Snowflake (SNOW)

Snowflake is interesting. Its high growth and retention show customers can’t stop spending money on its mission-critical products.― StockStory Analyst Team

1. News

2. Summary

Why Snowflake Is Interesting

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

- Net revenue retention rate of 126% demonstrates its ability to expand within existing accounts through upsells and cross-sells

- Impressive 39.6% annual revenue growth over the last three years indicates it’s winning market share

- A blemish is its mounting operating losses demonstrate the tradeoff between growth and profitability

Snowflake has some noteworthy aspects. If you like the story, the valuation seems reasonable.

Why Is Now The Time To Buy Snowflake?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Snowflake?

Snowflake is trading at $209.60 per share, or 14.6x forward price-to-sales. This multiple is higher than that of most software companies, sure, but we still think the valuation is fair given the revenue growth.

It could be a good time to invest if you see something the market doesn’t.

3. Snowflake (SNOW) Research Report: Q1 CY2025 Update

Data warehouse-as-a-service Snowflake (NYSE:SNOW) announced better-than-expected revenue in Q1 CY2025, with sales up 25.7% year on year to $1.04 billion. Its non-GAAP profit of $0.24 per share was 13.1% above analysts’ consensus estimates.

Snowflake (SNOW) Q1 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.01 billion (25.7% year-on-year growth, 3.4% beat)

- Adjusted EPS: $0.24 vs analyst estimates of $0.21 (13.1% beat)

- Adjusted Operating Income: $91.66 million vs analyst estimates of $52.66 million (8.8% margin, 74.1% beat)

- Product Revenue Guidance for Q2 CY2025 is $1.04 billion at the midpoint, higher than expectations of $1.02 billion

- Operating Margin: -42.9%, in line with the same quarter last year

- Free Cash Flow Margin: 0%, down from 42.1% in the previous quarter

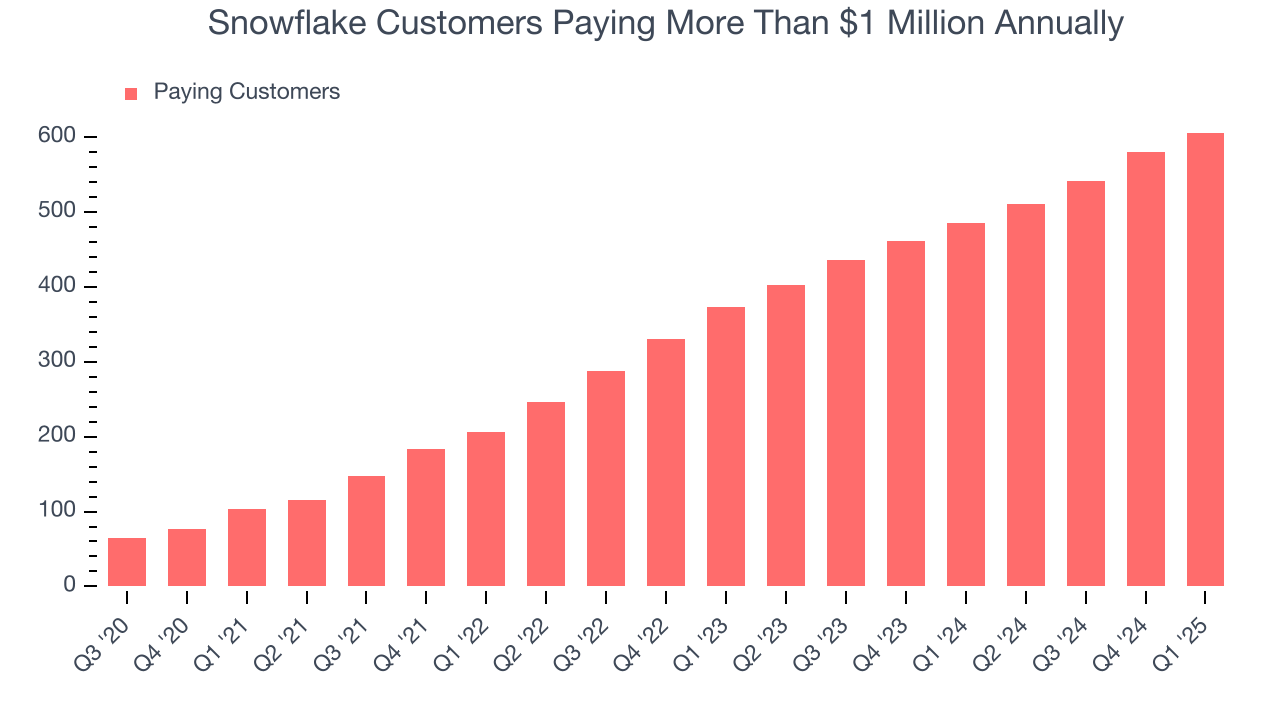

- Customers: 606 customers paying more than $1 million annually

- Net Revenue Retention Rate: 124%, down from 126% in the previous quarter

- Billings: $770.7 million at quarter end, up 36.2% year on year (2% miss vs expectations of $786 million)

- Market Capitalization: $61.02 billion

Company Overview

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

The amount of data generated and collected by companies has exploded and so has the need to analyze it, but it is still often stored in incompatible formats, spread across many different types of storages, and with increasing complexity, slow to analyze. Traditional on-premise data warehouses turned out to be quite inefficient, requiring large computing power to deal with the peak demand which not only laid idle large blocks of time, but actually still struggled when a number of requests arrived at the same time.

Snowflake’s cloud platform separates the storage and analysis making it significantly faster, cheaper and easier for their customers to answer data questions, often replacing a number of different systems at once.

4. Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Snowflake’s cloud innovation has played a significant role in its market visibility given the level of competition in a market that includes Teradata (NYSE:TDC), Cloudera (NYSE:CLDR), and cloud service providers such as Microsoft (NASDAQ:MSFT), Google, and Amazon (NASDAQ:AMZN).

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Snowflake grew its sales at an exceptional 39.6% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Snowflake reported robust year-on-year revenue growth of 25.7%, and its $1.04 billion of revenue topped Wall Street estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 22.8% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Snowflake’s billings punched in at $770.7 million in Q1, and over the last four quarters, its growth was fantastic as it averaged 26.6% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Enterprise Customer Base

This quarter, Snowflake reported 606 enterprise customers paying more than $1 million annually, an increase of 26 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Snowflake will likely need to upsell its existing large customers or move down market to maintain its top-line growth.

8. Customer Acquisition Efficiency

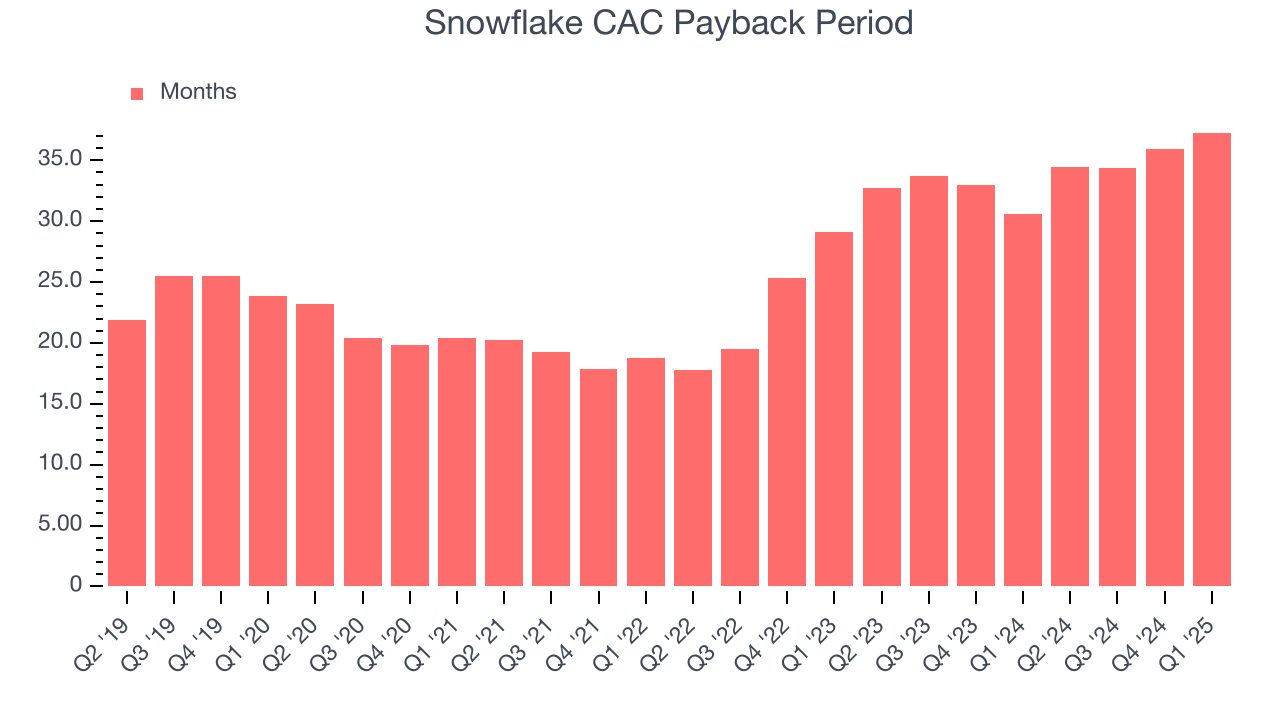

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Snowflake is efficient at acquiring new customers, and its CAC payback period checked in at 37.3 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Snowflake’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 126% in Q1. This means Snowflake would’ve grown its revenue by 26% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Snowflake still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

10. Gross Margin & Pricing Power

For software companies like Snowflake, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Snowflake’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 66.6% gross margin over the last year. That means Snowflake paid its providers a lot of money ($33.42 for every $100 in revenue) to run its business.

This quarter, Snowflake’s gross profit margin was 66.5%, in line with the same quarter last year. Zooming out, Snowflake’s full-year margin has been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

11. Operating Margin

Snowflake’s expensive cost structure has contributed to an average operating margin of negative 40.5% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Analyzing the trend in its profitability, Snowflake’s operating margin decreased by 1.6 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Snowflake’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Snowflake generated a negative 42.9% operating margin.

12. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Snowflake has shown impressive cash profitability, driven by its cost-effective customer acquisition strategy that gives it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 14.4% over the last year, better than the broader software sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Snowflake broke even from a free cash flow perspective in Q1. The company’s cash profitability regressed as it was 40 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Snowflake’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 14.4% for the last 12 months will increase to 25%, it options for capital deployment (investments, share buybacks, etc.).

13. Balance Sheet Assessment

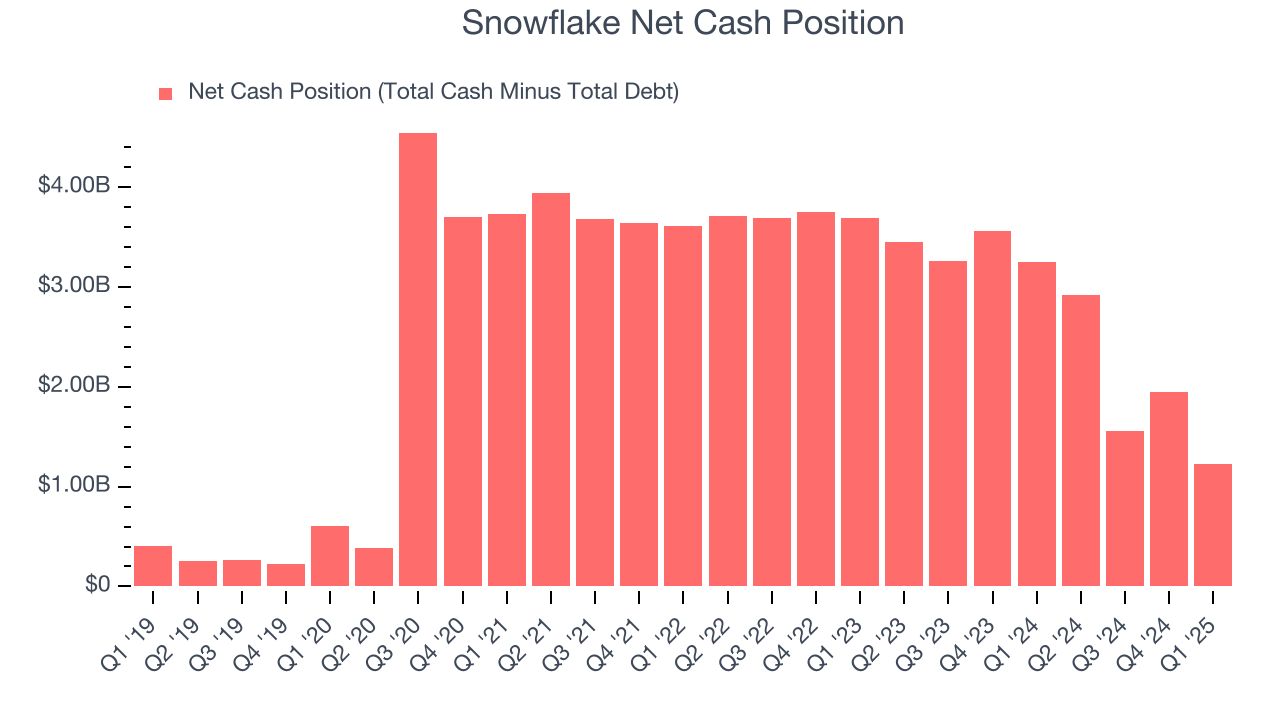

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Snowflake is a well-capitalized company with $3.91 billion of cash and $2.69 billion of debt on its balance sheet. This $1.22 billion net cash position is 2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from Snowflake’s Q1 Results

It was encouraging to see Snowflake beat analysts’ revenue expectations this quarter. Additionally, profitability was much stronger than expected, leading adjusted operating profit and adjusted EPS to beat handily. Looking ahead, Q2 product revenue was slightly higher than Wall Street Consensus. On the other hand, its billings missed and its net revenue retention decreased. This wasn't a perfect quarter, but it was still very solid. The stock traded up 5.7% to $189.30 immediately after reporting.

15. Is Now The Time To Buy Snowflake?

Updated: June 5, 2025 at 10:11 PM EDT

Before deciding whether to buy Snowflake or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We think Snowflake is a solid business. To kick things off, its revenue growth was exceptional over the last three years. And while its operating margins reveal poor profitability compared to other software companies, its first-class retention signals customer loyalty and high switching costs. On top of that, its strong free cash flow generation gives it reinvestment options.

Snowflake’s price-to-sales ratio based on the next 12 months is 14.6x. When scanning the software space, Snowflake trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $225.21 on the company (compared to the current share price of $209.60), implying they see 7.4% upside in buying Snowflake in the short term.