Global Business Travel (GBTG)

We’re cautious of Global Business Travel. Its low gross margin indicates weak unit economics, partly explaining why it struggles to generate cash flow.― StockStory Analyst Team

1. News

2. Summary

Why We Think Global Business Travel Will Underperform

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

- High servicing costs result in a relatively inferior gross margin of 60.8% that must be offset through increased usage

- Estimated sales growth of 1.9% for the next 12 months implies demand will slow from its three-year trend

- One positive is that its annual revenue growth of 35.1% over the last three years was superb and indicates its market share is rising

Global Business Travel’s quality doesn’t meet our hurdle. You should search for better opportunities.

Why There Are Better Opportunities Than Global Business Travel

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Global Business Travel

Global Business Travel is trading at $6.40 per share, or 1.2x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Global Business Travel (GBTG) Research Report: Q1 CY2025 Update

B2B travel services company Global Business Travel (NYSE:GBTG) missed Wall Street’s revenue expectations in Q1 CY2025 as sales only rose 1.8% year on year to $621 million. Next quarter’s revenue guidance of $625 million underwhelmed, coming in 4.2% below analysts’ estimates. Its GAAP profit of $0.16 per share was 78.5% above analysts’ consensus estimates.

Global Business Travel (GBTG) Q1 CY2025 Highlights:

- Revenue: $621 million vs analyst estimates of $633.3 million (1.8% year-on-year growth, 1.9% miss)

- EPS (GAAP): $0.16 vs analyst estimates of $0.09 (78.5% beat)

- Adjusted EBITDA: $141 million vs analyst estimates of $139.8 million (22.7% margin, 0.9% beat)

- The company dropped its revenue guidance for the full year to $2.43 billion at the midpoint from $2.53 billion, a 3.8% decrease

- EBITDA guidance for the full year is $510 million at the midpoint, below analyst estimates of $549.5 million

- Operating Margin: 8.9%, up from 2.6% in the same quarter last year

- Free Cash Flow Margin: 4.2%, down from 5.6% in the previous quarter

- Transaction Value: 8.35 billion, up 244 million year on year

- Market Capitalization: $3.24 billion

Company Overview

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

GBT specializes in delivering seamless travel experiences for corporate clients, ranging from small businesses to large multinational corporations. The core of its services includes arranging business travel, managing travel expenses, and providing global customer support.

GBT’s expertise extends across various aspects of travel management, including air and ground transportation, hotel accommodations, meetings and events planning, and risk management services. This comprehensive approach ensures clients can manage all aspects of business travel through a single, integrated platform.

The company invests heavily in digital solutions to enhance the travel booking and management process. This includes user-friendly online booking tools, mobile applications, and advanced data analytics platforms. These technological innovations not only streamline the travel management process but also provide valuable insights to help companies optimize their travel spending and policies.

Customer service is a cornerstone of GBT’s business model. The company is known for its 24/7 customer support, provided by experienced travel counselors who offer personalized assistance. This high level of service ensures that business travelers receive prompt support and solutions, regardless of their location or time zone.

4. Spend Management Software

The adoption of financial technology software is propelled by an ongoing drive to reduce costs. The combination of rising transaction volumes and global supply chain complexity is driving demand for cloud-based spend management platforms able to integrate the two.

Global Business Travel’s primary competitors include Expedia Group (NASDAQ:EXPE), Flight Centre Travel (ASX:FLT), and American Express Travel (owned by American Express Company NYSE:AXP), and private companies BCD Travel and CWT.

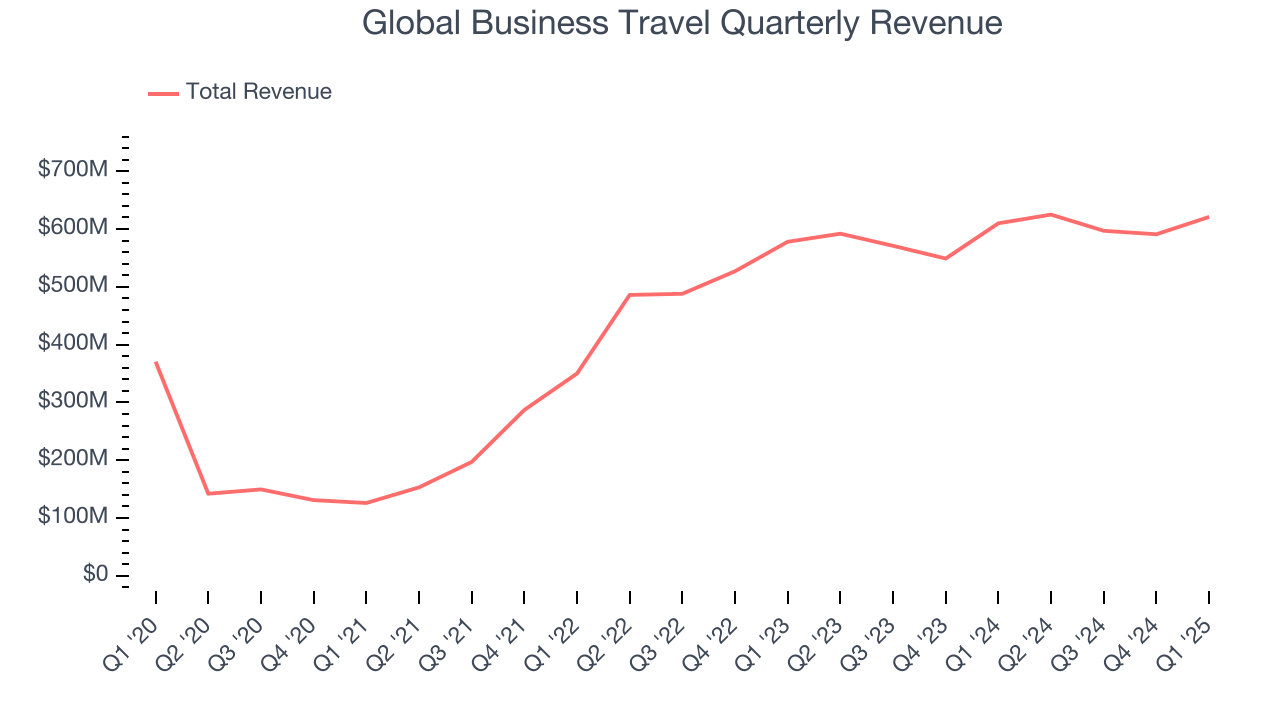

5. Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Global Business Travel’s 35.1% annualized revenue growth over the last three years was excellent. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Global Business Travel’s revenue grew by 1.8% year on year to $621 million, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

For software companies like Global Business Travel, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Global Business Travel’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.8% gross margin over the last year. That means Global Business Travel paid its providers a lot of money ($39.15 for every $100 in revenue) to run its business.

Global Business Travel produced a 62.8% gross profit margin in Q1, marking a 3 percentage point increase from 59.8% in the same quarter last year. Global Business Travel’s full-year margin has also been trending up over the past 12 months, increasing by 2.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

7. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Global Business Travel has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 6.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Global Business Travel’s operating margin rose by 5.6 percentage points over the last year, as its sales growth gave it operating leverage.

This quarter, Global Business Travel generated an operating profit margin of 8.9%, up 6.2 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Global Business Travel has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.9%, subpar for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Global Business Travel to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Global Business Travel’s free cash flow clocked in at $26 million in Q1, equivalent to a 4.2% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

9. Balance Sheet Assessment

Global Business Travel reported $552 million of cash and $1.46 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $496 million of EBITDA over the last 12 months, we view Global Business Travel’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $54 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Global Business Travel’s Q1 Results

It was good to see Global Business Travel top analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed and its full-year revenue and EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better, but the stock traded up 4% to $7.16 immediately after reporting.

11. Is Now The Time To Buy Global Business Travel?

Updated: June 3, 2025 at 11:02 PM EDT

Are you wondering whether to buy Global Business Travel or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Global Business Travel isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was exceptional over the last three years, it’s expected to deteriorate over the next 12 months and its gross margins show its business model is much less lucrative than other companies. And while the company’s expanding operating margin shows it’s becoming more efficient at building and selling its software, the downside is its low free cash flow margins give it little breathing room.

Global Business Travel’s price-to-sales ratio based on the next 12 months is 1.2x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $9.34 on the company (compared to the current share price of $6.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.

Enjoyed this research report? Then you will absolutely love StockStory Edge.

StockStory Edge provides you with in-depth research on more than 1,100 stocks including many that fly under-the-radar, helping you understand not only what to buy but also what to avoid.

Did you know that StockStory High Quality stocks generated a market-beating return of 183% from March 31, 2020 to March 31, 2025 vs an 117% return for the market? We achieve this outperformance by blending AI-powered analysis with the expertise of our analysts to identify opportunities overlooked by the market.