Bumble (BMBL)

Bumble doesn’t excite us. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why Bumble Is Not Exciting

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

- Estimated sales decline of 11.1% for the next 12 months implies a challenging demand environment

- Customer spending has dipped by 4.9% on average as it focused on growing its buyers

- One positive is that its excellent EBITDA margin highlights the strength of its business model, and its operating leverage amplified its profits over the last few years

Bumble’s quality is lacking. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Bumble

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bumble

Bumble is trading at $5.10 per share, or 2.3x forward EV/EBITDA. Bumble’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Bumble (BMBL) Research Report: Q1 CY2025 Update

Online dating app Bumble (NASDAQ:BMBL) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 7.7% year on year to $247.1 million. On the other hand, next quarter’s revenue guidance of $239 million was less impressive, coming in 2% below analysts’ estimates. Its GAAP profit of $0.13 per share was 14.3% below analysts’ consensus estimates.

Bumble (BMBL) Q1 CY2025 Highlights:

- Revenue: $247.1 million vs analyst estimates of $246.4 million (7.7% year-on-year decline, in line)

- EPS (GAAP): $0.13 vs analyst expectations of $0.15 (14.3% miss)

- Adjusted EBITDA: $64.4 million vs analyst estimates of $61.74 million (26.1% margin, 4.3% beat)

- Revenue Guidance for Q2 CY2025 is $239 million at the midpoint, below analyst estimates of $243.8 million

- EBITDA guidance for Q2 CY2025 is $81.5 million at the midpoint, above analyst estimates of $58.94 million

- Operating Margin: 18.1%, in line with the same quarter last year

- Free Cash Flow was $40.83 million, up from -$8.57 million in the previous quarter

- Paying Users: 4.01 million, in line with the same quarter last year

- Market Capitalization: $453.2 million

Company Overview

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

Online dating apps have disrupted the more traditional ways that people meet romantic partners, by greatly expanding the pool of potential dating partners, allowing people to more readily find those with shared common interests. Today, approximately 40% of couples now meet Online in the U.S., up from 20% in the early-2000s.

Bumble operates two dating apps – Bumble and Badoo. The Badoo app, founded by Andrey Andreev and launched in 2006, differentiates itself by its mantra of “Date Honestly” which is meant to be a mix of both dating app and social discovery app, where one can meet friends with similar interests. It is the market leader in Europe and Latin America.

Bumble launched in 2014, with the innovation of giving women the authority to make the first move under the premise that women would feel more confident and empowered, resulting in higher engagement than on other dating apps. As a result, within North America, Bumble has more female users for every male user than any other dating app, an indication of how well the product resonates with its users. Along the lines of being women-centric, Bumble was one of the first major dating apps to launch automated photo verification (ensuring matches are real people), develop in-app video chat, use machine learning to blur lewd images, and ban obscene images, all with the intention of improving the comfort level of meeting in person. Bumble has also added other mental health resources like a crisis support line, suicide prevention lifeline, and stress management tutorials, all of which bolster its reputation of being a safer, kinder, and more accountable dating app experience. The app itself is simple and works similarly to Tinder, profiles of potential matches are displayed to users, who can "swipe left" to reject a candidate or "swipe right" to indicate interest.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Bumble (NASDAQ:BMBL)’s online dating peers include direct rivals Match Group (NASDAQ:MTCH) and Spark Networks (NYSE:LOV), along with social networks like Snapchat (NYSE:SNAP) and Meta Platforms (NASDAQ:FB).

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Bumble’s sales grew at a mediocre 9.4% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Bumble reported a rather uninspiring 7.7% year-on-year revenue decline to $247.1 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 11% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 7.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Paying Users

Buyer Growth

As a subscription-based app, Bumble generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Bumble’s paying users, a key performance metric for the company, increased by 12.4% annually to 4.01 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

Unfortunately, Bumble’s paying users were flat year on year in Q1. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Bumble’s ARPB fell over the last two years, averaging 4.9% annual declines. This isn’t great, but the increase in paying users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Bumble tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyers can continue growing at the current pace.

This quarter, Bumble’s ARPB clocked in at $20.24. It declined 7.3% year on year, worse than the change in its paying users.

7. Gross Margin & Pricing Power

For internet subscription businesses like Bumble, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Bumble has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 70.5% gross margin over the last two years. Said differently, roughly $70.46 was left to spend on selling, marketing, and R&D for every $100 in revenue.

Bumble’s gross profit margin came in at 70.3% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Consumer internet businesses like Bumble grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Bumble is efficient at acquiring new users, spending 34.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates relatively solid competitive positioning, giving Bumble the freedom to invest its resources into new growth initiatives.

9. EBITDA

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Bumble has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Bumble’s EBITDA margin rose by 1.7 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q1, Bumble generated an EBITDA profit margin of 26.1%, down 1.6 percentage points year on year. Since Bumble’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

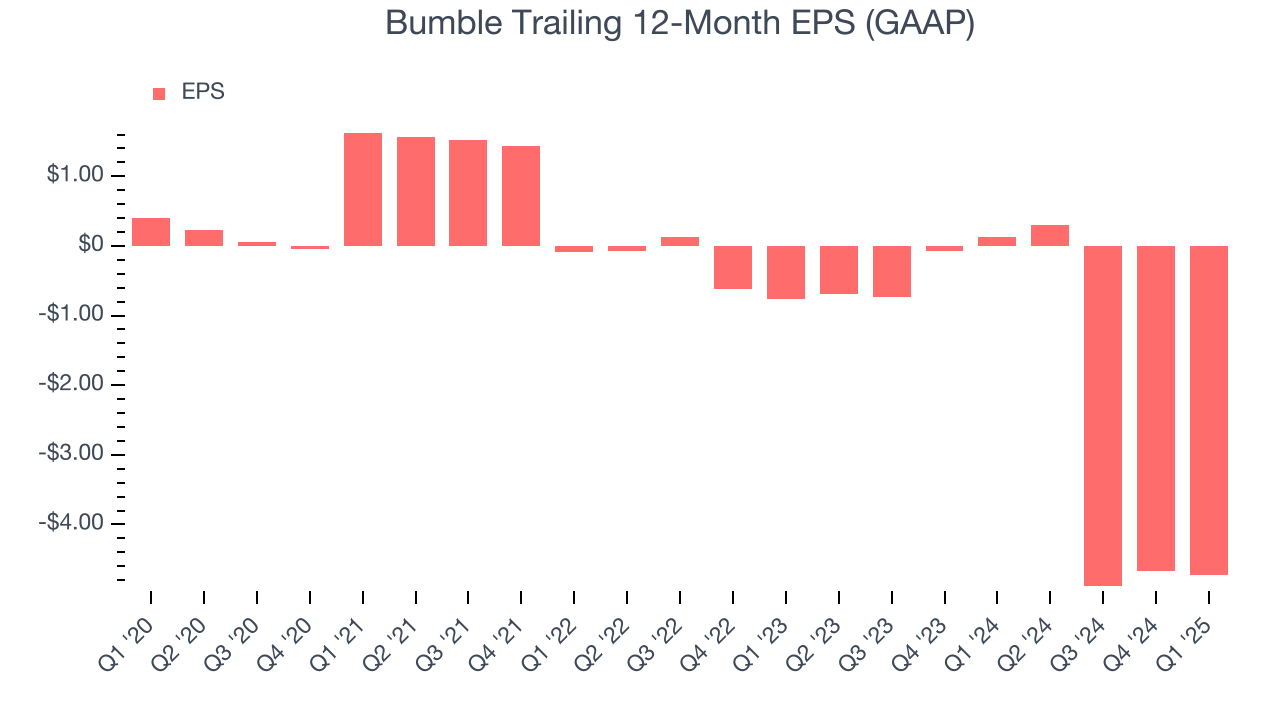

10. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bumble’s earnings losses deepened over the last three years as its EPS dropped 272% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Bumble’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Bumble reported EPS at $0.13, down from $0.19 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Bumble’s full-year EPS of negative $4.72 will flip to positive $0.59.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Bumble has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 14.8% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Bumble’s margin dropped by 4.4 percentage points over the last few years. If its declines continue, it could signal increasing investment needs and capital intensity.

Bumble’s free cash flow clocked in at $40.83 million in Q1, equivalent to a 16.5% margin. This result was good as its margin was 16.7 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

12. Balance Sheet Assessment

Bumble reported $202.2 million of cash and $616.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $294.5 million of EBITDA over the last 12 months, we view Bumble’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $22.99 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Bumble’s Q1 Results

We were impressed by Bumble’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Zooming out, we still think this was a decent quarter featuring some areas of strength. The stock traded up 8.9% to $4.78 immediately after reporting.

14. Is Now The Time To Buy Bumble?

Updated: June 22, 2025 at 10:29 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Bumble, you should also grasp the company’s longer-term business quality and valuation.

Bumble isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its impressive EBITDA margins show it has a highly efficient business model, the downside is its projected EPS for the next year is lacking. On top of that, its ARPU has declined over the last two years.

Bumble’s EV/EBITDA ratio based on the next 12 months is 2.3x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $5.60 on the company (compared to the current share price of $5.10).