Meritage Homes (MTH)

Meritage Homes keeps us up at night. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Meritage Homes Will Underperform

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE:MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

- Sales stagnated over the last two years and signal the need for new growth strategies

- Flat earnings per share over the last two years underperformed the sector average

- Product roadmap and go-to-market strategy need to be reconsidered as its backlog has averaged 38.2% declines over the past two years

Meritage Homes doesn’t live up to our standards. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Meritage Homes

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Meritage Homes

Meritage Homes is trading at $64.58 per share, or 7.2x forward P/E. Meritage Homes’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Meritage Homes (MTH) Research Report: Q1 CY2025 Update

Homebuilder Meritage Homes (NYSE:MTH) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 7.9% year on year to $1.36 billion. The company’s full-year revenue guidance of $6.75 billion at the midpoint came in 1.5% above analysts’ estimates. Its GAAP profit of $1.69 per share was in line with analysts’ consensus estimates.

Meritage Homes (MTH) Q1 CY2025 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.33 billion (7.9% year-on-year decline, 1.9% beat)

- EPS (GAAP): $1.69 vs analyst estimates of $1.69 (in line)

- The company reconfirmed its revenue guidance for the full year of $6.75 billion at the midpoint

- Free Cash Flow was -$48.17 million, down from $75.75 million in the same quarter last year

- Backlog: $812.4 million at quarter end, down 34.7% year on year

- Market Capitalization: $4.90 billion

Company Overview

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE:MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Meritage Homes Corporation is a leading designer and builder of single-family homes in the United States. The company operates in three regions - West, Central and East - covering ten states across the country. Meritage focuses on offering a variety of entry-level and first move-up homes, catering to first-time and move-up buyers.

A key differentiator for Meritage is its focus on energy efficiency and sustainability. All Meritage homes meet ENERGY STAR standards and include features like advanced air filtration systems and efficient HVAC units. The company has received multiple awards recognizing its commitment to energy-efficient homebuilding.

Meritage employs a spec home building strategy, particularly for its entry-level products, allowing buyers to move in quickly. The company also offers simplified design options for move-up homes to streamline the sales process. Meritage leverages technology extensively, providing virtual tours, online tools, and digital services to enhance the homebuying experience.

The company pursues a disciplined land acquisition strategy, targeting a four-to-five year supply of lots. Meritage focuses on acquiring undeveloped land in affordable locations with good access to urban amenities. This approach allows the company to better control costs and timing of development.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Other homebuilders operating in Mertiage's markets include Lennar (NYSE:LEN), PulteGroup (NYSE:PHM), and DR Horton (NYSE:NVR).

5. Sales Growth

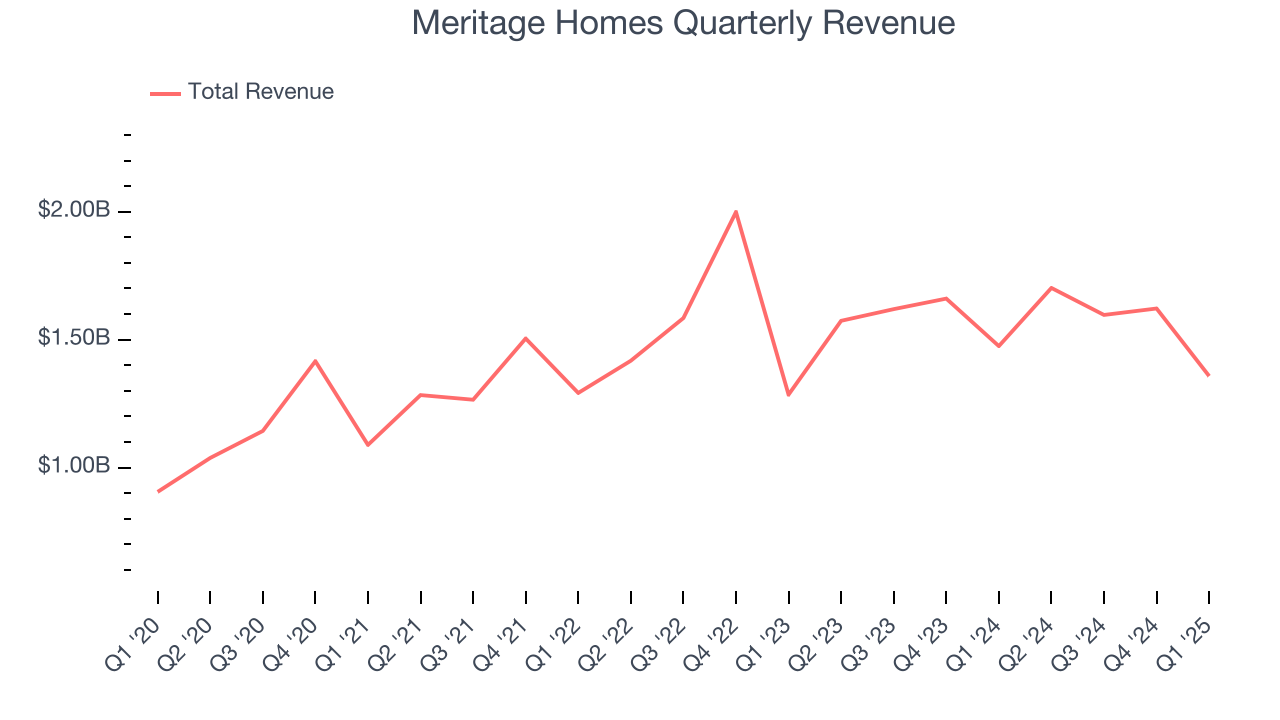

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Meritage Homes grew its sales at a solid 10.2% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Meritage Homes’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Meritage Homes also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Meritage Homes’s backlog reached $812.4 million in the latest quarter and averaged 38.2% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Meritage Homes’s revenue fell by 7.9% year on year to $1.36 billion but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Meritage Homes has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25.8% gross margin over the last five years. That means Meritage Homes paid its suppliers a lot of money ($74.15 for every $100 in revenue) to run its business.

Meritage Homes produced a 22% gross profit margin in Q1, marking a 3.6 percentage point decrease from 25.6% in the same quarter last year. Meritage Homes’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Meritage Homes has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Meritage Homes’s operating margin rose by 1.9 percentage points over the last five years, as its sales growth gave it operating leverage.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Meritage Homes’s EPS grew at an astounding 21.1% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Meritage Homes’s earnings to better understand the drivers of its performance. As we mentioned earlier, Meritage Homes’s operating margin expanded by 1.9 percentage points over the last five years. On top of that, its share count shrank by 6.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Meritage Homes, its two-year annual EPS declines of 10.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Meritage Homes can return to earnings growth in the future.

In Q1, Meritage Homes reported EPS at $1.69, down from $2.53 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Meritage Homes’s full-year EPS of $9.88 to shrink by 7.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Meritage Homes has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.4%, lousy for an industrials business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Meritage Homes to make large cash investments in working capital and capital expenditures.

Taking a step back, we can see that Meritage Homes’s margin dropped by 15.7 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Meritage Homes burned through $48.17 million of cash in Q1, equivalent to a negative 3.5% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Meritage Homes hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 20%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Meritage Homes’s ROIC decreased by 3 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Meritage Homes reported $1.01 billion of cash and $1.87 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $952.3 million of EBITDA over the last 12 months, we view Meritage Homes’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $7.16 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Meritage Homes’s Q1 Results

We enjoyed seeing Meritage Homes beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its backlog missed, which could signal weaker revenue to come. Overall, this was a mixed quarter. The stock traded up 1.2% to $69 immediately following the results.

13. Is Now The Time To Buy Meritage Homes?

Updated: June 16, 2025 at 11:57 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Meritage Homes, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies making their customers lives easier, but in the case of Meritage Homes, we’ll be cheering from the sidelines. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking.

Meritage Homes’s P/E ratio based on the next 12 months is 7.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $90.64 on the company (compared to the current share price of $64.58).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.