Tractor Supply (TSCO)

Tractor Supply is intriguing. Its extraordinary growth in new stores shows it’s pursuing an aggressive strategy to increase revenue.― StockStory Analyst Team

1. News

2. Summary

Why Tractor Supply Is Interesting

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

- ROIC punches in at 35.2%, illustrating management’s expertise in identifying profitable investments

- Bold push to open new stores demonstrates an ambitious strategy to establish itself in underpenetrated territories

- The stock is trading at a reasonable price if you like its story and growth prospects

Tractor Supply shows some signs of a high-quality business. If you like the company, the valuation seems reasonable.

Why Is Now The Time To Buy Tractor Supply?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Tractor Supply?

Tractor Supply is trading at $50.81 per share, or 22.9x forward P/E. When stacked up against other consumer retail companies, we think Tractor Supply’s multiple is fair for the fundamentals you get.

It could be a good time to invest if you see something the market doesn’t.

3. Tractor Supply (TSCO) Research Report: Q1 CY2025 Update

Rural goods retailer Tractor Supply (NASDAQ:TSCO) missed Wall Street’s revenue expectations in Q1 CY2025 as sales rose 2.1% year on year to $3.47 billion. The company’s full-year revenue guidance of $6 billion at the midpoint came in 61.8% below analysts’ estimates. Its GAAP profit of $0.34 per share was 7.9% below analysts’ consensus estimates.

Tractor Supply (TSCO) Q1 CY2025 Highlights:

- Revenue: $3.47 billion vs analyst estimates of $3.53 billion (2.1% year-on-year growth, 1.9% miss)

- EPS (GAAP): $0.34 vs analyst expectations of $0.37 (7.9% miss)

- Adjusted EBITDA: $382.4 million vs analyst estimates of $386.1 million (11% margin, 1% miss)

- EPS (GAAP) guidance for the full year is $2.00 at the midpoint, missing analyst estimates by 7.5%

- Operating Margin: 7.2%, in line with the same quarter last year

- Free Cash Flow Margin: 2.2%, similar to the same quarter last year

- Locations: 2,311 at quarter end, down from 2,435 in the same quarter last year

- Same-Store Sales were flat year on year (1.1% in the same quarter last year)

- Market Capitalization: $26.97 billion

Company Overview

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

The core customer is typically a farmer, rancher, or general rural homeowner who tends to be handy, which explains the company’s tagline of “for life out here.” These customers make their living or heavily rely on their equipment, livestock, and land. They need a dependable source for essential supplies such as trailers for trucks, animal feed, and fencing supplies, all of which can be purchased from Tractor Supply.

Tractor Supply stores can vary in size, but the average location is fairly small at 15,000 feet with outdoor display and storage space for larger products and equipment. These stores tend to be located in rural and suburban shopping centers and retail plazas. Many of these rural areas don’t have a high density of other retailers, so Tractor Supply aims to be a nearly one-stop shop for customer needs.

The company established its e-commerce platform in 2007, and today, customers can buy online for home delivery or store pickup. The site and app also feature online-only deals and a blog about rural living that includes product reviews/comparisons, animal care guides, and primers on farming and agriculture.

4. Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that offer one or more overlapping product categories include Home Depot (NYSE:HD), Lowe’s (NYSE:LOW), and Petco Health and Wellness (NASDAQ:WOOF).

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $14.96 billion in revenue over the past 12 months, Tractor Supply is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Tractor Supply’s 10.9% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and expanded its reach.

This quarter, Tractor Supply’s revenue grew by 2.1% year on year to $3.47 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last six years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its products.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Tractor Supply operated 2,311 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 3.6% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Tractor Supply should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Tractor Supply’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

Tractor Supply’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 36.2% gross margin over the last two years. That means for every $100 in revenue, $63.82 went towards paying for inventory, transportation, and distribution.

This quarter, Tractor Supply’s gross profit margin was 36.2%, in line with the same quarter last year and analysts’ estimates. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

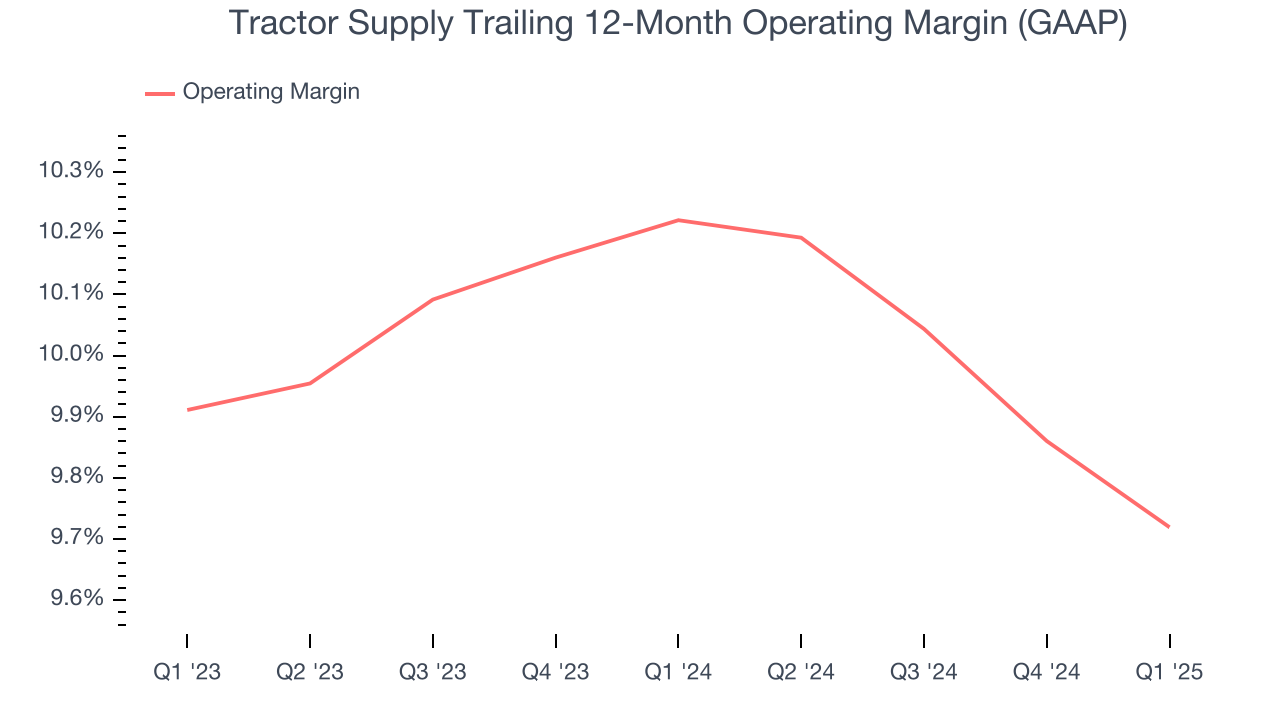

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Tractor Supply has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 10%, higher than the broader consumer retail sector.

Analyzing the trend in its profitability, Tractor Supply’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Tractor Supply generated an operating profit margin of 7.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Tractor Supply has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.8% over the last two years, better than the broader consumer retail sector.

Taking a step back, we can see that Tractor Supply’s margin dropped by 1.5 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Tractor Supply’s free cash flow clocked in at $75.5 million in Q1, equivalent to a 2.2% margin. This cash profitability was in line with the comparable period last year but below its two-year average. We wouldn’t read too much into it because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Tractor Supply’s five-year average ROIC was 35.2%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Balance Sheet Assessment

Tractor Supply reported $231.7 million of cash and $6.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.93 billion of EBITDA over the last 12 months, we view Tractor Supply’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $23.05 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Tractor Supply’s Q1 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.4% to $48.44 immediately after reporting.

13. Is Now The Time To Buy Tractor Supply?

Updated: June 9, 2025 at 10:28 PM EDT

Before making an investment decision, investors should account for Tractor Supply’s business fundamentals and valuation in addition to what happened in the latest quarter.

We think Tractor Supply is a solid business. To kick things off, its revenue growth was decent over the last six years. And while its poor same-store sales performance has been a headwind, its new store openings have increased its brand equity. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Tractor Supply’s P/E ratio based on the next 12 months is 22.9x. Looking at the consumer retail space right now, Tractor Supply trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $54.37 on the company (compared to the current share price of $50.81), implying they see 7% upside in buying Tractor Supply in the short term.