Semtech (SMTC)

Semtech faces an uphill battle. Its negative returns on capital raise questions about its ability to allocate resources and generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Semtech Will Underperform

A public company since the late 1960s, Semtech (NASDAQ:SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

- Persistent operating margin losses and eroding margin over the last five years point to its preference for growth over profits

- Negative returns on capital show management lost money while trying to expand the business, and its shrinking returns suggest its past profit sources are losing steam

- Estimated sales growth of 3% for the next 12 months implies demand will slow from its two-year trend

Semtech lacks the business quality we seek. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Semtech

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Semtech

At $41.93 per share, Semtech trades at 24.1x forward P/E. Semtech’s multiple may seem like a great deal among semiconductor peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Semtech (SMTC) Research Report: Q1 CY2025 Update

Semiconductor company Semtech (NASDAQ:SMTC) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 21.8% year on year to $251.1 million. On the other hand, next quarter’s revenue guidance of $256 million was less impressive, coming in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.38 per share was in line with analysts’ consensus estimates.

Semtech (SMTC) Q1 CY2025 Highlights:

- Revenue: $251.1 million vs analyst estimates of $251 million (21.8% year-on-year growth, in line)

- Adjusted EPS: $0.38 vs analyst estimates of $0.37 (in line)

- Adjusted EBITDA: $55.4 million vs analyst estimates of $47.72 million (22.1% margin, 16.1% beat)

- Revenue Guidance for Q2 CY2025 is $256 million at the midpoint, below analyst estimates of $260.4 million

- Adjusted EPS guidance for Q2 CY2025 is $0.40 at the midpoint

- EBITDA guidance for Q2 CY2025 is $56 million at the midpoint, above analyst estimates of $49.2 million

- Operating Margin: 14.3%, up from 1.5% in the same quarter last year

- Free Cash Flow was $26.2 million, up from -$1.42 million in the same quarter last year

- Inventory Days Outstanding: 129, down from 153 in the previous quarter

- Market Capitalization: $3.23 billion

Company Overview

A public company since the late 1960s, Semtech (NASDAQ:SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

Semtech was founded in 1960 by Gustav H.D. Franzen and Harvey Stump, Jr. The two initially started Semtech to provide components for companies with aerospace and military contracts. The company went public in 1967.

Semtech is a pioneer and leader in LoRa (long range) technology for radio communication, which has become the de facto wireless platform of Internet of Things. LoRa encodes information on radio waves using chirp pulses, making its transmission robust against disturbances over longer distances and superior over WiFi and Bluetooth. LoRa is also well-suited for applications that transmit small chunks of data with low bit rate, making it ideal for the sensors that operate in low power mode found in IoT applications.

In addition, Semtech offers a portfolio of signal integrity products for optical data communications and video transport. The company’s signal integrity chips can be found in wireless base stations that enable cellular communications and high-definition broadcasts that enable television technologies.

Semtech’s customers include major OEMs and their subcontractors in the infrastructure, consumer, and industrial end markets. Semtech outsources the majority of manufacturing functions to third-party foundries and assembly contractors.

Competitors offering analog and mixed-signal semiconductors for infrastructure and communications include Cisco (NASDAQ:CSCO), KORE Group (NYSE:KORE), and NXP Semiconductors (NASDAQ:NXPI).

4. Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Semtech’s 11.7% annualized revenue growth over the last five years was solid. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Semtech’s annualized revenue growth of 9.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Semtech’s year-on-year revenue growth of 21.8% was excellent, and its $251.1 million of revenue was in line with Wall Street’s estimates. Beyond meeting estimates, we believe the company is still in the early days of an upcycle as this was the third consecutive quarter of growth - a typical upcycle tends to last 8-10 quarters. Company management is currently guiding for a 18.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Semtech’s DIO came in at 129, which is 21 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

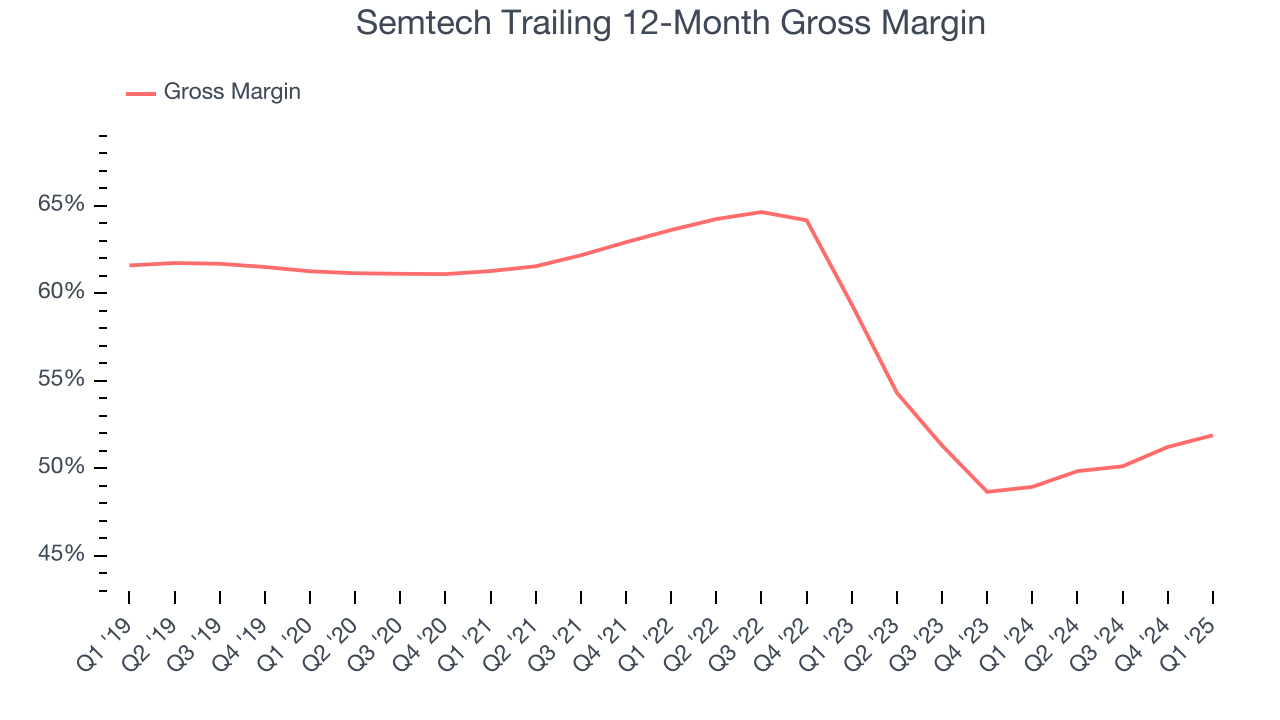

Semtech’s unit economics are reasonably high for a semiconductor business, pointing to a lack of meaningful pricing pressure and its products’ solid competitive positioning. As you can see below, it averaged an impressive 50.5% gross margin over the last two years. Said differently, Semtech paid its suppliers $49.50 for every $100 in revenue.

Semtech’s gross profit margin came in at 52.3% this quarter, up 2.9 percentage points year on year. Semtech’s full-year margin has also been trending up over the past 12 months, increasing by 2.9 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Although Semtech was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 47.2% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Semtech’s operating margin decreased by 5.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Semtech’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Semtech generated an operating profit margin of 14.3%, up 12.8 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Semtech, its EPS declined by 5.7% annually over the last five years while its revenue grew by 11.7%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Semtech’s earnings to better understand the drivers of its performance. As we mentioned earlier, Semtech’s operating margin improved this quarter but declined by 5.1 percentage points over the last five years. Its share count also grew by 35.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Semtech reported EPS at $0.38, up from $0.06 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects Semtech’s full-year EPS of $1.15 to grow 50.9%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Semtech has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, lousy for a semiconductor business.

Taking a step back, we can see that Semtech’s margin dropped by 6.8 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business.

Semtech’s free cash flow clocked in at $26.2 million in Q1, equivalent to a 10.4% margin. This result was good as its margin was 11.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Semtech’s five-year average ROIC was negative 6.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

11. Balance Sheet Assessment

Semtech reported $156.5 million of cash and $542.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $216.5 million of EBITDA over the last 12 months, we view Semtech’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $58.48 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Semtech’s Q1 Results

We were impressed by Semtech’s strong improvement in inventory levels. We were also glad its adjusted operating income outperformed Wall Street’s estimates. On the other hand, revenue was just in line this quarter, and revenue guidance for next quarter missed. Overall, this print was mixed. The stock traded down 3.5% to $37.45 immediately after reporting.

13. Is Now The Time To Buy Semtech?

Updated: June 20, 2025 at 10:23 PM EDT

Before making an investment decision, investors should account for Semtech’s business fundamentals and valuation in addition to what happened in the latest quarter.

Semtech doesn’t pass our quality test. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s gross margins indicate it has pricing power, the downside is its operating margins reveal poor profitability compared to other semiconductor companies.

Semtech’s P/E ratio based on the next 12 months is 24.1x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $55.50 on the company (compared to the current share price of $41.93).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.