Luxfer (LXFR)

Luxfer keeps us up at night. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Luxfer Will Underperform

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

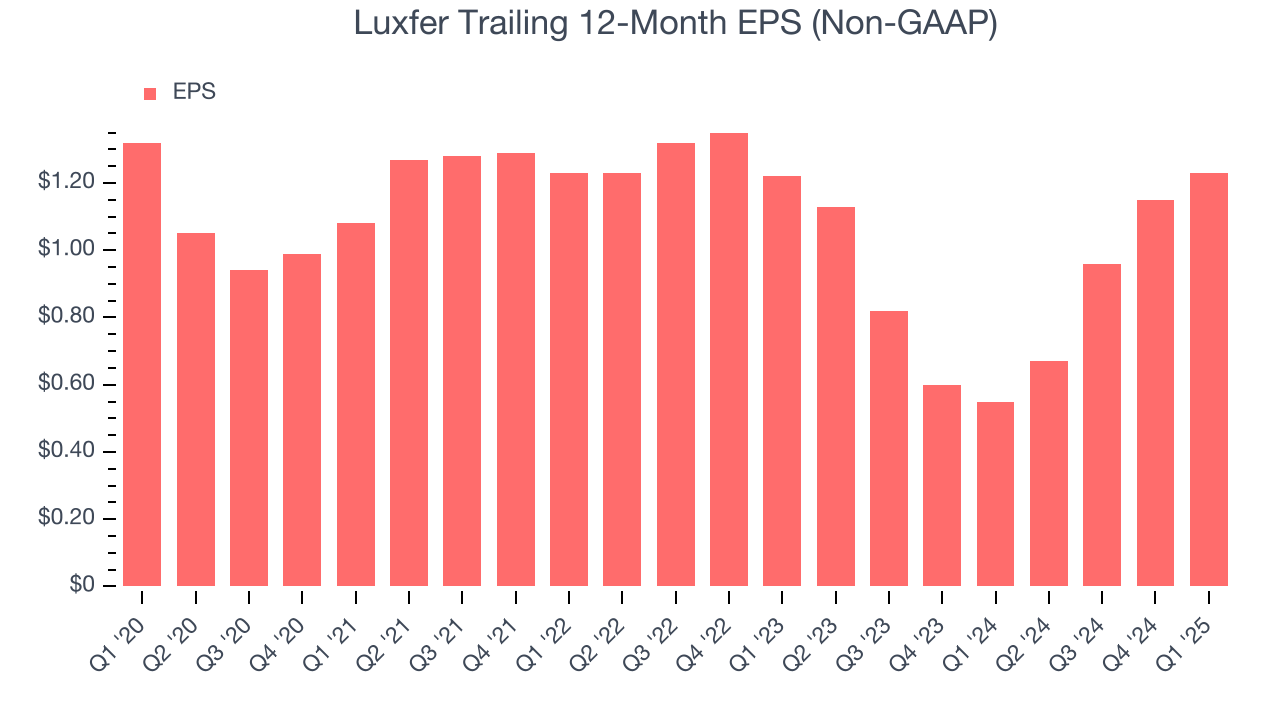

- Earnings per share have contracted by 1.4% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

- Muted 1.6% annual revenue growth over the last one years shows its demand lagged behind its industrials peers

- Gross margin of 22.6% is below its competitors, leaving less money to invest in areas like marketing and R&D

Luxfer falls short of our expectations. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Luxfer

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Luxfer

Luxfer is trading at $11.91 per share, or 11.6x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Luxfer (LXFR) Research Report: Q1 CY2025 Update

Speciality material and gas containment company Luxfer (NYSE:LXFR) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 8.5% year on year to $97 million. Its non-GAAP profit of $0.23 per share was 35.3% above analysts’ consensus estimates.

Luxfer (LXFR) Q1 CY2025 Highlights:

- Revenue: $97 million vs analyst estimates of $86.7 million (8.5% year-on-year growth, 11.9% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.17 (35.3% beat)

- Adjusted EBITDA: $11.3 million vs analyst estimates of $9.5 million (11.6% margin, 18.9% beat)

- Management reiterated its full-year Adjusted EPS guidance of $1 at the midpoint

- EBITDA guidance for the full year is $50 million at the midpoint, above analyst estimates of $47.9 million

- Operating Margin: 7.8%, up from 6.6% in the same quarter last year

- Free Cash Flow Margin: 4.3%, up from 2.6% in the same quarter last year

- Market Capitalization: $266.6 million

Company Overview

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

Luxfer Group, founded in 1898 in Manchester, England, began with developing and patenting magnesium alloys for lightweight, high-strength applications. Early successes included photographic flashbulbs and the world's first aluminum gas cylinders. Throughout the 20th century, Luxfer expanded its product line to include gas cylinders and composite materials, meeting growing demands in healthcare, environmental technology, and aerospace.

The company’s product offerings include high-pressure gas cylinders, magnesium alloys, zirconium chemicals and materials, and carbon composite materials, among others. Luxfer’s products are designed to meet the requirements of a broad array of end markets. These markets include environmental technologies, healthcare, protection, specialty automotive systems, and aerospace. Each of these sectors relies on Luxfer for materials for performance under extreme conditions. For instance, in the healthcare sector, Luxfer's lightweight oxygen cylinders are integral for portable medical oxygen systems used in ambulances and emergency medical services. Similarly, in the aerospace industry, Luxfer provides advanced materials that are essential for manufacturing components that can withstand high temperatures and corrosive environments.

Luxfer also produces products for the graphic art industry, primarily known for its magnesium photo-engraving plates, copper and zinc plates for luxury packaging, alongside developer solutions that aid in the engraving process. However, the company has decided to divest its Graphic Arts Segment as part of a strategic shift to focus on high-performance materials and advanced industrial applications. The planned divestiture in 2024 aims to streamline Luxfer's operations and focus resources on areas with higher strategic importance and potential for growth within its portfolio.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Worthington (NYSE:WOR), Constellium (NYSE:CSTM), and Dynamic Materials (NASDAQ:BOOM).

5. Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last four years, Luxfer grew its sales at a tepid 5.6% compounded annual growth rate. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Luxfer’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last one years was below its four-year trend.

This quarter, Luxfer reported year-on-year revenue growth of 8.5%, and its $97 million of revenue exceeded Wall Street’s estimates by 11.9%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Luxfer has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 22.6% gross margin over the last five years. That means Luxfer paid its suppliers a lot of money ($77.38 for every $100 in revenue) to run its business.

Luxfer produced a 22.1% gross profit margin in Q1, up 1.5 percentage points year on year. Luxfer’s full-year margin has also been trending up over the past 12 months, increasing by 3.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Luxfer has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.8%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Luxfer’s operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Luxfer generated an operating profit margin of 7.8%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Luxfer’s full-year EPS dropped 7.2%, or 1.4% annually, over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Luxfer’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Luxfer, EPS didn’t budge over the last two years, but at least that was better than its five-year trend. We hope its earnings can grow in the coming years.

In Q1, Luxfer reported EPS at $0.23, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Luxfer’s full-year EPS of $1.23 to shrink by 14.6%.

9. Cash Is King

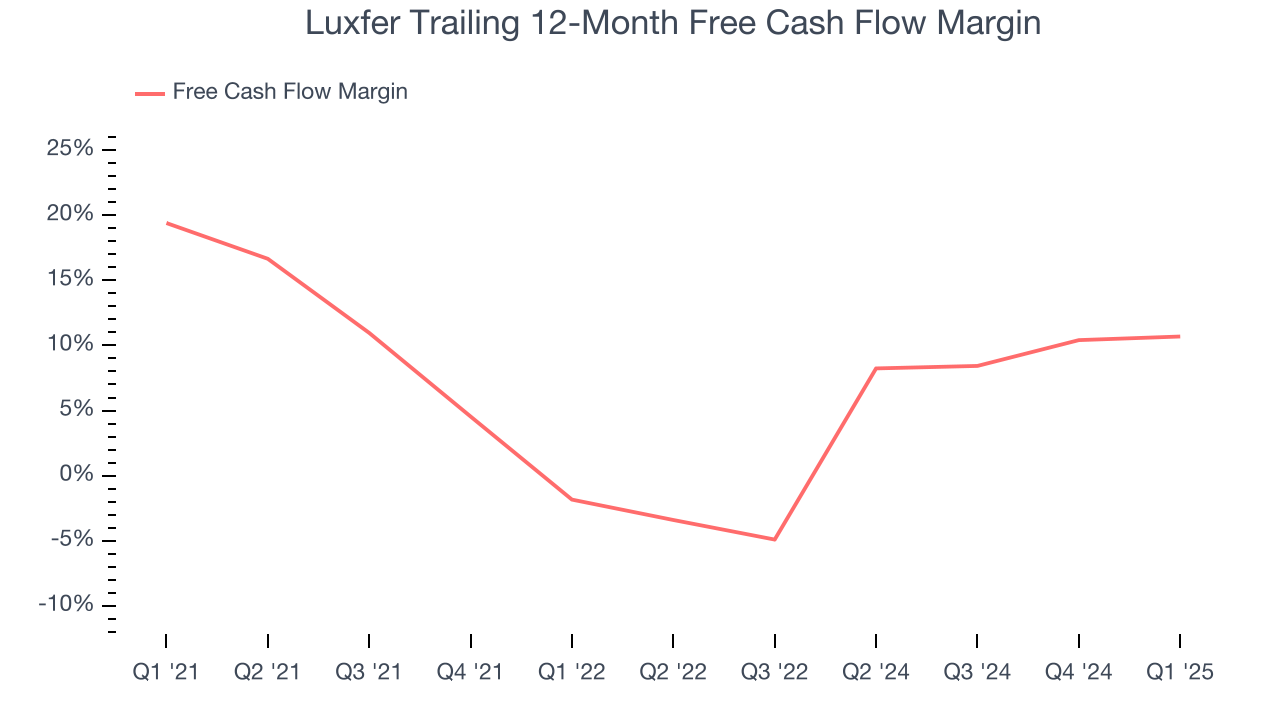

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Luxfer has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Luxfer’s margin dropped by 8.7 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Luxfer’s free cash flow clocked in at $4.2 million in Q1, equivalent to a 4.3% margin. This result was good as its margin was 1.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Luxfer hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.3%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Luxfer’s ROIC averaged 4.8 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Luxfer reported $4.1 million of cash and $46 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $58.4 million of EBITDA over the last 12 months, we view Luxfer’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Luxfer’s Q1 Results

We were impressed by how significantly Luxfer blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $10 immediately following the results.

13. Is Now The Time To Buy Luxfer?

Updated: June 9, 2025 at 11:33 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Luxfer.

We cheer for all companies making their customers lives easier, but in the case of Luxfer, we’ll be cheering from the sidelines. First off, its revenue growth was uninspiring over the last four years. And while its solid ROIC suggests it has grown profitably in the past, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

Luxfer’s P/E ratio based on the next 12 months is 11.6x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $17 on the company (compared to the current share price of $11.91).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.