is Now The Time To Buy Sanmina?

Updated: June 26, 2025 at 11:22 PM EDT

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Sanmina falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low gross margins indicate some combination of competitive pressures and high production costs. On top of that, its low free cash flow margins give it little breathing room.

Sanmina’s P/E ratio based on the next 12 months is 14.4x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $97.50 on the company (compared to the current share price of $96.99).