Hubbell (HUBB)

Hubbell is intriguing. It repeatedly invests in lucrative growth initiatives, generating robust cash flows and returns on capital.― StockStory Analyst Team

1. News

2. Summary

Why Hubbell Is Interesting

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

- Industry-leading 25.4% return on capital demonstrates management’s skill in finding high-return investments, and its returns are growing as it capitalizes on even better market opportunities

- Successful business model is illustrated by its impressive operating margin, and its operating leverage amplified its profits over the last five years

- On the other hand, its core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

Hubbell shows some potential. If you like the stock, the valuation seems fair.

Why Is Now The Time To Buy Hubbell?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Hubbell?

At $399.06 per share, Hubbell trades at 22.3x forward P/E. Scanning companies across the industrials space, we think that Hubbell’s valuation is appropriate for the business quality.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Hubbell (HUBB) Research Report: Q1 CY2025 Update

Electrical and electronic products company Hubbell (NYSE:HUBB) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 2.4% year on year to $1.37 billion. Its non-GAAP profit of $3.50 per share was 6% below analysts’ consensus estimates.

Hubbell (HUBB) Q1 CY2025 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.38 billion (2.4% year-on-year decline, 1.3% miss)

- Adjusted EPS: $3.50 vs analyst expectations of $3.72 (6% miss)

- Adjusted EBITDA: $285.7 million vs analyst estimates of $301.6 million (20.9% margin, 5.3% miss)

- Management reiterated its full-year Adjusted EPS guidance of $17.60 at the midpoint

- Operating Margin: 17.5%, up from 16.3% in the same quarter last year

- Free Cash Flow Margin: 0.8%, down from 3.7% in the same quarter last year

- Market Capitalization: $19.46 billion

Company Overview

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

In the construction industry, Hubbell provides wiring devices, lighting fixtures, and electrical components. It also sells a range of robust industrial electrical equipment like heavy-duty connectors, motor controls, and power systems designed to withstand harsh environments for the industrial industry.

The company also manufactures power distribution equipment like transformers and insulators, which are crucial for the generation and transmission of electricity, which are sold to companies in the utility and energy industries. Lastly, Hubell produces fiber optic connectors, enclosures, and structured cabling systems to telecommunications companies.

The bulk of Hubbell’s revenue comes from product sales to companies in their respective sectors, along with its associated maintenance and support services. The company also often engages in large contractual projects, especially with utility and construction companies, to help them with comprehensive start-to-finish solutions. It sells its products through a wide network of distributors, wholesalers, and retailers, as well as directly to large institutional customers.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Hubbell include Eaton (NYSE:ETN), ABB (NYSE:ABB), and Schneider Electric (EPA:SU).

5. Sales Growth

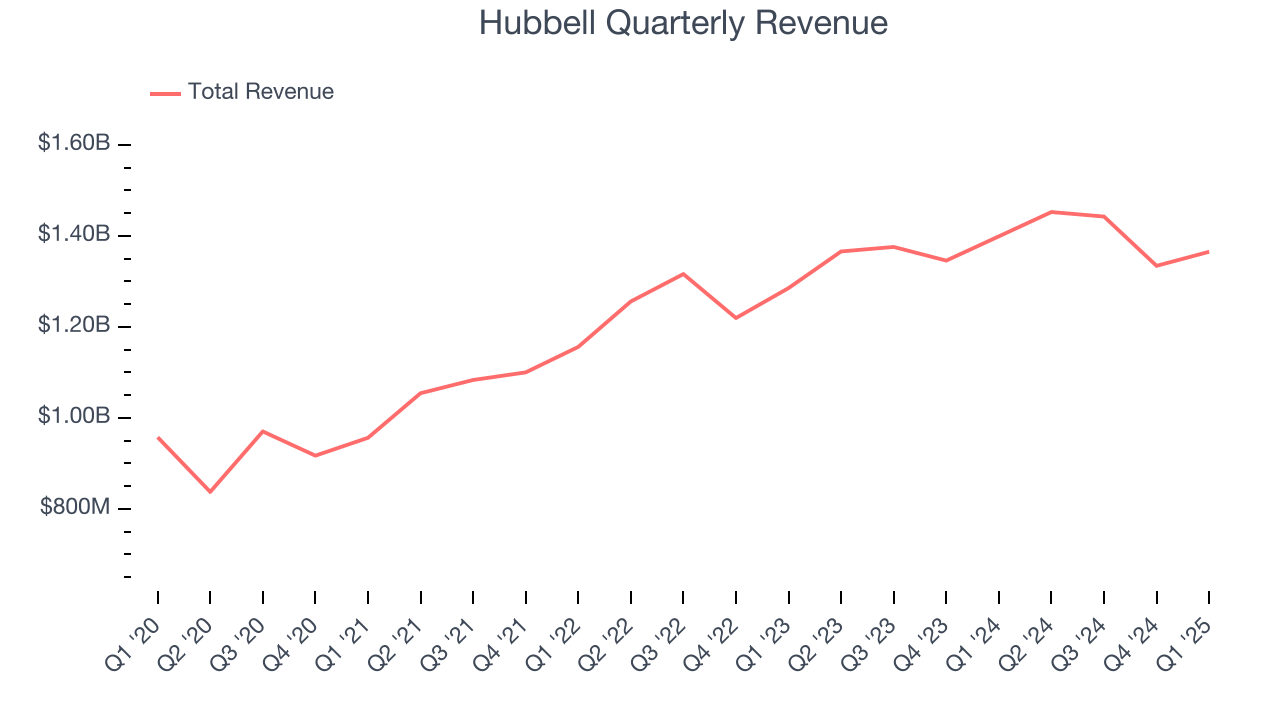

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Hubbell’s 4.6% annualized revenue growth over the last five years was tepid. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Hubbell.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hubbell’s annualized revenue growth of 5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Hubbell missed Wall Street’s estimates and reported a rather uninspiring 2.4% year-on-year revenue decline, generating $1.37 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, similar to its two-year rate. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Hubbell’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 31.1% gross margin over the last five years. Said differently, Hubbell paid its suppliers $68.93 for every $100 in revenue.

Hubbell’s gross profit margin came in at 33.1% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Hubbell has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.5%.

Looking at the trend in its profitability, Hubbell’s operating margin rose by 6.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, Hubbell generated an operating profit margin of 17.5%, up 1.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hubbell’s EPS grew at a spectacular 15.4% compounded annual growth rate over the last five years, higher than its 4.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Hubbell’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Hubbell’s operating margin expanded by 6.2 percentage points over the last five years. On top of that, its share count shrank by 1.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Hubbell, its two-year annual EPS growth of 16.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Hubbell reported EPS at $3.50, down from $3.60 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Hubbell’s full-year EPS of $16.47 to grow 8.6%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Hubbell has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Hubbell’s margin expanded by 1.1 percentage points during that time. This is encouraging because it gives the company more optionality.

Hubbell broke even from a free cash flow perspective in Q1. The company’s cash profitability regressed as it was 2.9 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hubbell’s five-year average ROIC was 25%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Hubbell’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Hubbell reported $360.3 million of cash and $1.86 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.3 billion of EBITDA over the last 12 months, we view Hubbell’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $66.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Hubbell’s Q1 Results

We struggled to find many positives in these results. Its EBITDA missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $359.67 immediately after reporting.

13. Is Now The Time To Buy Hubbell?

Updated: June 26, 2025 at 10:52 PM EDT

Before investing in or passing on Hubbell, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Hubbell possesses a number of positive attributes. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Hubbell’s organic revenue growth has disappointed, its expanding operating margin shows the business has become more efficient. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Hubbell’s P/E ratio based on the next 12 months is 22.7x. Looking at the industrials space right now, Hubbell trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $415.38 on the company (compared to the current share price of $405.26), implying they see 2.5% upside in buying Hubbell in the short term.