Packaging Corporation of America (PKG)

We wouldn’t buy Packaging Corporation of America. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Packaging Corporation of America Will Underperform

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

- Falling earnings per share over the last two years has some investors worried as stock prices ultimately follow EPS over the long term

- 1.4% annual revenue growth over the last two years was slower than its industrials peers

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 22.7%

Packaging Corporation of America falls short of our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Packaging Corporation of America

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Packaging Corporation of America

Packaging Corporation of America’s stock price of $194.22 implies a valuation ratio of 11.9x forward EV-to-EBITDA. This multiple rich for the business quality. Not a great combination.

It’s better to invest in high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Packaging Corporation of America (PKG) Research Report: Q1 CY2025 Update

Packaging Corporation of America (NYSE:PKG) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 8.2% year on year to $2.14 billion. Its GAAP profit of $2.26 per share was 2% above analysts’ consensus estimates.

Packaging Corporation of America (PKG) Q1 CY2025 Highlights:

- Revenue: $2.14 billion vs analyst estimates of $2.11 billion (8.2% year-on-year growth, 1.5% beat)

- EPS (GAAP): $2.26 vs analyst estimates of $2.22 (2% beat)

- Adjusted EBITDA: $421.1 million vs analyst estimates of $415.3 million (19.7% margin, 1.4% beat)

- EPS (GAAP) guidance for Q2 CY2025 is $2.41 at the midpoint, missing analyst estimates by 6.6%

- Operating Margin: 13.1%, up from 9.9% in the same quarter last year

- Sales Volumes rose 7.6% year on year, in line with the same quarter last year

- Market Capitalization: $16.26 billion

Company Overview

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

Packaging Corporation of America originally started as a single facility and has expanded through strategic acquisitions and organic growth. Packaging Corporation of America offers products including standard corrugated boxes, multi-color retail displays, and heavy-duty containers for industrial products. These packaging solutions cater to sectors such as food and beverage, manufacturing, and e-commerce, providing essential packaging for shipping and displaying products. The company also owns Boise Paper, a subsidiary that produces a variety of printing and office papers.

The company's revenue primarily stems from its corrugated packaging products and paper solutions. Its product portfolio can logically be broken down into packaging and paper, which are marketed directly to manufacturers, distributors, and retailers.

Packaging Corporation of America's cost structure incorporates fixed costs related to its manufacturing operations and variable costs linked to raw materials and distribution. The company benefits from recurring revenue streams due to consistent customer demand for packaging products and ongoing supply contracts, providing a stable financial base.

4. Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Competitors in the packaging industry include Crown Holdings (NYSE:CCK), Ardagh Group (NYSE:ARD), and Silgan Holdings (NASDAQ:SLGN)

5. Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Packaging Corporation of America’s 4.3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Packaging Corporation of America’s recent performance shows its demand has slowed as its annualized revenue growth of 1.4% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 1.25 million in the latest quarter. Over the last two years, Packaging Corporation of America’s units sold averaged 8.5% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Packaging Corporation of America reported year-on-year revenue growth of 8.2%, and its $2.14 billion of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Packaging Corporation of America has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 22.7% gross margin over the last five years. That means Packaging Corporation of America paid its suppliers a lot of money ($77.32 for every $100 in revenue) to run its business.

Packaging Corporation of America’s gross profit margin came in at 21.2% this quarter, marking a 2.4 percentage point increase from 18.8% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

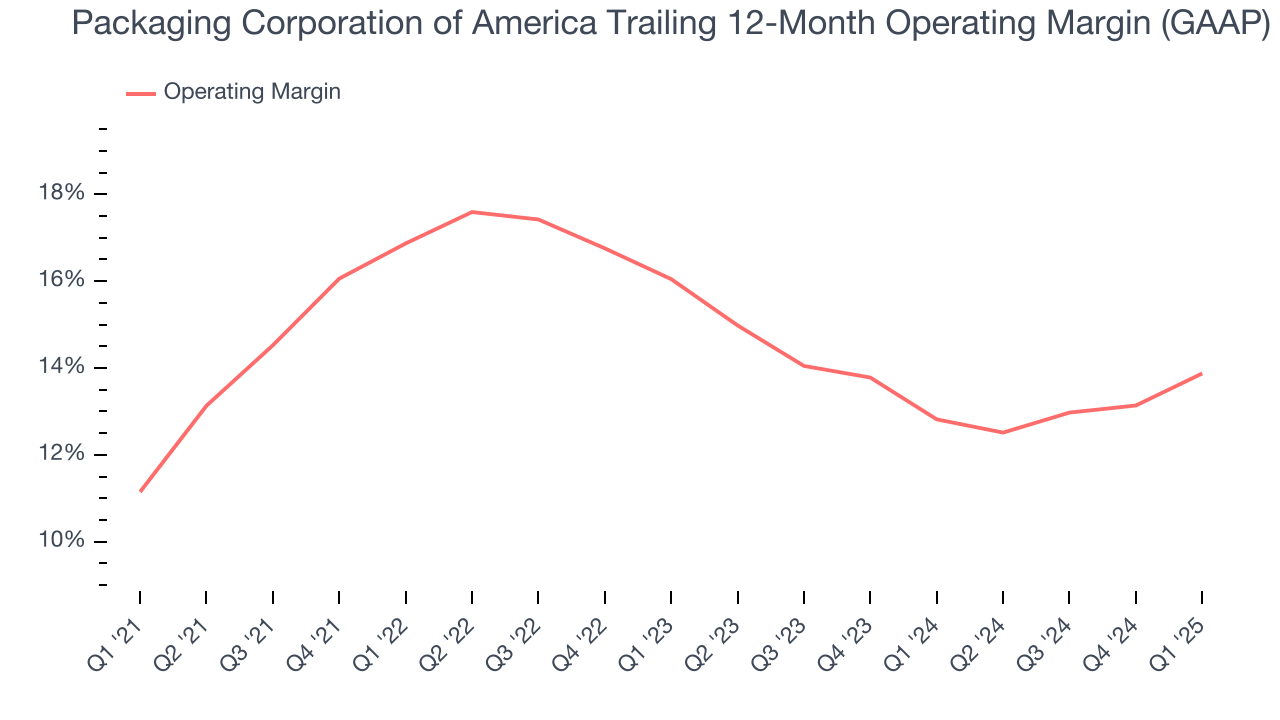

7. Operating Margin

Packaging Corporation of America has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Packaging Corporation of America’s operating margin rose by 2.7 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering most Industrial Packaging peers saw their margins plummet.

In Q1, Packaging Corporation of America generated an operating profit margin of 13.1%, up 3.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Packaging Corporation of America’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Packaging Corporation of America’s earnings can give us a better understanding of its performance. As we mentioned earlier, Packaging Corporation of America’s operating margin expanded by 2.7 percentage points over the last five years. On top of that, its share count shrank by 5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Packaging Corporation of America, its two-year annual EPS declines of 4.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Packaging Corporation of America reported EPS at $2.26, up from $1.63 in the same quarter last year. This print beat analysts’ estimates by 2%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Packaging Corporation of America has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Packaging Corporation of America’s margin dropped by 3.7 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Packaging Corporation of America hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16.1%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Packaging Corporation of America’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Balance Sheet Assessment

Packaging Corporation of America reported $0 of cash and $0 of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.73 billion of EBITDA over the last 12 months, we view Packaging Corporation of America’s 0.0× net-debt-to-EBITDA ratio as safe. We also see its $44.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Packaging Corporation of America’s Q1 Results

We enjoyed seeing Packaging Corporation of America beat analysts’ sales volume expectations this quarter. We were also happy its revenue, EPS, and EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly. Overall, we think this was still a solid quarter with some key areas of upside. The guidance seems to be driving the move, and shares traded down 8.1% to $171.30 immediately following the results.

13. Is Now The Time To Buy Packaging Corporation of America?

Updated: May 17, 2025 at 11:27 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Packaging Corporation of America.

Packaging Corporation of America falls short of our quality standards. To kick things off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its strong operating margins show it’s a well-run business, the downside is its low gross margins indicate some combination of competitive pressures and high production costs. On top of that, its cash profitability fell over the last five years.

Packaging Corporation of America’s EV-to-EBITDA ratio based on the next 12 months is 11.9x. At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there.

Wall Street analysts have a consensus one-year price target of $201.48 on the company (compared to the current share price of $194.22).

Want to invest in a High Quality big tech company? We’d point you in the direction of Microsoft and Google, which have durable competitive moats and strong fundamentals, factors that are large determinants of long-term market outperformance.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist. We typically have quarterly earnings results analyzed within seconds of the data being released, giving investors the chance to react before the market has fully absorbed the information. This is especially true for companies reporting pre-market.