AbbVie (ABBV)

AbbVie doesn’t excite us. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why AbbVie Is Not Exciting

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE:ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

- Performance over the past five years shows its incremental sales were less profitable, as its 2.2% annual earnings per share growth trailed its revenue gains

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 6.3% over the last five years was below our standards for the healthcare sector

- A bright spot is that its excellent adjusted operating margin highlights the strength of its business model

AbbVie doesn’t live up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than AbbVie

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AbbVie

AbbVie’s stock price of $189.98 implies a valuation ratio of 14.9x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. AbbVie (ABBV) Research Report: Q1 CY2025 Update

Pharmaceutical company AbbVie (NYSE:ABBV) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 8.4% year on year to $13.34 billion. Its non-GAAP profit of $2.46 per share was 2.6% above analysts’ consensus estimates.

AbbVie (ABBV) Q1 CY2025 Highlights:

- Revenue: $13.34 billion vs analyst estimates of $12.92 billion (8.4% year-on-year growth, 3.3% beat)

- Adjusted EPS: $2.46 vs analyst estimates of $2.40 (2.6% beat)

- Management reiterated its full-year Adjusted EPS guidance of $12.19 at the midpoint

- Operating Margin: 28%, up from 22.7% in the same quarter last year

- Constant Currency Revenue rose 9.8% year on year (1.6% in the same quarter last year)

- Market Capitalization: $319.1 billion

Company Overview

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE:ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

AbbVie's portfolio spans several therapeutic areas, with particular strength in immunology where its flagship products include Humira, Skyrizi, and Rinvoq. These medications treat conditions like rheumatoid arthritis, psoriasis, Crohn's disease, and ulcerative colitis by targeting specific pathways in the immune system that drive inflammation.

In oncology, AbbVie offers treatments like Imbruvica and Venclexta for blood cancers such as chronic lymphocytic leukemia. The company's neuroscience division produces Botox Therapeutic for migraines and muscle spasticity, Vraylar for psychiatric disorders, and medications for Parkinson's disease and migraines.

AbbVie expanded its reach significantly in 2020 by acquiring Allergan, adding an aesthetics business that includes Botox Cosmetic and the Juvederm collection of dermal fillers. This acquisition also brought in eye care products like Restasis for dry eyes and medications for glaucoma.

A physician might prescribe AbbVie's Skyrizi to a patient with severe plaque psoriasis who hasn't responded to conventional treatments. The patient would receive two initial doses followed by quarterly injections that target a specific inflammatory protein, potentially clearing their skin condition.

The company generates revenue through prescription medication sales to wholesalers, healthcare facilities, and specialty pharmacies. AbbVie invests heavily in research and development to create new therapies and extend existing product lines. The company maintains a robust patent portfolio to protect its innovations, with key patents extending into the 2030s for some of its newer medications.

AbbVie operates globally, with a significant presence in North America, Europe, and Asia, working within various healthcare systems to secure reimbursement for its products.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

AbbVie's main competitors include other large pharmaceutical companies such as Johnson & Johnson (NYSE:JNJ), Pfizer (NYSE:PFE), Novartis (NYSE:NVS), and Amgen (NASDAQ:AMGN). In the immunology space, it also competes with Bristol Myers Squibb (NYSE:BMY) and in aesthetics with Revance Therapeutics (NASDAQ:RVNC).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $57.37 billion in revenue over the past 12 months, AbbVie is one of the most scaled enterprises in healthcare. This is particularly important because therapeutics companies are volume-driven businesses due to their low margins.

6. Sales Growth

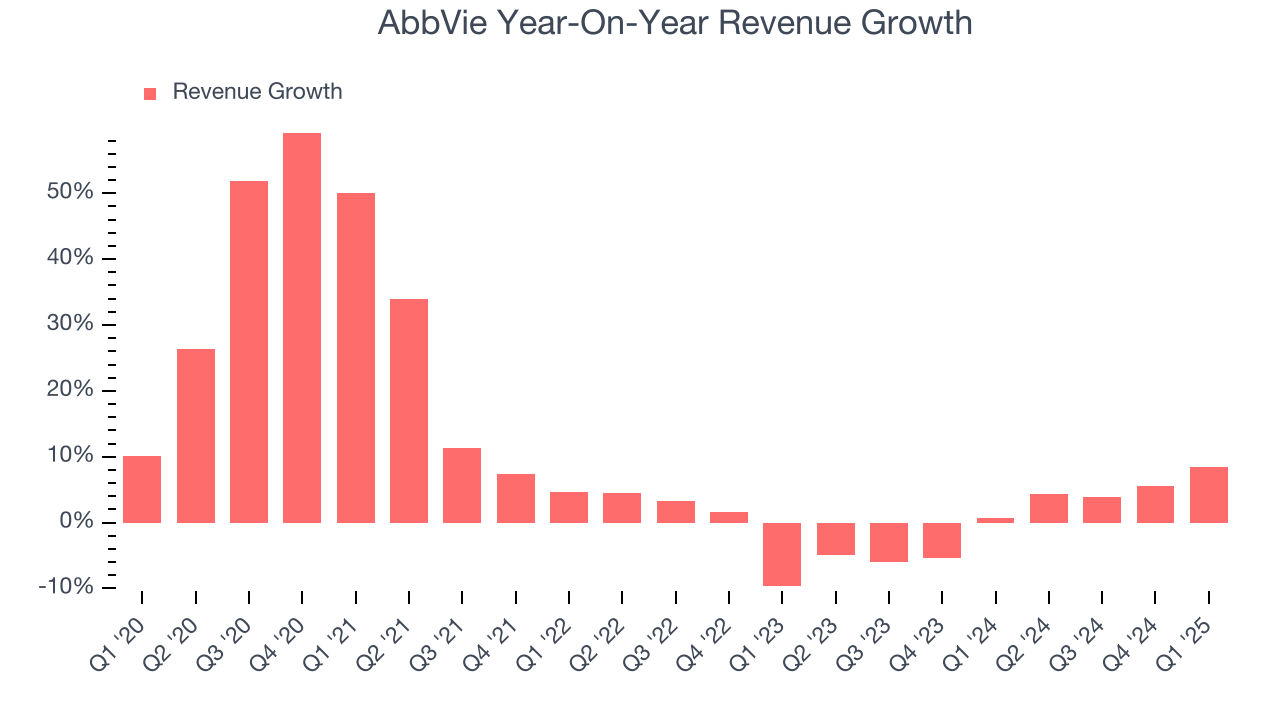

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, AbbVie’s sales grew at a decent 11% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. AbbVie’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for AbbVie.

This quarter, AbbVie reported year-on-year revenue growth of 8.4%, and its $13.34 billion of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

7. Operating Margin

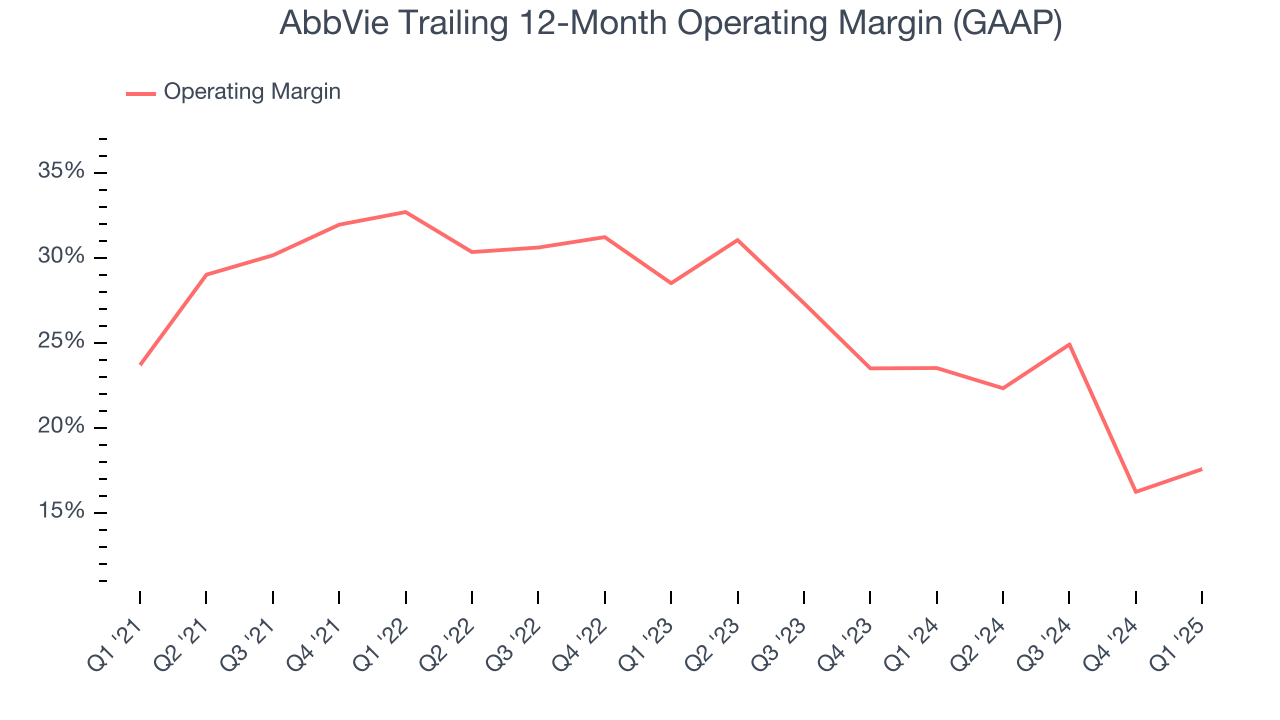

AbbVie has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 25.2%.

Analyzing the trend in its profitability, AbbVie’s operating margin decreased by 6.1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 10.9 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q1, AbbVie generated an operating profit margin of 28%, up 5.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

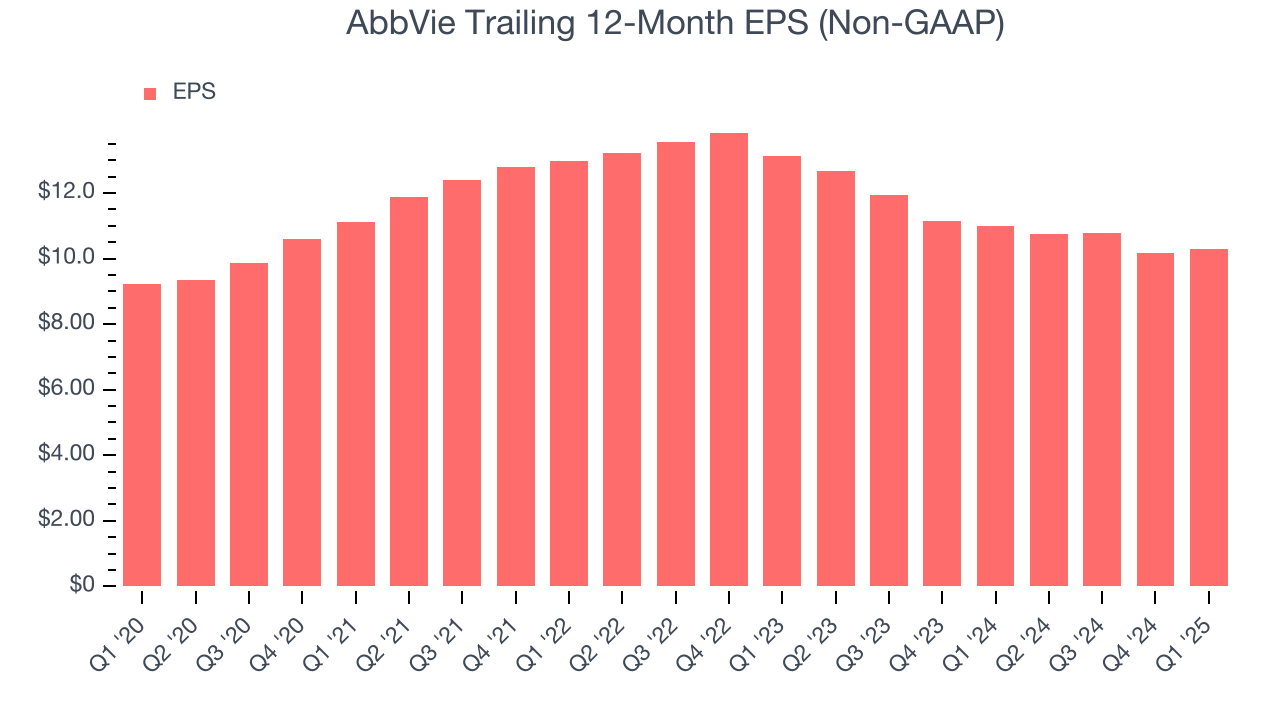

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AbbVie’s EPS grew at an unimpressive 2.2% compounded annual growth rate over the last five years, lower than its 11% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into AbbVie’s earnings to better understand the drivers of its performance. As we mentioned earlier, AbbVie’s operating margin improved this quarter but declined by 6.1 percentage points over the last five years. Its share count also grew by 19%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, AbbVie reported EPS at $2.46, up from $2.32 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects AbbVie’s full-year EPS of $10.30 to grow 23.6%.

9. Cash Is King

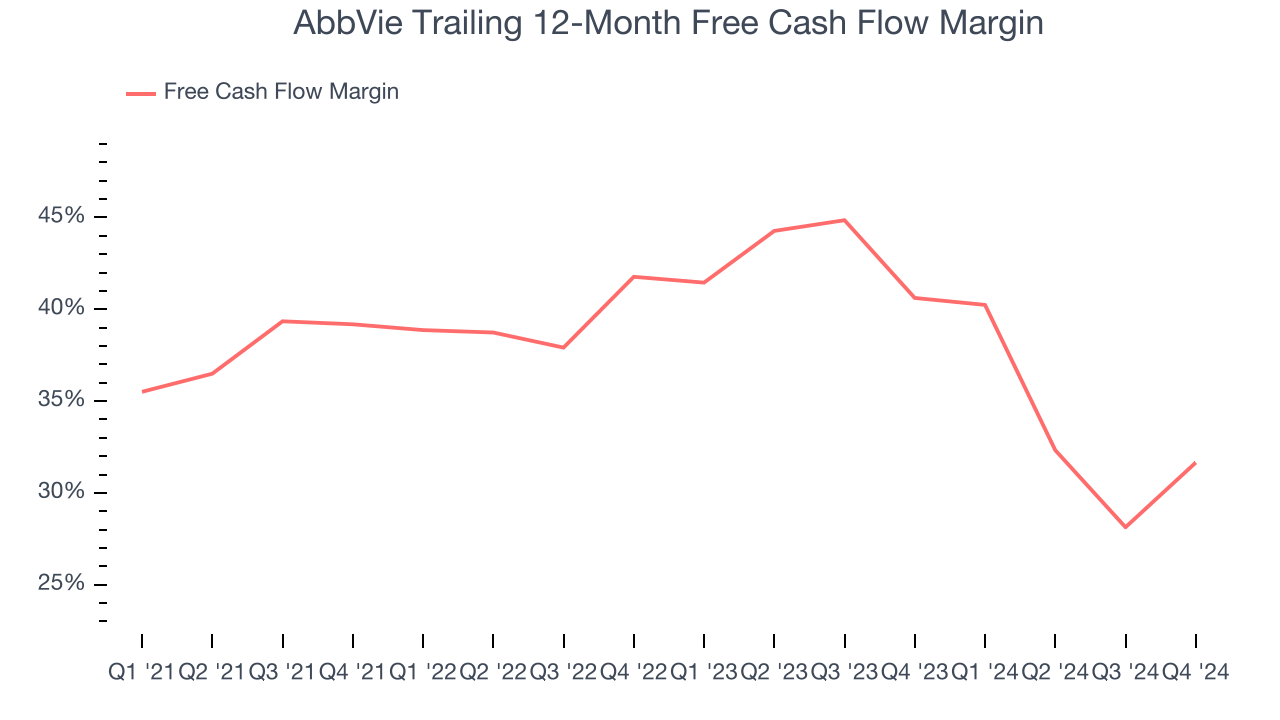

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AbbVie has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 37.9% over the last five years.

Taking a step back, we can see that AbbVie’s margin dropped by 3.5 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although AbbVie hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16.8%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, AbbVie’s ROIC increased by 2.1 percentage points annually over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

AbbVie reported $6.87 billion of cash and $71.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $24.91 billion of EBITDA over the last 12 months, we view AbbVie’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $2.33 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AbbVie’s Q1 Results

We were impressed by how significantly AbbVie blew past analysts’ sales and earnings expectations this quarter. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.4% to $186.66 immediately after reporting.

13. Is Now The Time To Buy AbbVie?

Updated: June 6, 2025 at 11:19 PM EDT

When considering an investment in AbbVie, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

AbbVie isn’t a bad business, but we have other favorites. Although its revenue growth was mediocre over the last five years, its scale makes it a trusted partner with negotiating leverage. Investors should still be cautious, however, as AbbVie’s declining adjusted operating margin shows the business has become less efficient.

AbbVie’s P/E ratio based on the next 12 months is 14.9x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $208.86 on the company (compared to the current share price of $189.98).