Moderna (MRNA)

Moderna is up against the odds. Its recent pullback in sales and profitability suggests it’s struggling to scale down costs as demand evaporates.― StockStory Analyst Team

1. News

2. Summary

Why We Think Moderna Will Underperform

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ:MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 54.1% annually over the last two years

- Earnings per share fell by 42.2% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Moderna is skating on thin ice. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Moderna

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Moderna

Moderna is trading at $27.05 per share, or 5x forward price-to-sales. The market typically values companies like Moderna based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Moderna (MRNA) Research Report: Q1 CY2025 Update

Biotechnology company Moderna (NASDAQ:MRNA) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 35.3% year on year to $108 million. The company’s full-year revenue guidance of $2 billion at the midpoint came in 6.1% below analysts’ estimates. Its GAAP loss of $2.52 per share was 18.6% above analysts’ consensus estimates.

Moderna (MRNA) Q1 CY2025 Highlights:

- Revenue: $108 million vs analyst estimates of $117.9 million (35.3% year-on-year decline, 8.4% miss)

- EPS (GAAP): -$2.52 vs analyst estimates of -$3.10 (18.6% beat)

- Adjusted EBITDA: -$896 million vs analyst estimates of -$1.07 billion (-830% margin, 16% beat)

- The company reconfirmed its revenue guidance for the full year of $2 billion at the midpoint

- Operating Margin: -972%, down from -758% in the same quarter last year

- Free Cash Flow was -$1.15 billion compared to -$1.19 billion in the same quarter last year

- Market Capitalization: $11.03 billion

Company Overview

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ:MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna's technology platform revolves around synthetic mRNA, which serves as instructions for cells to produce proteins. When delivered into the body, these mRNA sequences instruct cells to create specific proteins that can prevent or treat disease. This approach differs from traditional vaccines and therapeutics that often introduce weakened pathogens or manufactured proteins into the body.

The company's product portfolio extends beyond its COVID-19 vaccine (Spikevax). Moderna is advancing a respiratory vaccine franchise that includes candidates for respiratory syncytial virus (RSV), influenza, and human metapneumovirus. It's also developing vaccines against latent viruses like cytomegalovirus (CMV), Epstein-Barr virus (EBV), and HIV.

In oncology, Moderna is working on individualized neoantigen therapies (INTs) that are custom-designed for each cancer patient based on the unique mutations in their tumor cells. These personalized cancer vaccines aim to help the immune system recognize and attack cancer cells. The company has partnered with Merck to develop these therapies, with promising results in melanoma trials.

Moderna also has programs targeting rare genetic diseases such as propionic acidemia, methylmalonic acidemia, and phenylketonuria. These conditions often result from missing or defective enzymes, and Moderna's approach uses mRNA to instruct cells to produce the needed proteins.

The company's business model involves both independent development of medicines and strategic collaborations with pharmaceutical companies, research institutions, and government agencies. Its manufacturing capabilities include highly specialized facilities designed to produce mRNA-based medicines at scale, a capability that proved crucial during the COVID-19 pandemic.

As the market for COVID-19 vaccines has shifted from pandemic to endemic, Moderna has adapted by offering different product presentations, including single-dose options and pre-filled syringes, while simultaneously advancing its broader pipeline of mRNA medicines.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Moderna's primary competitors include Pfizer/BioNTech (NYSE:PFE/NASDAQ:BNTX), which also produces an mRNA-based COVID-19 vaccine. Other competitors in the vaccine space include Novavax (NASDAQ:NVAX), Johnson & Johnson (NYSE:JNJ), and AstraZeneca (NASDAQ:AZN). In the broader mRNA therapeutics field, companies like CureVac (NASDAQ:CVAC) and Translate Bio (acquired by Sanofi) are also developing competing technologies.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.18 billion in revenue over the past 12 months, Moderna has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Moderna grew its sales at an incredible 127% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Moderna’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 54.1% over the last two years.

This quarter, Moderna missed Wall Street’s estimates and reported a rather uninspiring 35.3% year-on-year revenue decline, generating $108 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 33.6% over the next 12 months. While this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Moderna has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 26.4%.

Analyzing the trend in its profitability, Moderna’s operating margin decreased significantly over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 149.4 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Moderna generated an operating profit margin of negative 972%, down 214.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Moderna’s earnings losses deepened over the last five years as its EPS dropped 42.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Moderna’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Moderna reported EPS at negative $2.52, up from negative $3.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Moderna to perform poorly. Analysts forecast its full-year EPS of negative $8.73 will tumble to negative $10.31.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

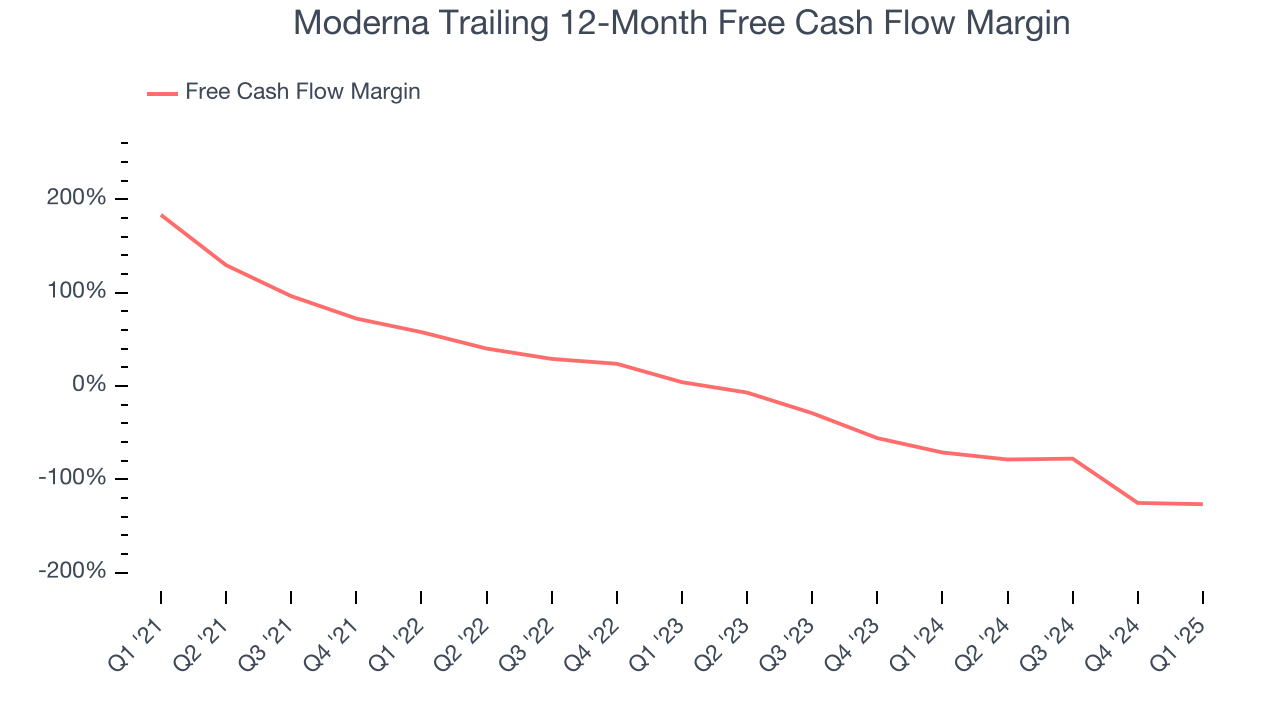

Moderna has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 22.5% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Moderna’s margin dropped meaningfully during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Moderna burned through $1.15 billion of cash in Q1, equivalent to a negative 1,069% margin. The company’s cash burn slowed from $1.19 billion of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Moderna burned through $4.02 billion of cash over the last year. With $5.98 billion of cash on its balance sheet, the company has around 18 months of runway left (assuming its $702 million of debt isn’t due right away).

Unless the Moderna’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Moderna until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Moderna’s Q1 Results

We enjoyed seeing Moderna beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $28.54 immediately after reporting.

12. Is Now The Time To Buy Moderna?

Updated: June 3, 2025 at 11:52 PM EDT

Before investing in or passing on Moderna, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We cheer for all companies serving everyday consumers, but in the case of Moderna, we’ll be cheering from the sidelines. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its declining adjusted operating margin shows the business has become less efficient.

Moderna’s forward price-to-sales ratio is 5.2x. The market typically values companies like Moderna based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $47.70 on the company (compared to the current share price of $27.87).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.

Enjoyed this research report? Then you will absolutely love StockStory Edge.

StockStory Edge provides you with in-depth research on more than 1,100 stocks including many that fly under-the-radar, helping you understand not only what to buy but also what to avoid.

Did you know that StockStory High Quality stocks generated a market-beating return of 183% from March 31, 2020 to March 31, 2025 vs an 117% return for the market? We achieve this outperformance by blending AI-powered analysis with the expertise of our analysts to identify opportunities overlooked by the market.