CACI (CACI)

CACI is a sound business. Its surging backlog proves it has a healthy sales pipeline.― StockStory Analyst Team

1. News

2. Summary

Why CACI Is Interesting

Founded to commercialize SIMSCRIPT, CACI International (NYSE:CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

- Demand is greater than supply as the company’s 13% average backlog growth over the past two years shows it’s securing new contracts and accumulating more orders than it can fulfill

- Earnings per share grew by 14.4% annually over the last five years, comfortably beating the peer group average

- The stock is trading at a reasonable price if you like its story and growth prospects

CACI shows some signs of a high-quality business. If you like the story, the valuation seems fair.

Why Is Now The Time To Buy CACI?

High Quality

Investable

Underperform

Why Is Now The Time To Buy CACI?

CACI is trading at $454.54 per share, or 17.1x forward P/E. Many industrials companies feature higher valuation multiples than CACI. Regardless, we think CACI’s current price is appropriate given the quality you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. CACI (CACI) Research Report: Q1 CY2025 Update

Defense, intelligence, and IT solutions provider CACI International (NYSE:CACI) announced better-than-expected revenue in Q1 CY2025, with sales up 11.8% year on year to $2.17 billion. The company expects the full year’s revenue to be around $8.6 billion, close to analysts’ estimates. Its non-GAAP profit of $6.23 per share was 11.3% above analysts’ consensus estimates.

CACI (CACI) Q1 CY2025 Highlights:

- Revenue: $2.17 billion vs analyst estimates of $2.13 billion (11.8% year-on-year growth, 1.5% beat)

- Adjusted EPS: $6.23 vs analyst estimates of $5.60 (11.3% beat)

- Adjusted EBITDA: $253.5 million vs analyst estimates of $233.5 million (11.7% margin, 8.6% beat)

- The company slightly lifted its revenue guidance for the full year to $8.6 billion at the midpoint from $8.55 billion

- Management slightly raised its full-year Adjusted EPS guidance to $24.56 at the midpoint

- Operating Margin: 9.1%, in line with the same quarter last year

- Free Cash Flow Margin: 8.7%, similar to the same quarter last year

- Backlog: $31.4 billion at quarter end, up 9.8% year on year

- Market Capitalization: $9.48 billion

Company Overview

Founded to commercialize SIMSCRIPT, CACI International (NYSE:CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI International was established in 1962 with the primary goal of commercializing the SIMSCRIPT simulation programming language, initially developed for use in government operations. The company wanted to leverage technology to solve complex problems, which laid the foundation for its expansion into defense, intelligence, and IT solutions.

Today, CACI International delivers services and solutions, including cybersecurity, surveillance and reconnaissance, network solutions, and identity management. For example, in cybersecurity, CACI offers protections against cyber threats for government agencies, ensuring the security of sensitive information. In surveillance and reconnaissance, it provides technologies that enable real-time monitoring and data analysis, critical for defense and intelligence operations.

CACI's revenue model is predominantly project and service-based, engaging with clients through government contracts that often include multi-year engagements. This approach has enabled CACI to create a steady stream of recurring revenue, as many of its contracts are for ongoing services. The company's clientele primarily consists of federal government agencies, including the Department of Defense, intelligence community, and Homeland Security.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Competitors in the defense, intelligence, and IT solutions sector include Leidos (NYSE:LDOS), SAIC (NYSE:SAIC), and Booz Allen (NYSE:BAH).

5. Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, CACI’s 8.4% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. CACI’s annualized revenue growth of 12.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. CACI’s backlog reached $31.4 billion in the latest quarter and averaged 13% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, CACI reported year-on-year revenue growth of 11.8%, and its $2.17 billion of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and implies the market is baking in success for its products and services.

6. Operating Margin

CACI has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.6%, higher than the broader industrials sector.

Analyzing the trend in its profitability, CACI’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, CACI generated an operating profit margin of 9.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

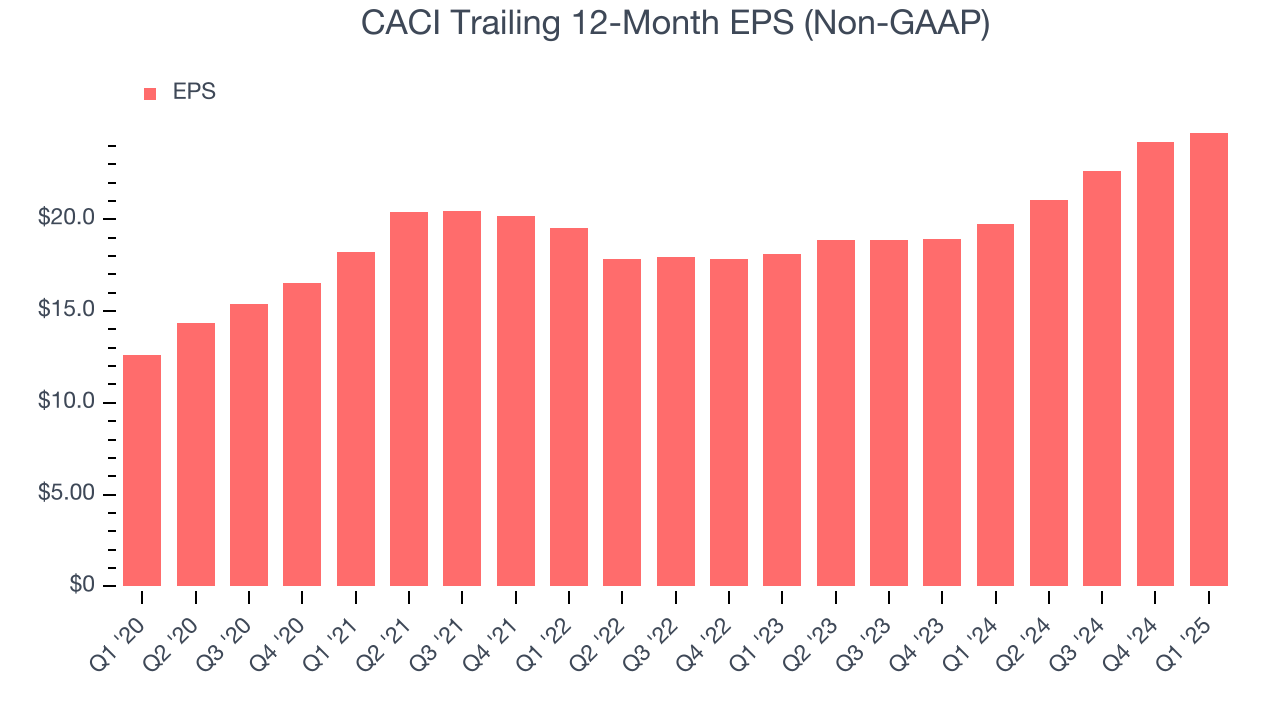

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

CACI’s EPS grew at a remarkable 14.4% compounded annual growth rate over the last five years, higher than its 8.4% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into CACI’s earnings quality to better understand the drivers of its performance. A five-year view shows that CACI has repurchased its stock, shrinking its share count by 12.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For CACI, its two-year annual EPS growth of 16.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, CACI reported EPS at $6.23, up from $5.74 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CACI’s full-year EPS of $24.72 to grow 7.4%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

CACI has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that CACI’s margin dropped by 4.4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

CACI’s free cash flow clocked in at $187.9 million in Q1, equivalent to a 8.7% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CACI’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, CACI’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

10. Balance Sheet Assessment

CACI reported $223.9 million of cash and $3.48 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $937.1 million of EBITDA over the last 12 months, we view CACI’s 3.5× net-debt-to-EBITDA ratio as safe. We also see its $47.22 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from CACI’s Q1 Results

We were impressed by how CACI beat analysts’ revenue, backlog, EPS, and EBITDA expectations this quarter. We were also glad it raised its full-year revenue and EPS guidance. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 1.9% to $432 immediately following the results.

12. Is Now The Time To Buy CACI?

Updated: June 18, 2025 at 11:30 PM EDT

Are you wondering whether to buy CACI or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are things to like about CACI. To begin with, the its revenue growth was good over the last five years, and analysts believe it can continue growing at these levels. And while its cash profitability fell over the last five years, its backlog growth has been splendid. On top of that, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

CACI’s P/E ratio based on the next 12 months is 17.1x. Looking at the industrials landscape right now, CACI trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $498.57 on the company (compared to the current share price of $454.54), implying they see 9.7% upside in buying CACI in the short term.