Roku (ROKU)

We’re skeptical of Roku. The demand for its offerings is expected to be weak over the next year, a tough backdrop for its returns.― StockStory Analyst Team

1. News

2. Summary

Why We Think Roku Will Underperform

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

- Earnings per share fell by 36.7% annually over the last three years while its revenue grew, showing its incremental sales were much less profitable

- Focus on expanding its platform came at the expense of monetization as its average revenue per user fell by 1.4% annually

- On the bright side, its total Hours Streamed have increased by an average of 20.1% annually, giving it the potential for margin-accretive growth if it can develop valuable complementary products and features

Roku doesn’t pass our quality test. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Roku

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Roku

Roku is trading at $78.88 per share, or 31.5x forward EV/EBITDA. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Roku (ROKU) Research Report: Q1 CY2025 Update

Streaming TV platform Roku (NASDAQ: ROKU) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 15.8% year on year to $1.02 billion. On the other hand, next quarter’s revenue guidance of $1.07 billion was less impressive, coming in 1.6% below analysts’ estimates. Its GAAP loss of $0.19 per share was 27.4% above analysts’ consensus estimates.

Roku (ROKU) Q1 CY2025 Highlights:

- Revenue: $1.02 billion vs analyst estimates of $1.01 billion (15.8% year-on-year growth, 1.5% beat)

- EPS (GAAP): -$0.19 vs analyst estimates of -$0.26 (27.4% beat)

- Adjusted EBITDA: $56.02 million vs analyst estimates of $60.43 million (5.5% margin, 7.3% miss)

- Revenue Guidance for Q2 CY2025 is $1.07 billion at the midpoint, below analyst estimates of $1.09 billion

- EBITDA guidance for the full year is $350 million at the midpoint, above analyst estimates of $337.7 million

- Operating Margin: -5.7%, up from -8.2% in the same quarter last year

- Free Cash Flow Margin: 29.2%, up from 6.4% in the previous quarter

- Total Hours Streamed: 35.8 billion

- Market Capitalization: $10 billion

Company Overview

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku was originally founded by Anthony Wood in 2002 – the name Roku means six in Japanese – it was Wood’s sixth company he founded. He would eventually go to work at Netflix tasked with developing a Netflix branded streaming player. Days before launch, Netflix decided it couldn’t release its own hardware player that would put it into competition with other hardware distribution partners like Sony or Samsung, so instead it spun Roku out.

Roku’s streaming content operating system runs on either Roku TV models or as the OS on a range of smart TV models. The company owns and operates the Roku channel, a collection of content offered for free. Its business is built on scaling the number of active accounts to grow the number of hours of viewing throughout its ecosystem, and then monetize through a combination of advertising and commissions from sales of subscription services.

The Roku ecosystem offers benefits to each of its stakeholders, ranging from consumers, content publishers, advertisers, Roku TV brand partners, and other partners. Consumers can discover and access a wide variety of streaming content, content publishers have access to a large base of over 50 million customers, while advertisers can leverage Roku’s data to serve targeted and measurable ads to TV viewers who increasingly don’t watch TV through traditional channels.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Roku (NASDAQ: ROKU) competes for streaming TV subscribers with Apple (NASDAQ: AAPL), Alphabet (NASDAQ:GOOG.L), Amazon (NASDAQ:AMZN), and competes with Disney (NYSE:DIS), Netflix (NASDAQ: NFLX), AT&T’s Warner (NYSE:T) and ViacomCBS (NASDAQ: VIAC) for streaming audiences, and a range of streaming advertisers notably YouTube and Amazon.

5. Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Roku grew its sales at a decent 13.3% compounded annual growth rate. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Roku reported year-on-year revenue growth of 15.8%, and its $1.02 billion of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 10.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, a slight deceleration versus the last three years. Despite the slowdown, this projection is above average for the sector and indicates the market is forecasting some success for its newer products and services.

6. Total Hours Streamed

User Growth

As a subscription-based app, Roku generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Roku’s total hours streamed, a key performance metric for the company, increased by 20.1% annually to 35.8 billion in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q1, Roku added 5 billion total hours streamed, leading to 16.2% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

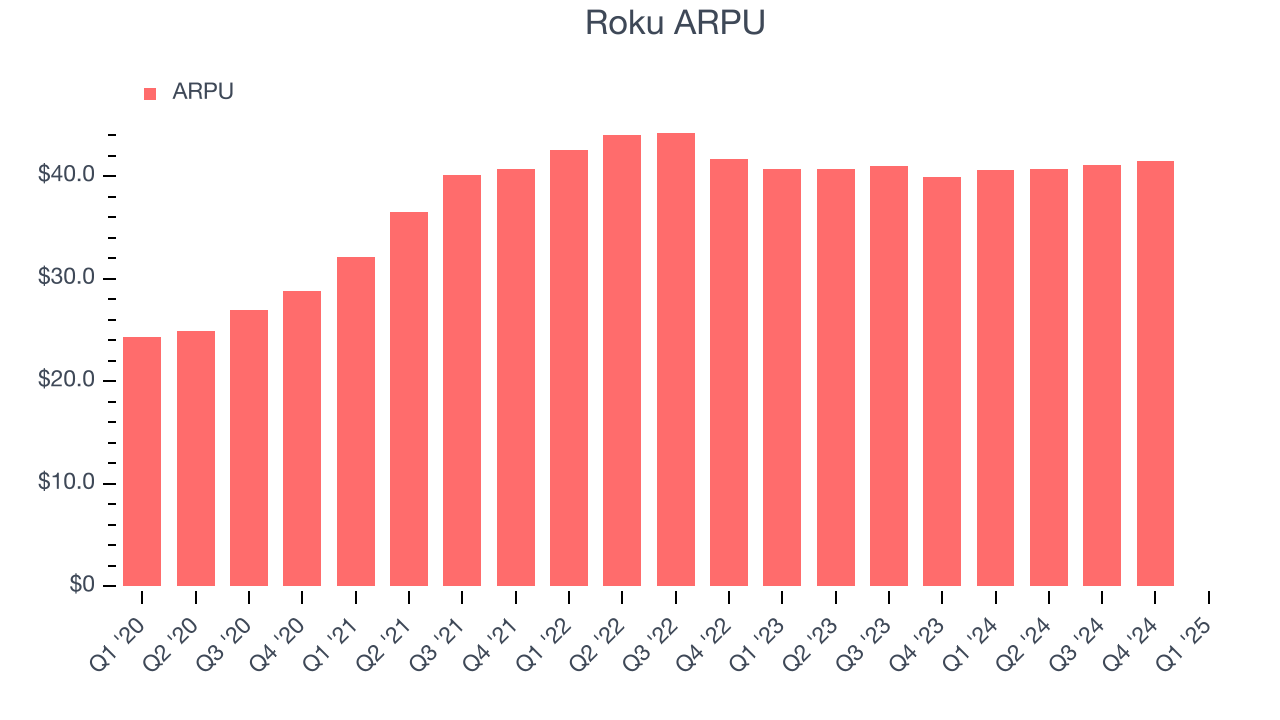

Average revenue per user (ARPU) is a critical metric to track because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Roku’s ARPU fell over the last two years, averaging 14.4% annual declines. This isn’t great, but the increase in total hours streamed is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roku tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Roku’s ARPU clocked in at $0.03. It declined 99.9% year on year, worse than the change in its total hours streamed.

7. Gross Margin & Pricing Power

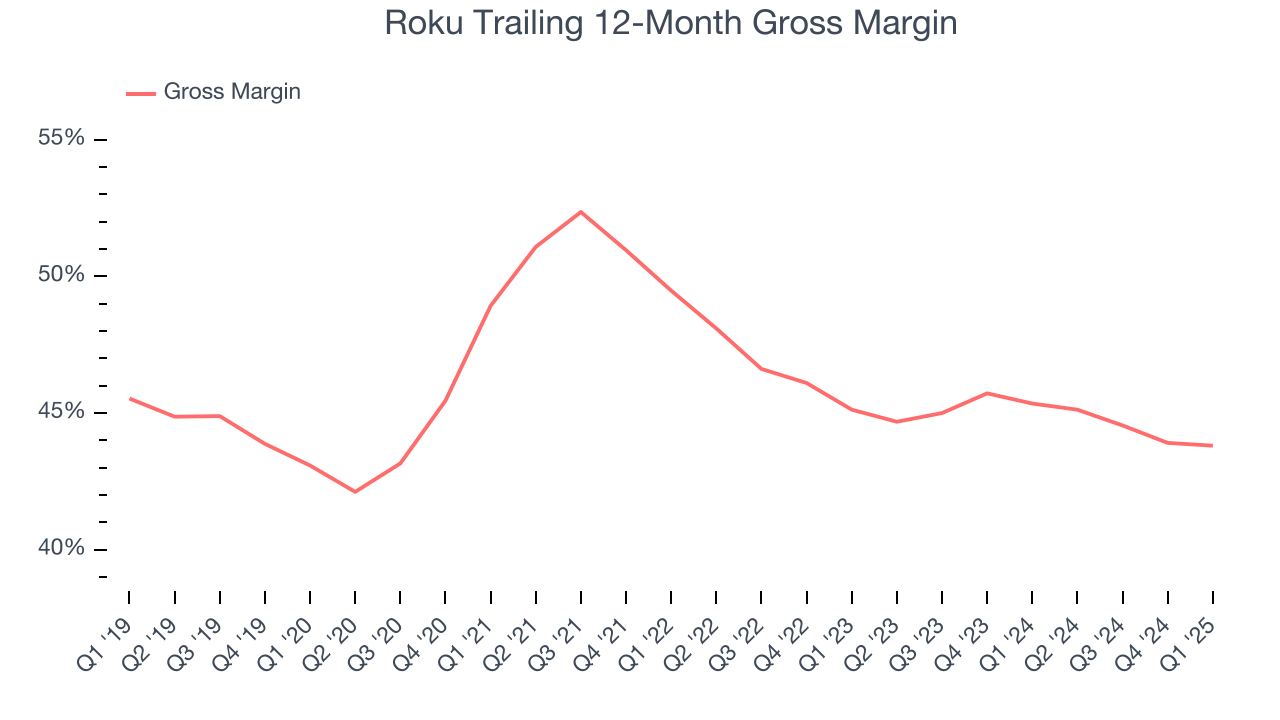

For internet subscription businesses like Roku, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Roku’s gross margin is below the broader consumer internet industry, giving it less room to hire engineering talent that can develop new products and services. As you can see below, it averaged a 44.5% gross margin over the last two years. Said differently, Roku had to pay a chunky $55.49 to its service providers for every $100 in revenue.

In Q1, Roku produced a 43.6% gross profit margin, in line with the same quarter last year. Zooming out, Roku’s full-year margin has been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. User Acquisition Efficiency

Consumer internet businesses like Roku grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s relatively expensive for Roku to acquire new users as the company has spent 49.9% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Roku operates in a competitive market and must continue investing to maintain an acceptable growth trajectory.

9. EBITDA

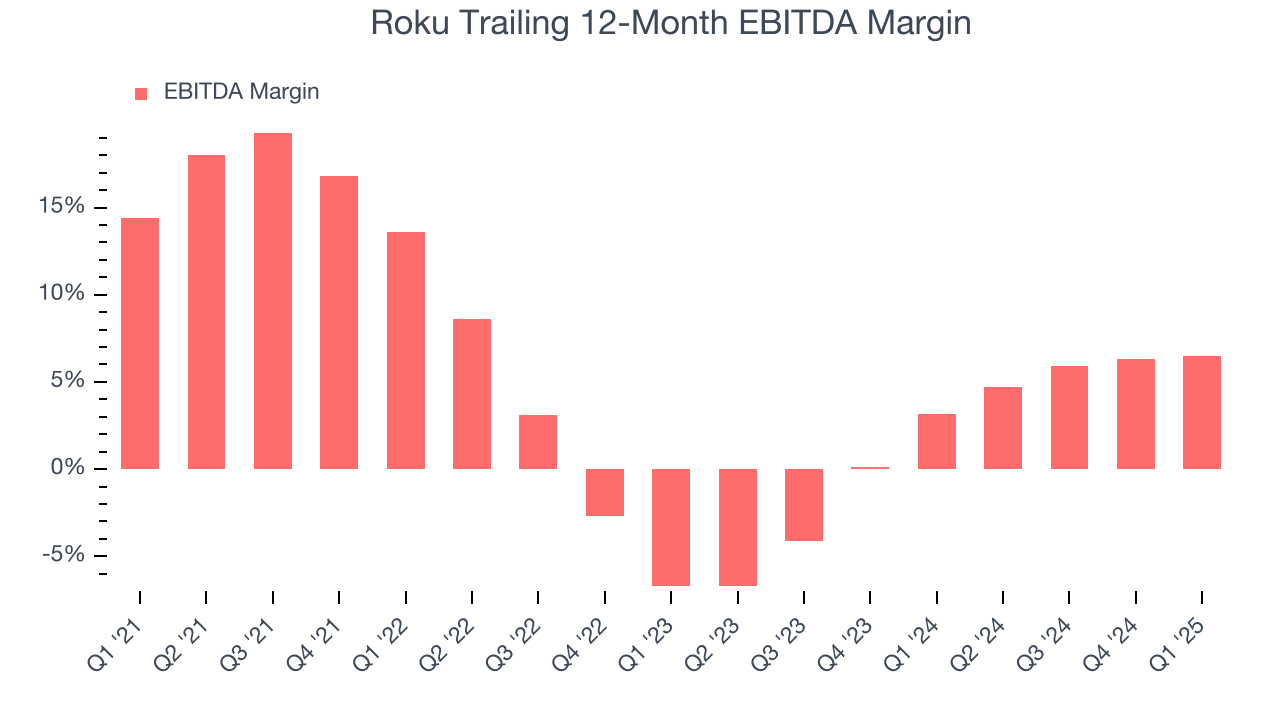

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Roku has managed its cost base well over the last two years. It demonstrated solid profitability for a consumer internet business, producing an average EBITDA margin of 4.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Roku’s EBITDA margin decreased by 7.1 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Roku generated an EBITDA profit margin of 5.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Roku, its EPS declined by 40% annually over the last three years while its revenue grew by 13.3%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Roku’s earnings to better understand the drivers of its performance. As we mentioned earlier, Roku’s EBITDA margin was flat this quarter but declined by 7.1 percentage points over the last three years. Its share count also grew by 7.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Roku reported EPS at negative $0.19, up from negative $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Roku’s full-year EPS of negative $0.73 will reach break even.

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Roku has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.3% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that Roku’s margin expanded by 4.7 percentage points over the last few years. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Roku’s free cash flow clocked in at $298.4 million in Q1, equivalent to a 29.2% margin. This result was good as its margin was 24 percentage points higher than in the same quarter last year, building on its favorable historical trend.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Roku is a well-capitalized company with $2.26 billion of cash and $496.1 million of debt on its balance sheet. This $1.76 billion net cash position is 17.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Roku’s Q1 Results

We were impressed by how significantly Roku blew past analysts’ EPS expectations this quarter. On the other hand, its revenue outlook for next quarter missed significantly, and it pulled its full-year guidance for advertising revenue. Overall, this was a softer quarter. The stock traded down 4.5% to $64.25 immediately following the results.

14. Is Now The Time To Buy Roku?

Updated: June 8, 2025 at 10:24 PM EDT

Before deciding whether to buy Roku or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Roku isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last three years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last three years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EBITDA margin shows the business has become less efficient.

Roku’s EV/EBITDA ratio based on the next 12 months is 31.5x. This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there.

Wall Street analysts have a consensus one-year price target of $84.88 on the company (compared to the current share price of $78.88).