FormFactor (FORM)

FormFactor keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think FormFactor Will Underperform

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

- Estimated sales growth of 2.4% for the next 12 months is soft and implies weaker demand

- ROIC of 9.4% reflects management’s challenges in identifying attractive investment opportunities, and its decreasing returns suggest its historical profit centers are aging

- Operating margin fell from an already low starting point over the last five years, and the smaller profit dollars make it harder to react to unexpected market developments

FormFactor fails to meet our quality criteria. There are more promising alternatives.

Why There Are Better Opportunities Than FormFactor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than FormFactor

FormFactor’s stock price of $34.30 implies a valuation ratio of 23.1x forward P/E. Yes, this valuation multiple is lower than that of other semiconductor peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. FormFactor (FORM) Research Report: Q1 CY2025 Update

Semiconductor testing company FormFactor (NASDAQ:FORM) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 1.6% year on year to $171.4 million. Guidance for next quarter’s revenue was better than expected at $190 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.23 per share was 21.1% above analysts’ consensus estimates.

FormFactor (FORM) Q1 CY2025 Highlights:

- Revenue: $171.4 million vs analyst estimates of $169.9 million (1.6% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.19 (21.1% beat)

- Adjusted Operating Income: $16.9 million vs analyst estimates of $13.77 million (9.9% margin, 22.7% beat)

- Revenue Guidance for Q2 CY2025 is $190 million at the midpoint, above analyst estimates of $186.3 million

- Adjusted EPS guidance for Q2 CY2025 is $0.30 at the midpoint, above analyst estimates of $0.29

- Operating Margin: 1.9%, down from 12.6% in the same quarter last year

- Free Cash Flow Margin: 2.9%, down from 11.7% in the same quarter last year

- Inventory Days Outstanding: 94, up from 80 in the previous quarter

- Market Capitalization: $2.15 billion

Company Overview

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor was founded in 1993 by former IBM researcher, Igor Khandros. The initial products served three semiconductor applications: sockets, packaging, and probe cards. FormFactor went public in June of 2003.

Designing semiconductors involves modeling, reliability testing, and design de-bug followed by qualification and production assessments. Along the way, testing and measurement occurs to ensure compliance with industry standards and to ensure accuracy. Since semiconductor manufacturing is a complex and resource-intensive process, detecting flaws early in the process means saving money and time. As such, testing and measurement impact yields, time-to-market, and overall quality.

FormFactor’s products – often customized to meet customers’ unique wafer and chip designs – address these testing and measurement needs through products such as probe cards, probe stations, thermal systems, and cryogenic systems. Probe cards, for example, ensure that a customer’s composite contact elements used in manufacturing are precise to length scales of a few microns and reliable across various compression levels. Thermal systems ensure precise temperature management during certain steps in semiconductor manufacturing.

Competitors in the market for probe cards, FormFactor’s largest product category, include Advanced Micro Silicon Technology, Chungwa Precision Test Technology, Feinmetall, and Japan Electronic Materials Corporation (TYO:6855).

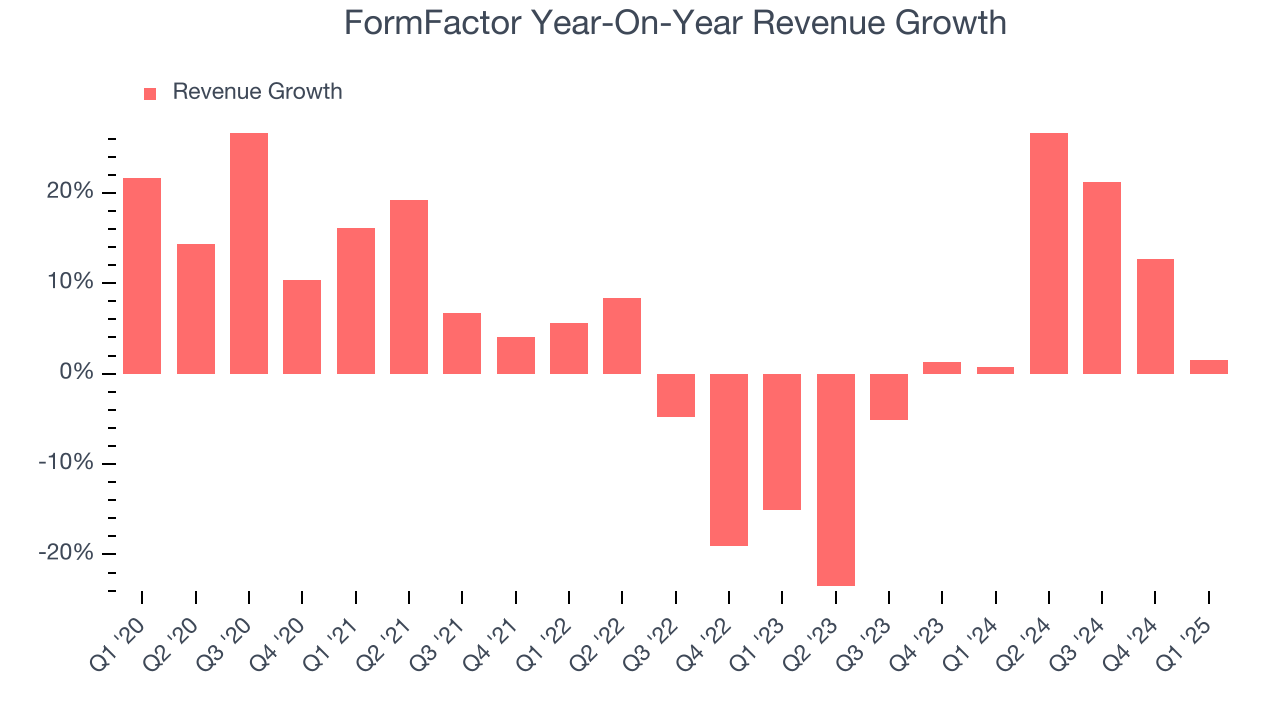

4. Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, FormFactor’s sales grew at a sluggish 4.4% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. FormFactor’s recent performance shows its demand has slowed as its annualized revenue growth of 3.3% over the last two years was below its five-year trend.

This quarter, FormFactor reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 0.9%. Despite the beat, this was its third consecutive quarter of decelerating growth, indicating a potential cyclical downturn. Company management is currently guiding for a 3.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

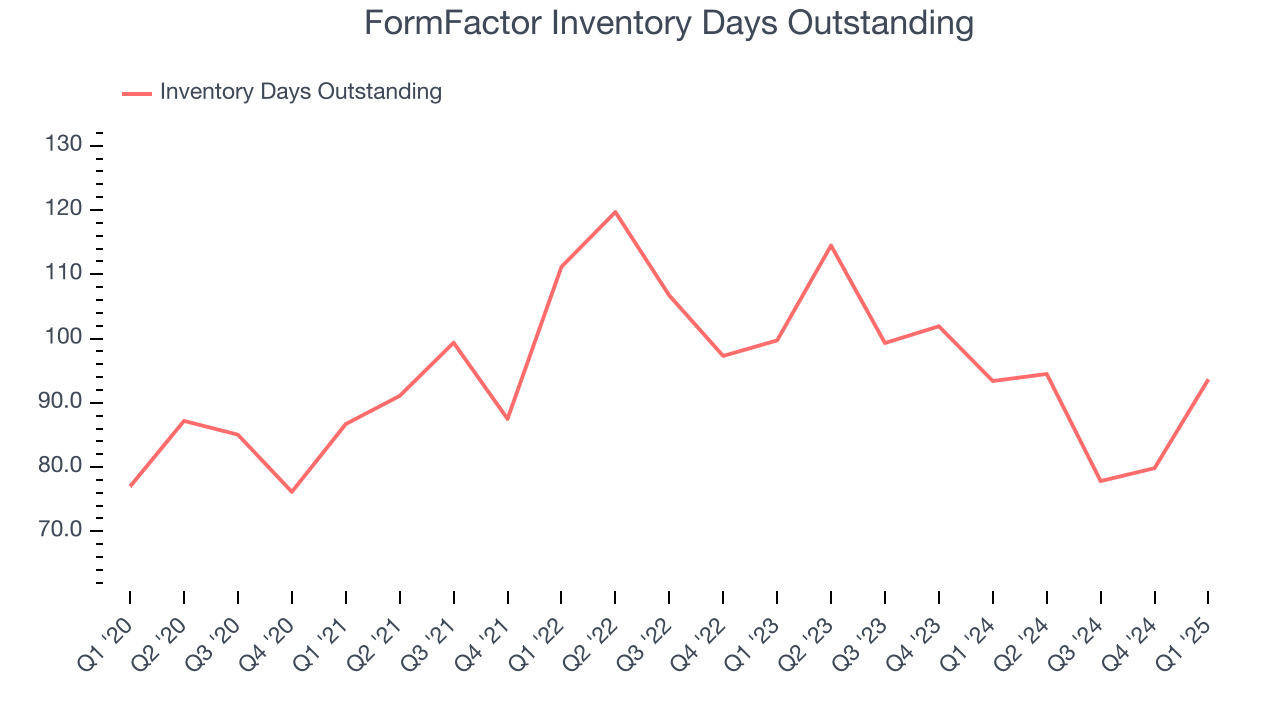

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, FormFactor’s DIO came in at 94, which is one day below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

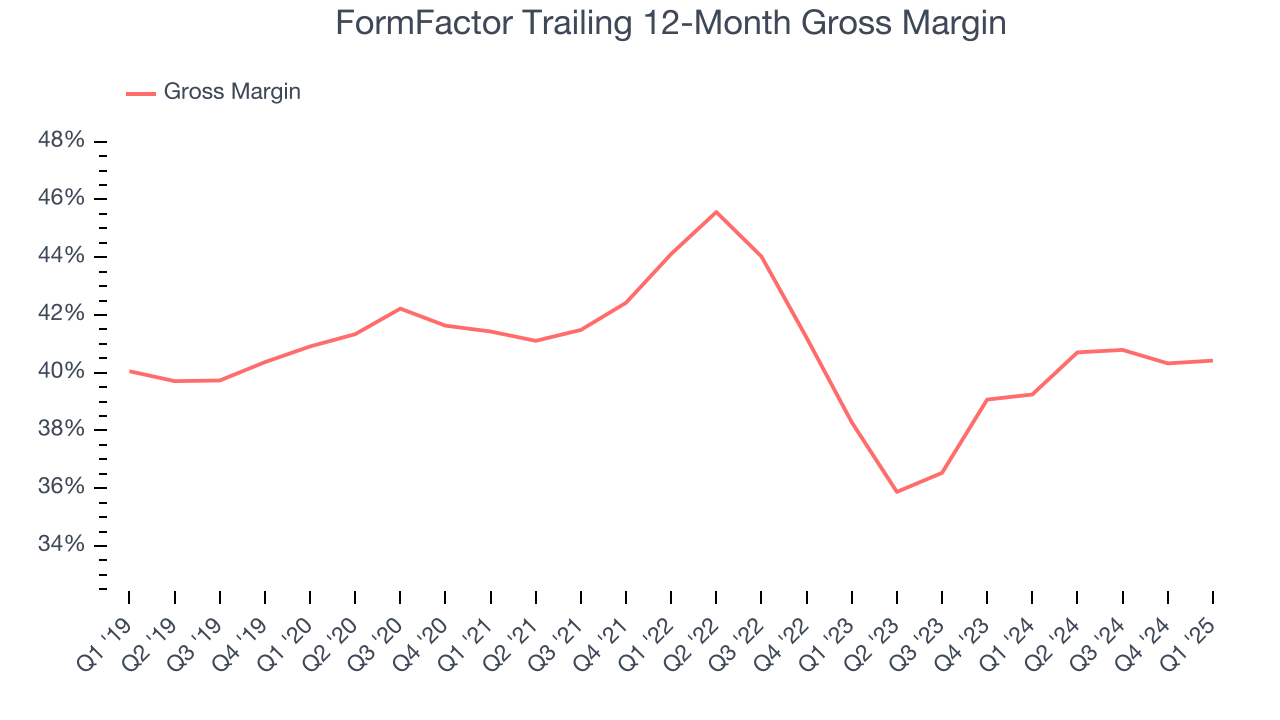

6. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

FormFactor’s gross margin is well below other semiconductor companies, indicating a lack of pricing power and a competitive market. As you can see below, it averaged a 39.9% gross margin over the last two years. Said differently, FormFactor had to pay a chunky $60.13 to its suppliers for every $100 in revenue.

This quarter, FormFactor’s gross profit margin was 37.7%, in line with the same quarter last year. Zooming out, FormFactor’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

FormFactor was profitable over the last two years but held back by its large cost base. Its average operating margin of 10.5% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, FormFactor’s operating margin decreased by 6.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. FormFactor’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, FormFactor generated an operating profit margin of 1.9%, down 10.7 percentage points year on year. Since FormFactor’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

FormFactor’s flat EPS over the last five years was below its 4.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of FormFactor’s earnings can give us a better understanding of its performance. As we mentioned earlier, FormFactor’s operating margin declined by 6.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, FormFactor reported EPS at $0.23, up from $0.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FormFactor’s full-year EPS of $1.20 to grow 23.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

FormFactor has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.4%, subpar for a semiconductor business.

Taking a step back, we can see that FormFactor’s margin dropped by 5.8 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle.

FormFactor’s free cash flow clocked in at $4.96 million in Q1, equivalent to a 2.9% margin. The company’s cash profitability regressed as it was 8.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

FormFactor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.5%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

FormFactor is a profitable, well-capitalized company with $299 million of cash and $21.5 million of debt on its balance sheet. This $277.5 million net cash position is 12.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from FormFactor’s Q1 Results

We were impressed by how significantly FormFactor blew past analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its inventory levels materially increased. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 5.2% to $29.55 immediately after reporting.

13. Is Now The Time To Buy FormFactor?

Updated: June 10, 2025 at 10:25 PM EDT

Before investing in or passing on FormFactor, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

FormFactor falls short of our quality standards. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, FormFactor’s declining operating margin shows the business has become less efficient, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

FormFactor’s P/E ratio based on the next 12 months is 23.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $37.88 on the company (compared to the current share price of $35.06).