Paycom (PAYC)

We see potential in Paycom. It’s not only a customer acquisition machine but also sports robust unit economics, a deadly combo.― StockStory Analyst Team

1. News

2. Summary

Why Paycom Is Interesting

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

- Software is difficult to replicate at scale and leads to a best-in-class gross margin of 85.9%

- Disciplined cost controls and effective management have materialized in a strong operating margin

- One risk is its estimated sales growth of 8.8% for the next 12 months implies demand will slow from its three-year trend

Paycom shows some potential. If you like the company, the valuation seems reasonable.

Why Is Now The Time To Buy Paycom?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Paycom?

Paycom is trading at $232.23 per share, or 6.3x forward price-to-sales. The current valuation is below that of most software companies, but this isn’t a bargain. Instead, the price is appropriate for the quality you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Paycom (PAYC) Research Report: Q1 CY2025 Update

Online payroll and human resource software provider Paycom (NYSE:PAYC) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 6.1% year on year to $530.5 million. The company expects the full year’s revenue to be around $2.03 billion, close to analysts’ estimates. Its non-GAAP profit of $2.80 per share was 9.4% above analysts’ consensus estimates.

Paycom (PAYC) Q1 CY2025 Highlights:

- Revenue: $530.5 million vs analyst estimates of $525.6 million (6.1% year-on-year growth, 0.9% beat)

- Adjusted EPS: $2.80 vs analyst estimates of $2.56 (9.4% beat)

- Adjusted EBITDA: $253.2 million vs analyst estimates of $236.9 million (47.7% margin, 6.9% beat)

- The company slightly lifted its revenue guidance for the full year to $2.03 billion at the midpoint from $2.03 billion

- EBITDA guidance for the full year is $850.5 million at the midpoint, above analyst estimates of $830 million

- Operating Margin: 34.9%, down from 57.2% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 22.1% in the previous quarter

- Market Capitalization: $12.89 billion

Company Overview

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Human Capital Management (HCM) software is meant to streamline mundane, but vital, business functions like keeping attendance, running payroll, and keeping compliant with shifting Federal and local government taxes and labor laws. For many small and medium sized businesses, these are often handled by their accountant which is an unnecessarily expensive use of resources, or QuickBooks style spreadsheets which don’t have sufficient functionality.

Using a single database or system of records, Paycom is a cost effective solution that allows SMBs to simplify the management of all their HR operations throughout an employee’s lifecycle, from when they first apply for a job, to onboarding and managing performance reviews, all the way through collecting retirement benefits.

Paycom has useful functionality that differentiates it from rivals, in part because the company regularly iterates its platform based on customer feedback. One example is that HR managers can automatically share open positions to career sites, which funnels qualified applicants back to the company to easily schedule interviews and conduct background checks. Another is the ability for businesses to conduct self evaluations based on analytics that pull together performance reviews and other HR data from across the company.

4. HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Other providers of HR solutions for small and medium-sized businesses include Paychex (NASDAQ:PAYX), ADP (NASDAQ:ADP), Asure, (NYSE:ASUR) and Paylocity (NASDAQ:PCTY).

5. Sales Growth

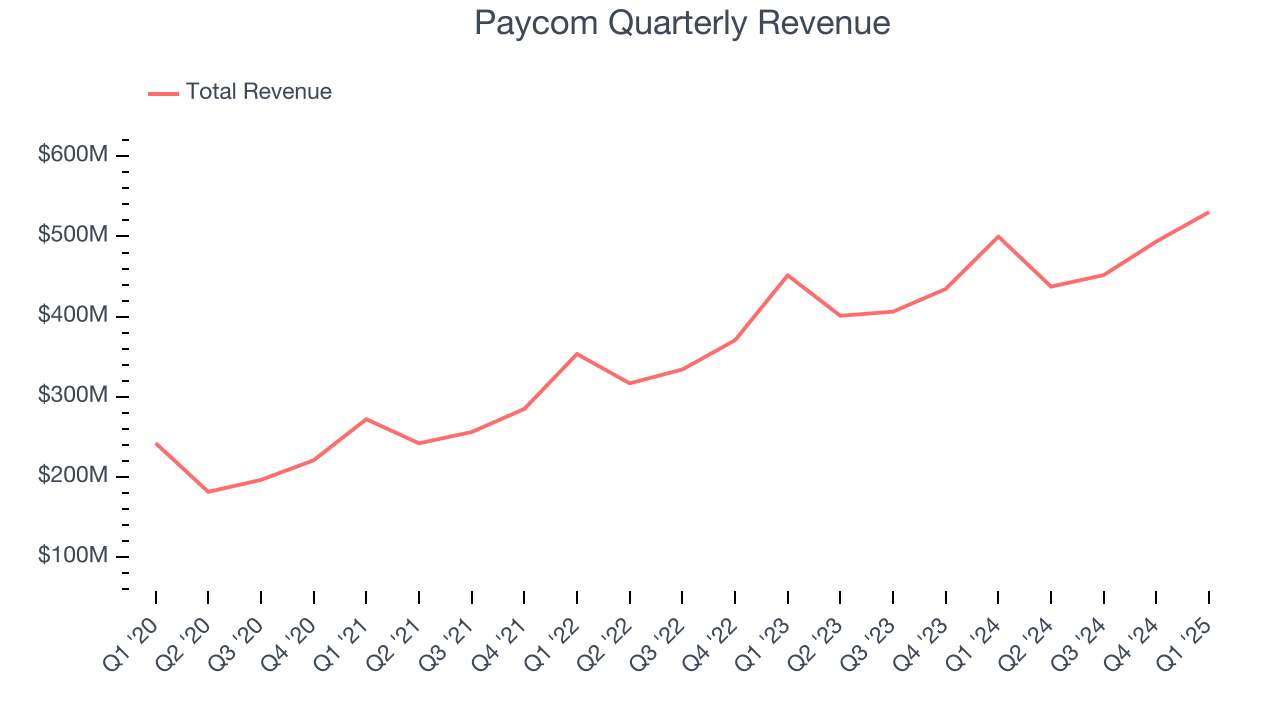

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Paycom grew its sales at a 19% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Paycom.

This quarter, Paycom reported year-on-year revenue growth of 6.1%, and its $530.5 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Paycom’s billings came in at $534.6 million in Q1, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Paycom is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

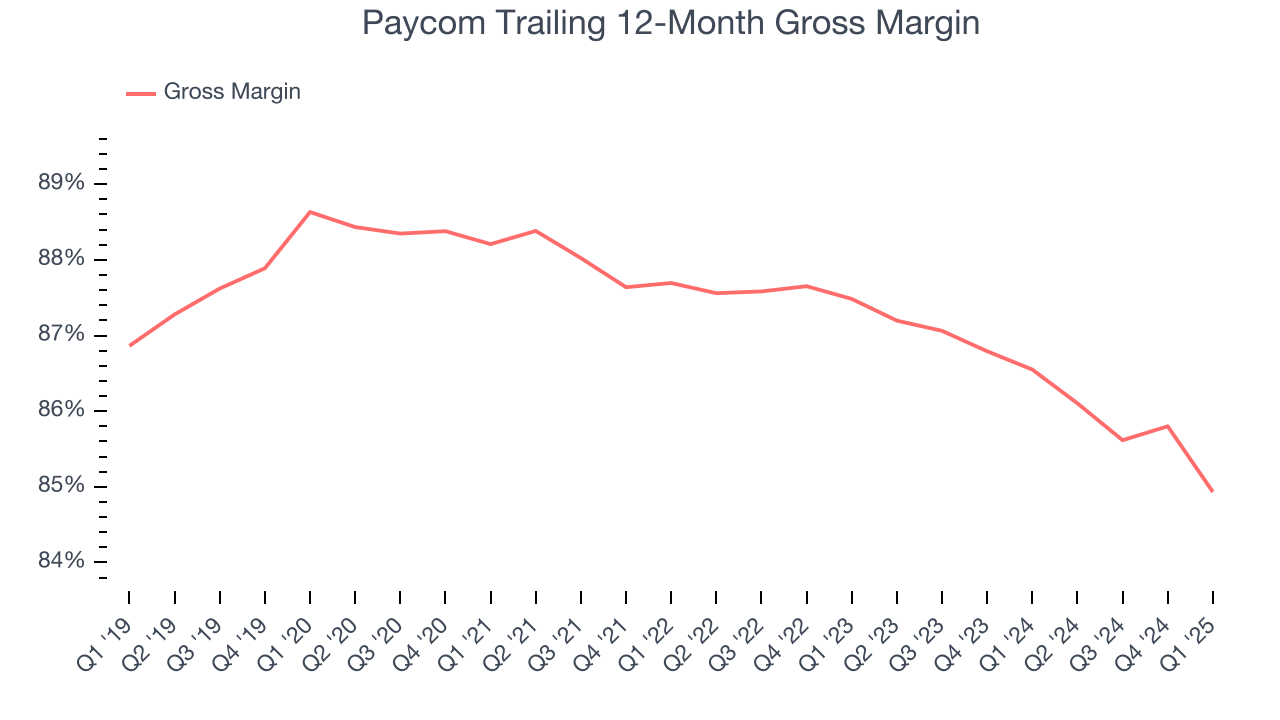

Paycom’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 84.9% gross margin over the last year. Said differently, roughly $84.93 was left to spend on selling, marketing, and R&D for every $100 in revenue.

Paycom produced a 84.1% gross profit margin in Q1, marking a 3.2 percentage point decrease from 87.3% in the same quarter last year. Paycom’s full-year margin has also been trending down over the past 12 months, decreasing by 1.6 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

Paycom has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 27.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Paycom’s operating margin decreased by 5.2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Paycom generated an operating profit margin of 34.9%, down 22.3 percentage points year on year. Since Paycom’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Paycom has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.6% over the last year, slightly better than the broader software sector.

Paycom broke even from a free cash flow perspective in Q1. The company’s cash profitability regressed as it was 20.2 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Paycom’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 12.6% for the last 12 months will increase to 19%, giving it more flexibility for investments, share buybacks, and dividends.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

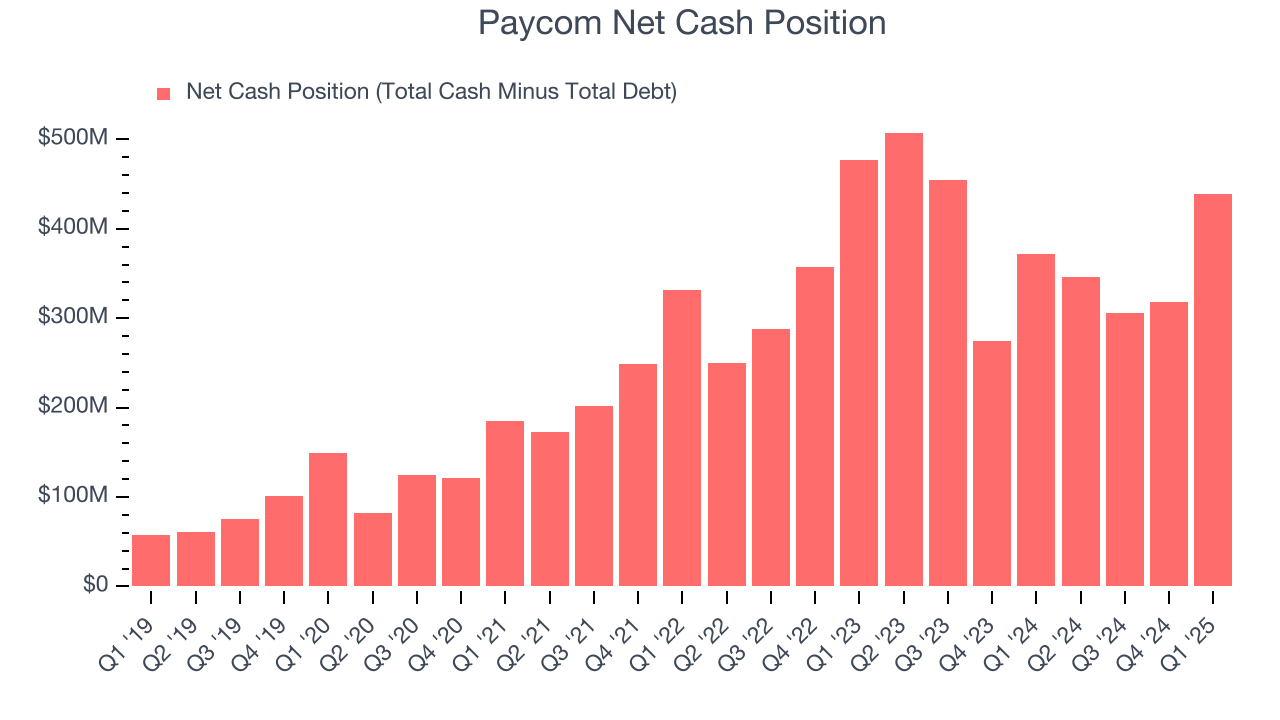

Paycom is a profitable, well-capitalized company with $520.8 million of cash and $81.5 million of debt on its balance sheet. This $439.3 million net cash position is 3.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Paycom’s Q1 Results

We enjoyed seeing Paycom beat analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.1% to $231 immediately after reporting.

13. Is Now The Time To Buy Paycom?

Updated: June 18, 2025 at 10:21 PM EDT

When considering an investment in Paycom, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are a lot of things to like about Paycom. Although its revenue growth was mediocre over the last three years and analysts expect growth to slow over the next 12 months, its admirable gross margin indicates excellent unit economics. And while its declining operating margin shows it’s becoming less efficient at building and selling its software, its efficient sales strategy allows it to target and onboard new users at scale.

Paycom’s price-to-sales ratio based on the next 12 months is 6.3x. Looking at the software space right now, Paycom trades at a compelling valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $240.55 on the company (compared to the current share price of $232.23), implying they see 3.6% upside in buying Paycom in the short term.